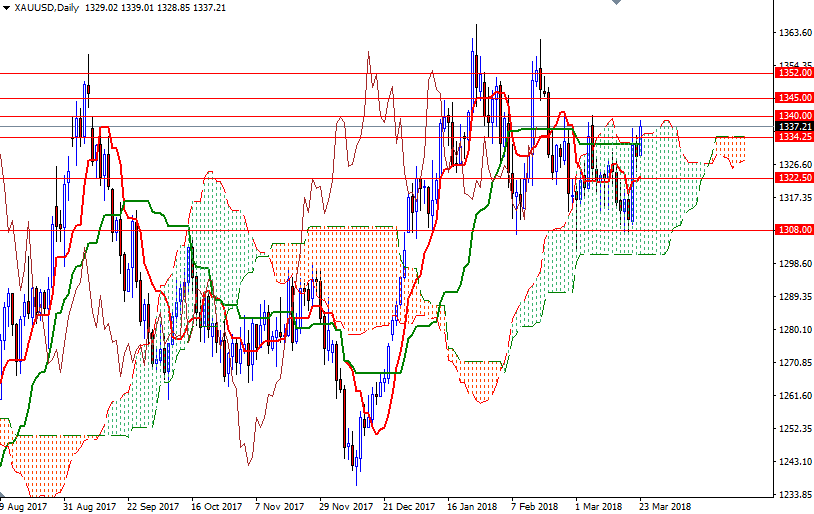

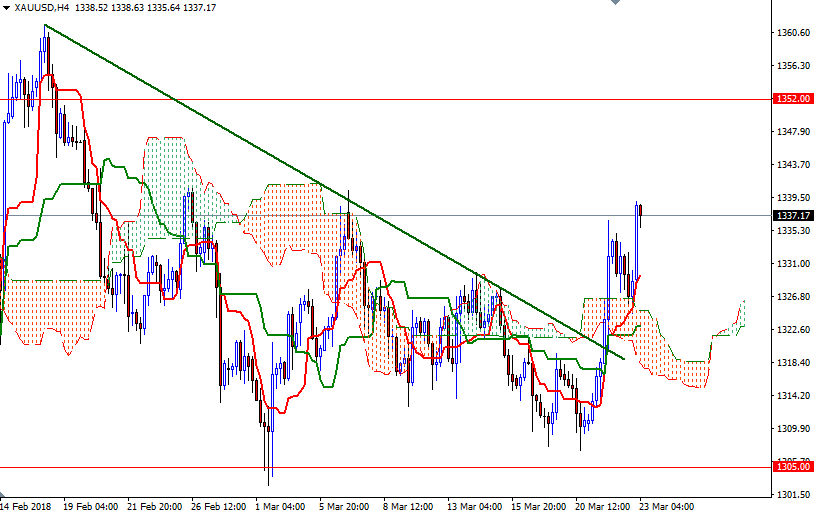

Gold prices fell $3.13 an ounce on Thursday as investors took profits from a rally spurred by a less hawkish than expected Federal Reserve and concerns over a brewing trade war with China. XAU/USD traded as low as $1324.66 but the anticipated support at the top of the 4-hourly Ichimoku cloud kicked in and pushed prices higher. The market rose further during today’s Asian session and reached a technical resistance at around $1340.

From a chart perspective, trading above the Ichimoku clouds on the 4-hour time frame suggests that the bulls have the near-term technical advantage. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned on the H4 chart and the Chikou-span (closing price plotted 26 periods behind, brown line) is above prices. However, as I mention in my previous analysis, the upside potential will be limited unless the resistance at 1340 is convincingly broken. If the bulls penetrate this barrier, the 1345 level will be the next target. A break up above 1345 indicates that the bulls are aiming for 1352/0.

On the other hand, if the bulls fail to push the market above 1340 and prices start to fall, we may revisit 1334.25 and 1331.80. The bears have to pull prices below 1331.80 to test the support at 1328, the top of the hourly cloud. A break down below there could foreshadow a move to 1325.