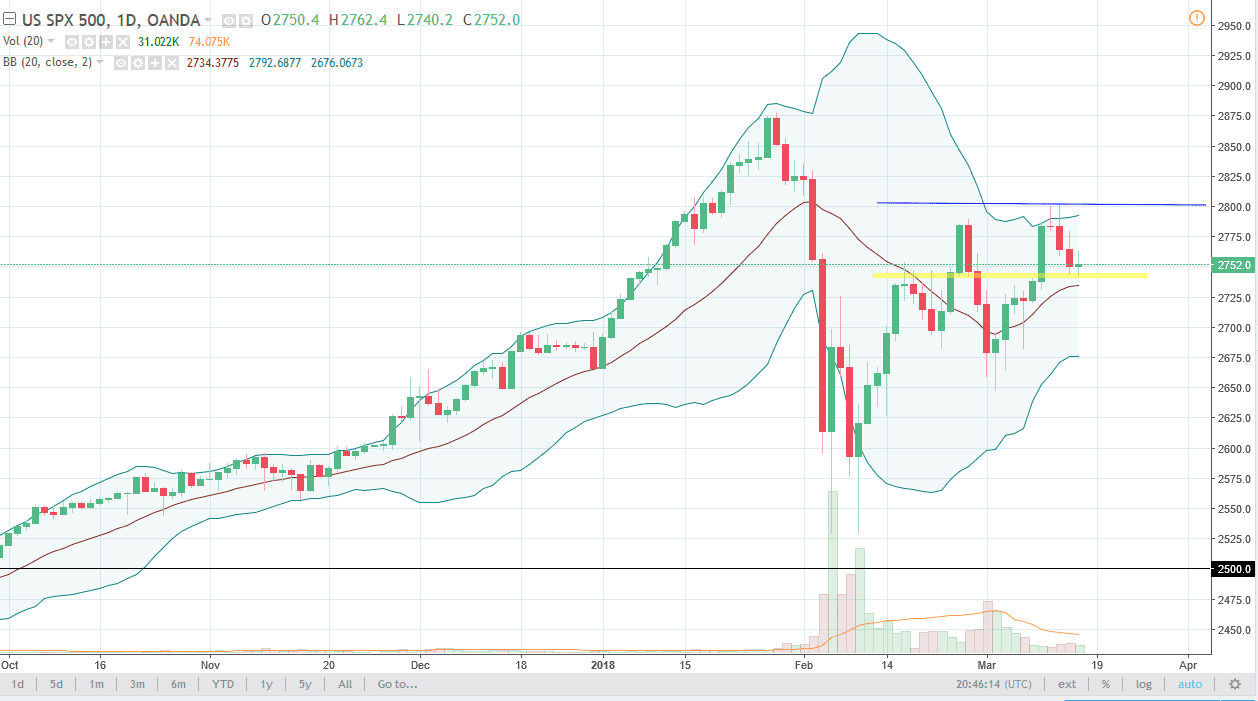

S&P 500

The S&P 500 went back and forth range trading on Thursday, testing the 2750 level. It looks as if the trade wars are still front and center as far as traders are concerned, and their fears. Because of this, we continue to struggle but I do anticipate that the buyers are coming sooner rather than later. If we break down below the bottom of the candle for the day, I anticipate that the 2700 level should offer support. Alternately, if we break above the top of the range for the day, then I think that we go back towards the 2800 level. I anticipate that things are going to be very noisy and choppy, but in general I’m not looking for some type of massive meltdown unless of course a trade war is started during the trading session.

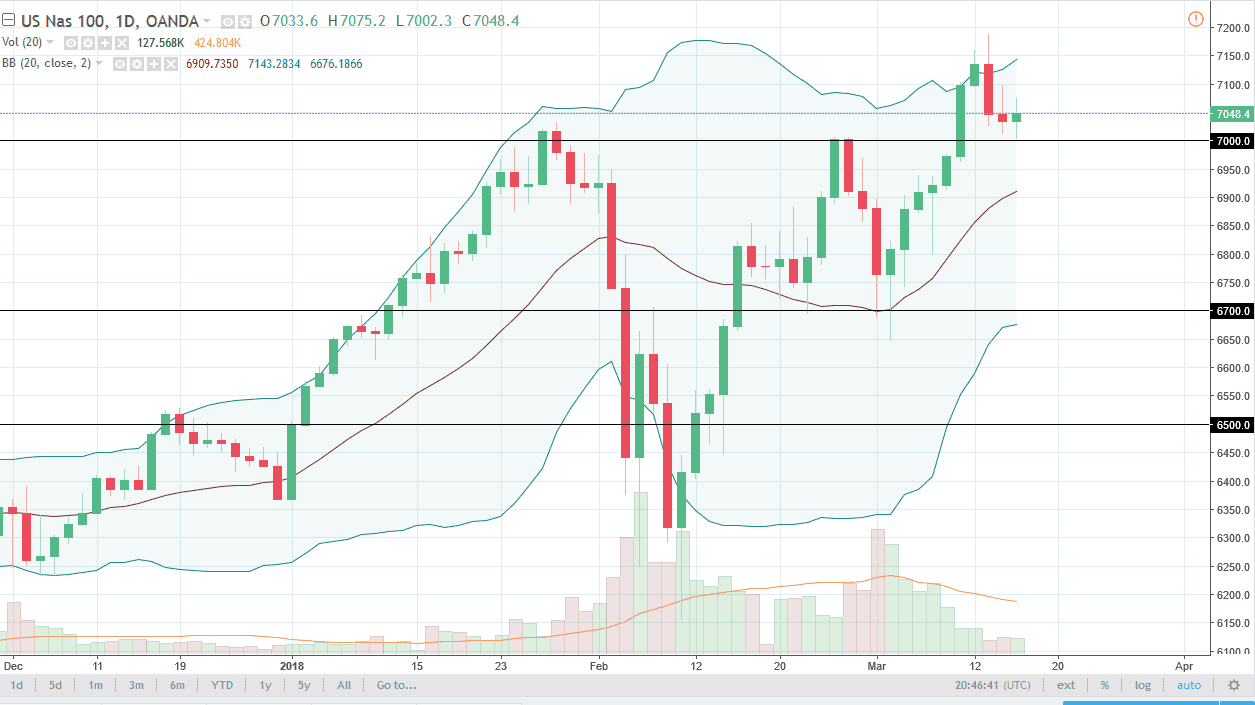

NASDAQ 100

The NASDAQ 100 went back and forth during the trading on Thursday as well, testing the 7000 level for support. That’s an area that was previously resistant, and this is a market that I think will continue to go higher, especially if we can continue to find buying opportunities. I think the market then goes to the 7200 level above, which is the recent highs. If we can break above there, the market should continue to be a “buy-and-hold” scenario. I think that the 7000 level should end up being very important, so if we did breakdown below there, that would probably unleash this market to drop down towards the 6000 level. There are a lot of concerns around the world right now about trade wars, so headlines could come into play and cause massive amounts of volatility. However, if we stay above 7000, I remain bullish.