Gold prices fell $5.82 an ounce on Tuesday, weighed down by a rise in the U.S. dollar ahead of a Federal Reserve meeting at which the central bank is expected to announce its first rate increase of 2018. While the outlook for rates is uncertain, holding above the $1308-$1305 zone suggests that the market is pricing in three hikes this year. XAU/USD is currently trading at $1246.54, up 0.19% from the previous close. Rising oil prices and the specter of a global trade war are supportive daily elements for the precious metal.

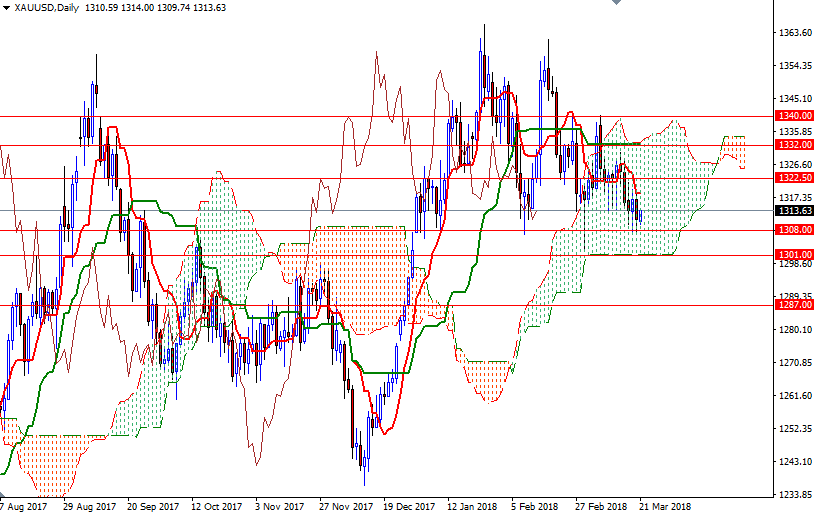

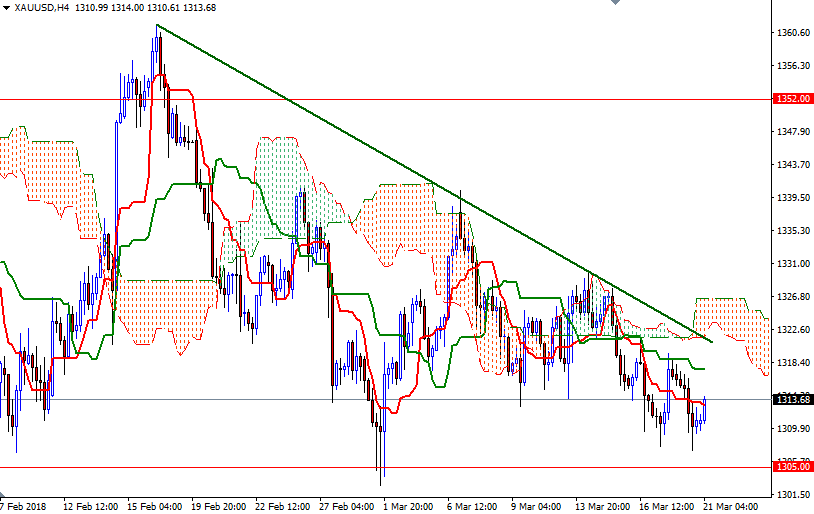

On the technical side, the first upside barrier comes in around 1318.70, near the 38.2% retracement of the bullish run from 1236.40 to 1365.95. That is followed by the bottom of the 4-hourly Ichimoku cloud at around 1322.50, while the 1308/5 area continues to provide support. XAU/USD has tested this area three times since the beginning of March and failed on each occasion. If prices drop through 1308/5, it is likely that the market will pay a visit to the 1301/0 area, the bottom of the daily cloud. A break below 1300 could see a fall to 1294/2.

However, if XAU/USD successfully gets back above 1322.50, a push up to 1328/5 seems possible. A break up above 1328 is essential for a continuation towards 1334.32-1332, the top of the daily cloud. The bulls have to produce a daily close above the 1334.32 level to set sail for 1340.