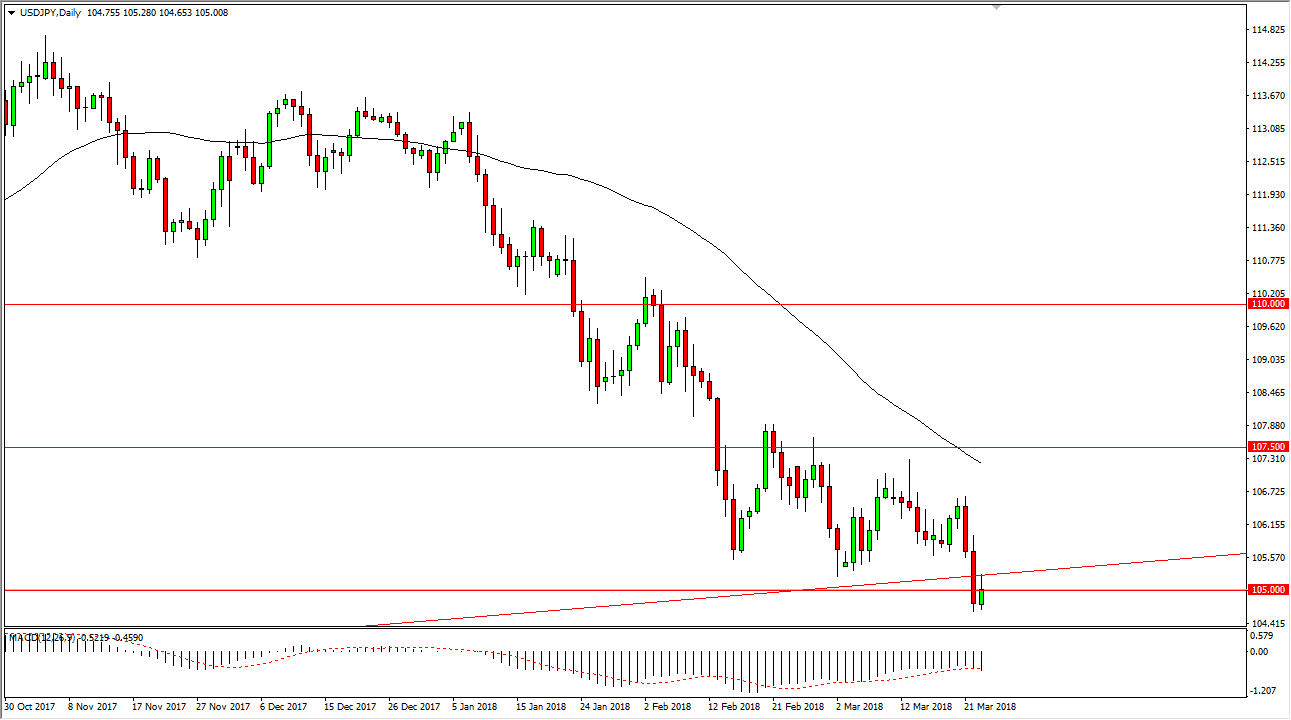

USD/JPY

The US dollar initially rallied against the Japanese yen on Friday, reaching towards the previous uptrend line. However, we have found resistance there and turned around to form a bit of a shooting star looking candle. I think if we break down below the bottom of the candle, that should send the market much lower, perhaps down to the 101 level. This will be influenced by rhetoric coming out of both China and the United States, as we are currently watching a trade war try to form. If cooler heads prevail over the weekend, then I think that the market will probably break above the top of the range for the Friday session, which is a very bullish sign and could send this market towards the 107 handle. If things ratchet up in the trade war rhetoric, this market will break down. It can be difficult to measure these things, so the open today will be crucial.

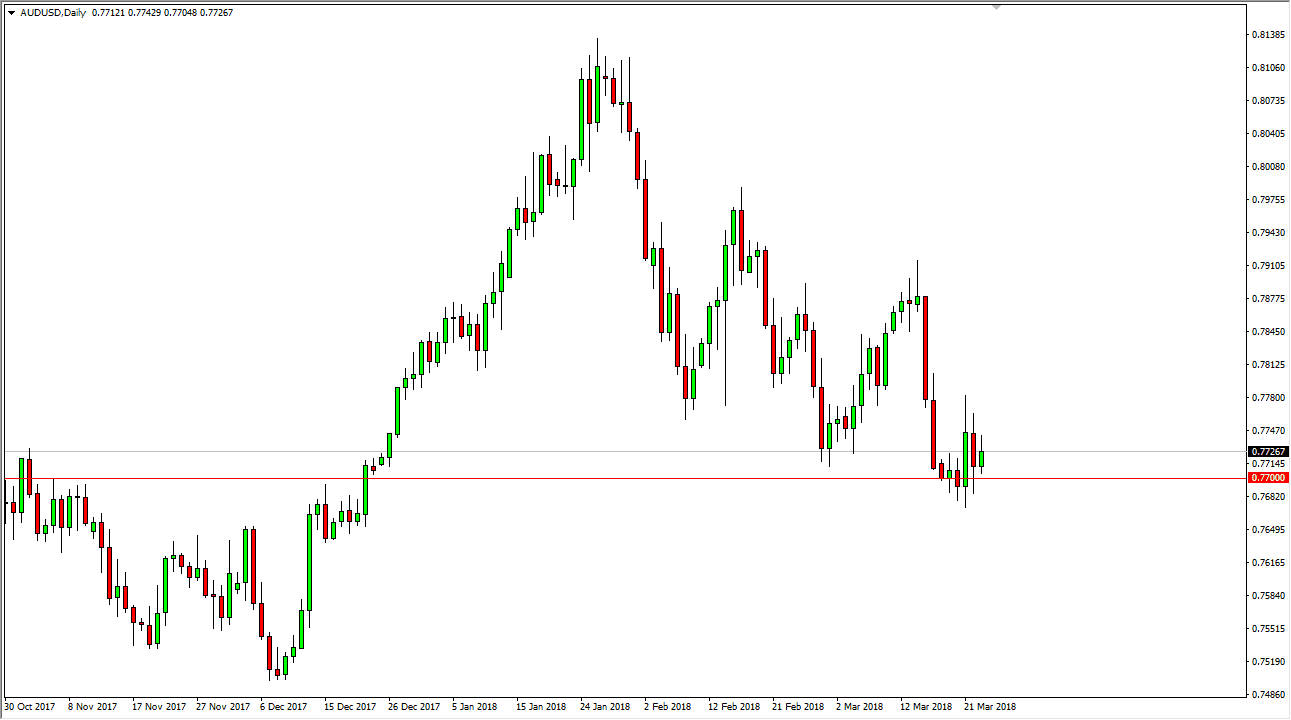

AUD/USD

The Australian dollar initially rally during the trading session on Friday but turned around to form a bit of a shooting star. The shooting star since just above the 0.77 handle, an area that should be important as it was previous resistance. We also have an uptrend line underneath near the 0.76 level which keeps the daily uptrend channel intact. I think we are going to be held hostage to rhetoric coming out of the United States and China, just as we are in the USD/JPY pair. If things calm down, this pair goes higher. If they don’t, then this pair goes lower. Australia is highly leveraged to the Chinese economy, so obviously those headlines will have a lot to do with the weather people want to own the Aussie or not.