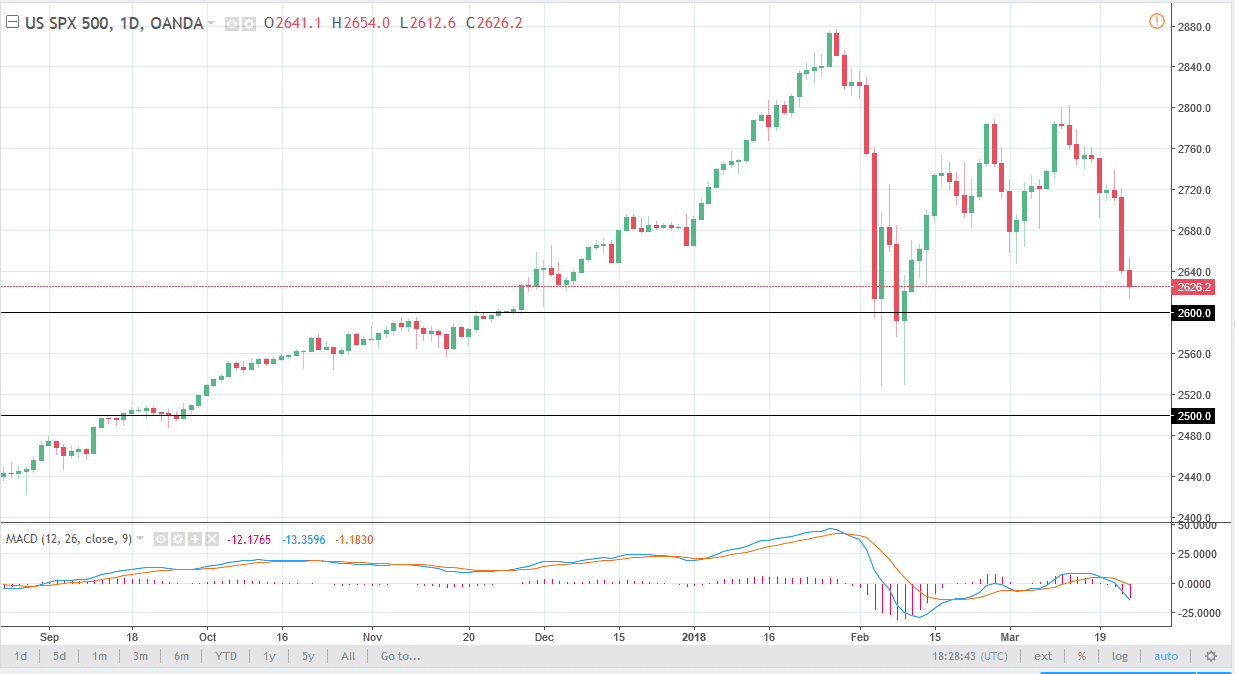

S&P 500

The S&P 500 fell again on Friday, as we continue to see bearish pressure in the markets as we worry about a potential trade war between the United States and China. I think that the market continues to make a lot of noise, but I think that the most important level in the near-term is going to be the 2600 level. If we can break down below there, then the market probably goes down to the 2525 level. Ultimately, the market will be reacting to news coming out of trade war headlines, for both the United States and China. If cooler heads prevail over the weekend, I suspect we will rally. Otherwise, we probably break down. At this point, I think that the market is likely to react to emotion more than anything else.

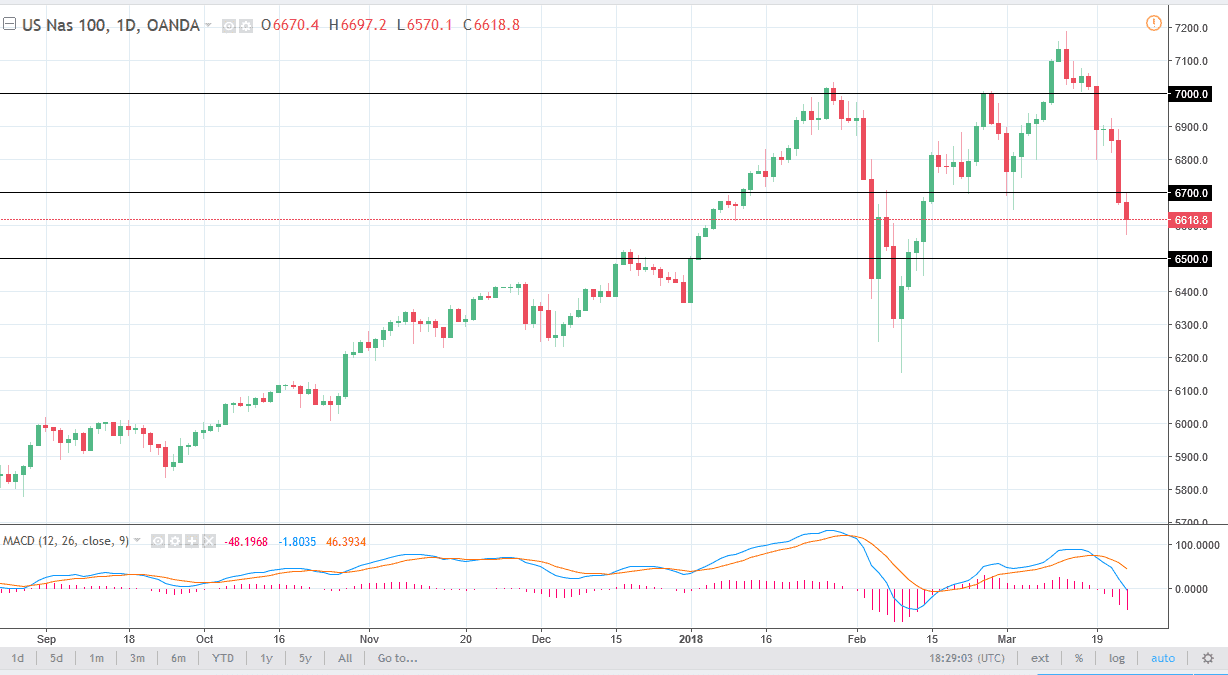

NASDAQ 100

The NASDAQ 100 also fell during the trading session on Friday, reaching towards the 6600 level before bouncing slightly. It looks as if we are facing the same problem over here, but we did confirm the 6700 level to be resistive, so if we can break above that level on good news, that would be a very bullish sign. Otherwise, I suspect that we will probably grind towards the 6500-level underneath. Market participants continue to be very cautious, as trade war fears of course cause quite a bit of concern. I think that the 6500-level underneath will be support, and the initial target. If we break down below there, the market probably goes down to the 6300 level. I believe that just like the S&P 500, the NASDAQ 100 will be trading mainly upon emotion and reaction to what goes on over the weekend.