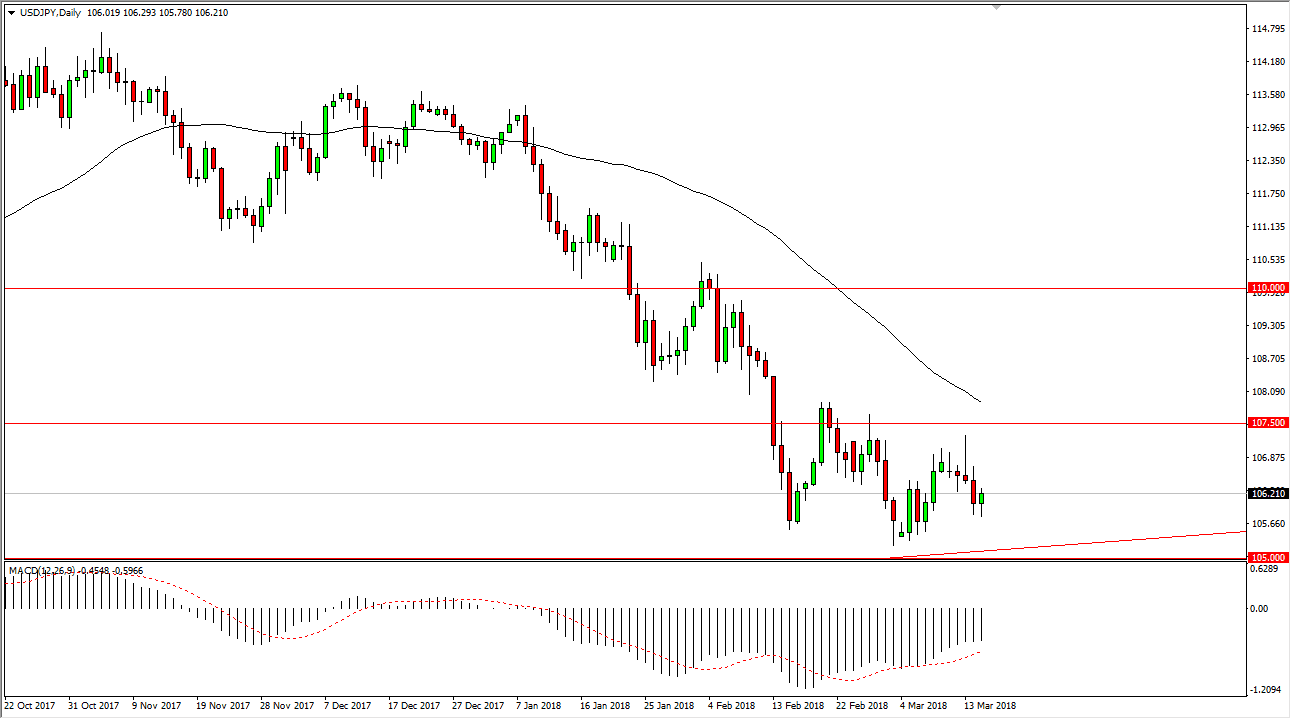

USD/JPY

The US dollar initially fell on Thursday but then turned around to rally a bit. I believe that the market will continue to be very choppy overall, and I think that the 105.50 level underneath continues to be massively supportive, just as the 107.50 level is resistance. I think that this market will continue to be one that is going to be highly influenced by the stock markets in general, which of course have been very skittish. I believe this market will eventually break out one way or another, but it will probably take some type of direction from the stock market to happen. If we break down below the 105 handle, I think that the market then goes down to the 105 level. Otherwise, if we turn around and break above the 107.50 level, the market could go as high as 110.

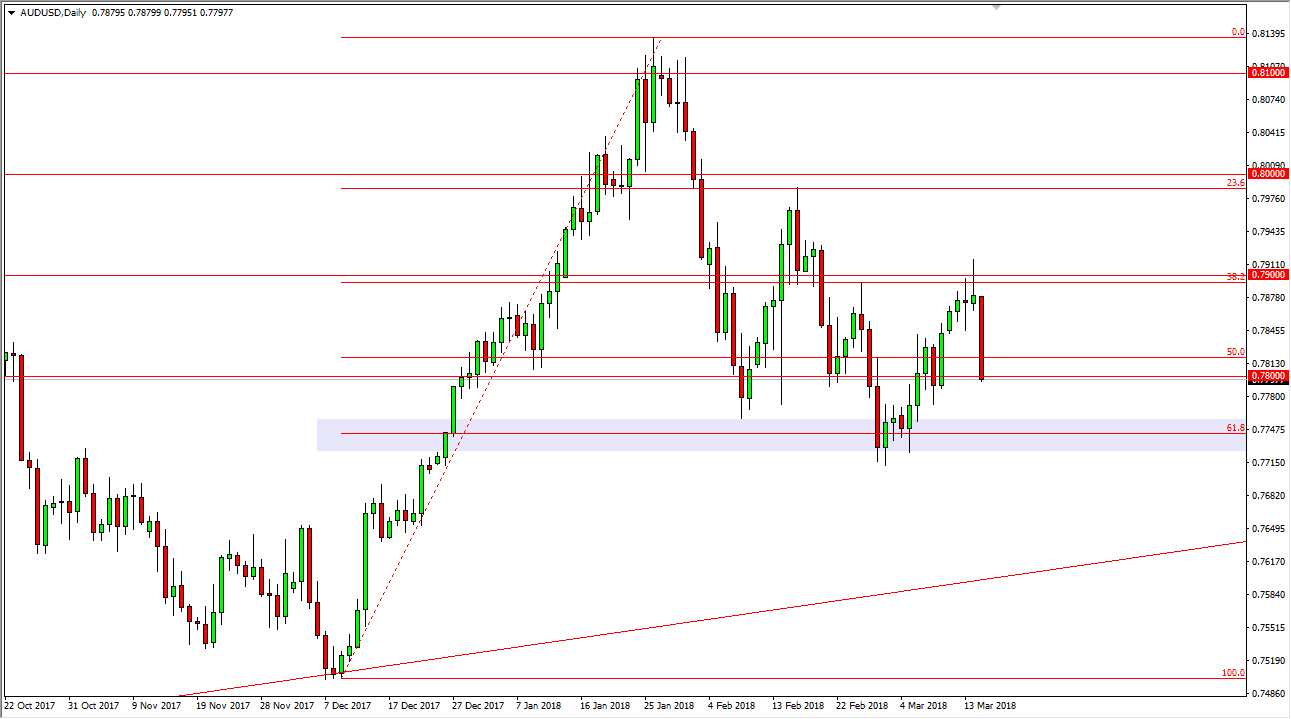

AUD/USD

The Australian dollar broke down significantly during the trading session on Thursday, slamming into the 0.78 level. However, the fact that we are closing so close to the bottom of the range tells me that we could continue to go lower. This was a very negative day, and we could find ourselves looking towards the 61.8% Fibonacci retracement level again. A breakdown below there would then send this market down to the previous uptrend line that is closer to the 0.76 handle.

Alternately, if we can bounce from here I think that the market should go to the 0.79 level. Breaking above the shooting star from the Wednesday session sends this market much higher, perhaps reaching towards the 0.80 level. The market will be noisy, and of course tickets directionality from the gold market as per usual, which of course got hit as well during the trading session.