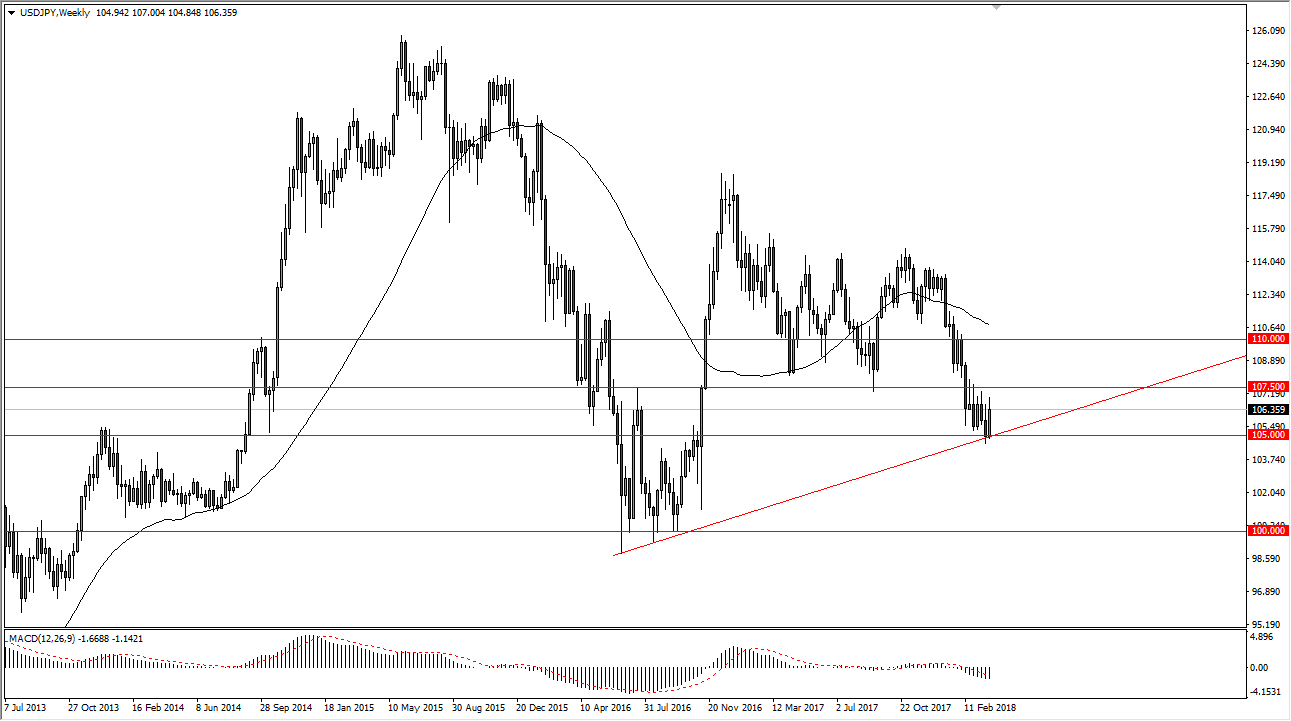

USD/JPY

The US dollar has been very choppy against the Japanese yen during the last month, but as you can see the 105 level seems to have held. I think this pair is looking at one thing initially, the potential of trade wars. If we do in fact get one, that will send this pair below the 105 level again, and almost undoubtedly down to the 100 level. However, if cooler heads prevail, I don’t see any reason this market will break above the 107.50 level this month and continue towards the 110 handle. I believe that this pair is essentially a barometer of how things are going between China and the United States, at least at this point. If we get a rallying stock market in the United States, that often will help this pair as well.

Remember, this is a very risk sensitive pair, so pay attention to headlines crossing the wire, but I think at this point it looks as if the support is trying to hold. We are not out of the woods until we break above the 107.50 level though, and short-term whipsaw action will certainly be a thread at any point. Trading with a small position is probably the best way to approach this market, because quite frankly, we have seen so much in the way of brutality with this most recent selloff. I would suggest that the selloff is probably a bit overdone anyway, so at the very least I think a bounce isn’t going to be too much to ask out of this market.

However, if we break down below the 105 level again, that could open the floodgates and send this market much lower, and probably down to 100 much quicker than most people are prepared to believe.