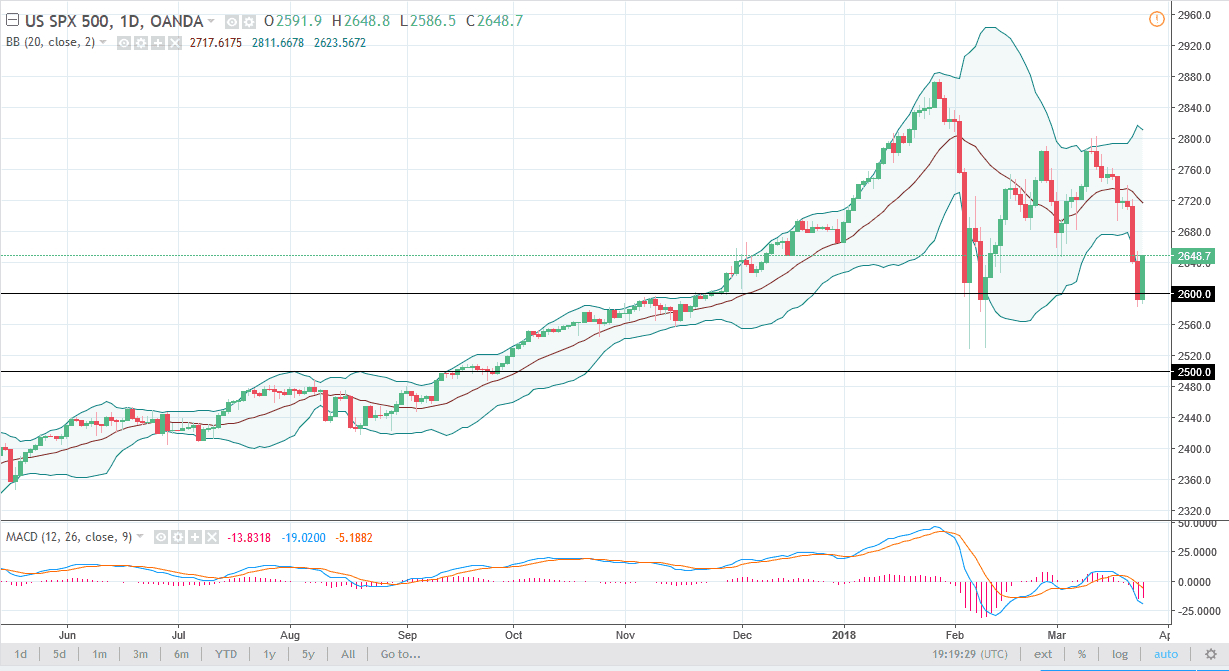

S&P 500

The S&P 500 traders bounced significantly during the trading session on Monday, as the 2600 level has offered support. It appears that there are talks between the US and China, and that has the stock markets optimistic that a trade war might be avoided. If we can continue to break above the candle for the session on Monday, then I think that the S&P 500 will reach towards the 2700 level, and then possibly the 2800 level. I think that pullbacks will probably be bought, unless there is some type of negative headlines coming out of those talks. I believe that this gives us an opportunity to pick up a bit of value in a market that has been beaten down rather drastically. However, if we break down below the lows from Friday, the market unwinds to the 2500 level next.

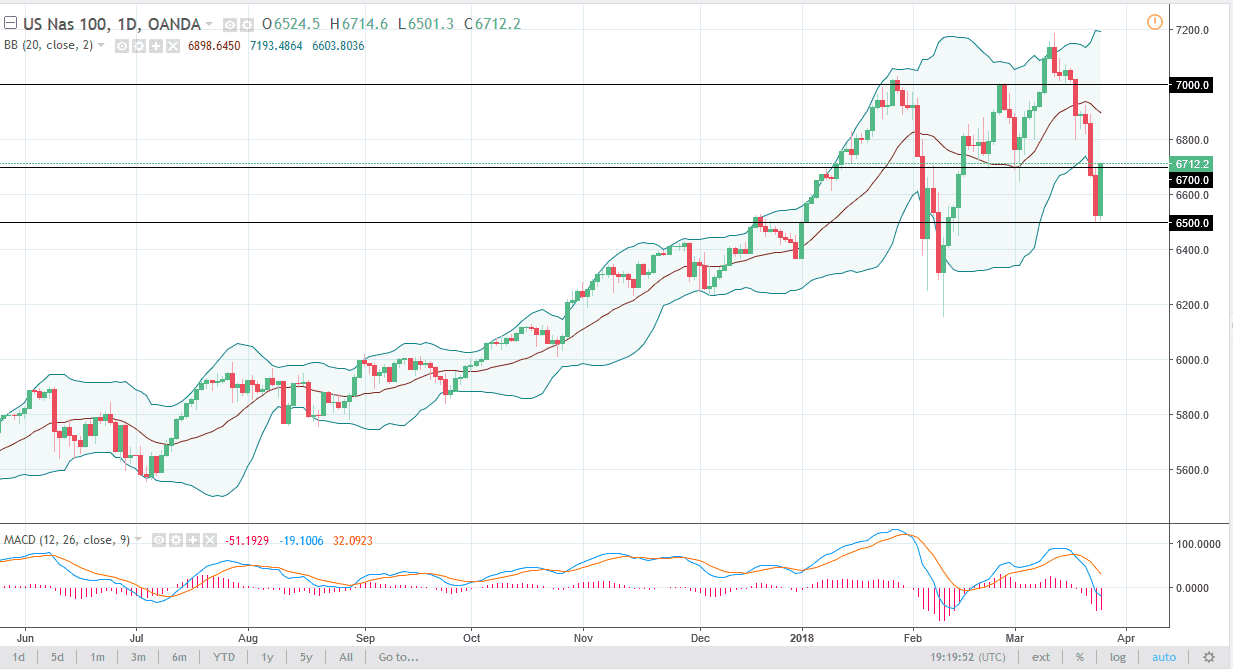

NASDAQ 100

The NASDAQ 100 also rallied significantly during trading on Monday, gaining 3%. We have broken above the 6700 level, using the 6500 level as support. There are rumors of talks between the US and China, and that gives us an idea that we may be able to avoid a significant trade war. If that’s the case, it’s likely that we will continue to go higher, if nothing else but for a relief rally.

If we break down below the 6500 level, then the market goes down to the 6200 level. I think that the market continues to be very noisy, but clearly, we have gotten far too oversold in the last several sessions. I think that the overall uptrend is still intact, especially considering that we have seen so much in the way of bullish pressure on Monday. I believe it’s going to be hard to continue climbing, but it certainly looks as if we are going to try.