By: DailyForex.com

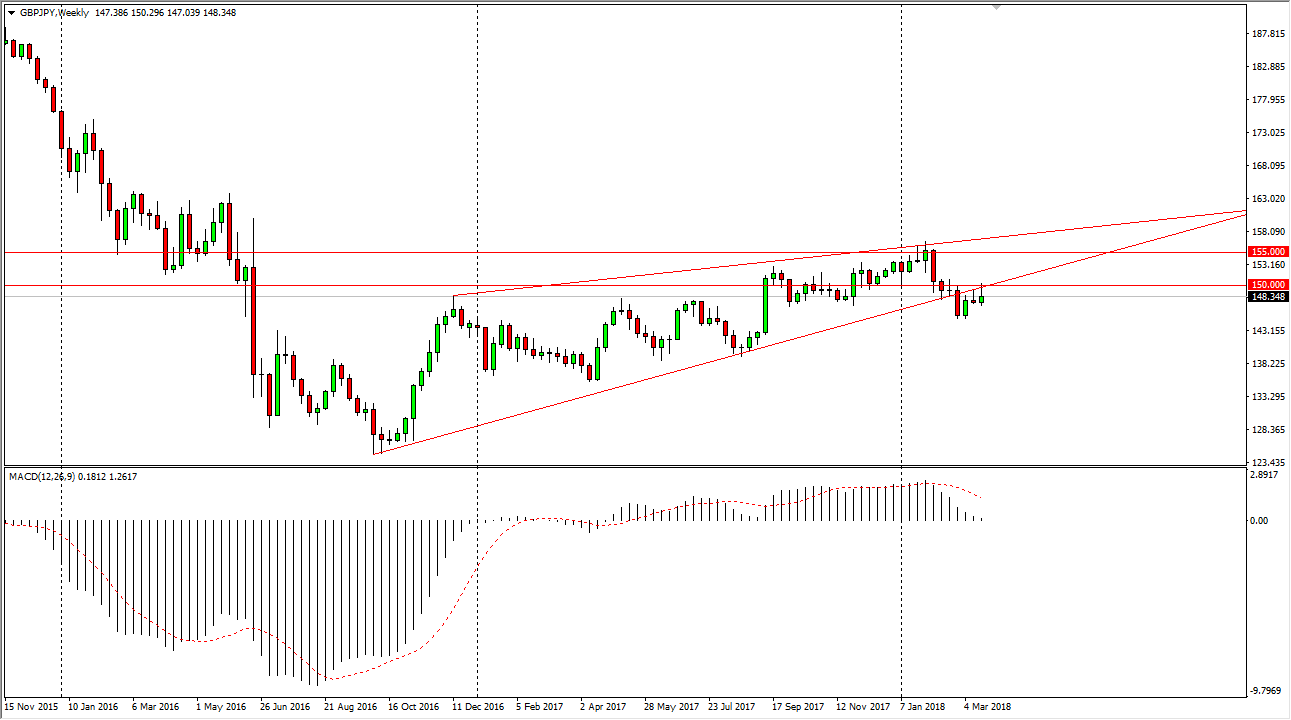

GBP/JPY

The British pound initially tried to rally against the Japanese yen during the week, but as you can see on the chart we ended up struggling at the 150 handle. Because of this, we turned around to form a shooting star on the weekly chart, suggesting that perhaps we are going to continue to see selling pressure. I suspect that short-term rallies will continue to offer selling opportunities, just as a breakdown below the bottom of the weekly candle would be. I believe that the market will go looking towards the 145 handle because of that. Alternately, if we break above the 150 handle, I think the market goes much higher.

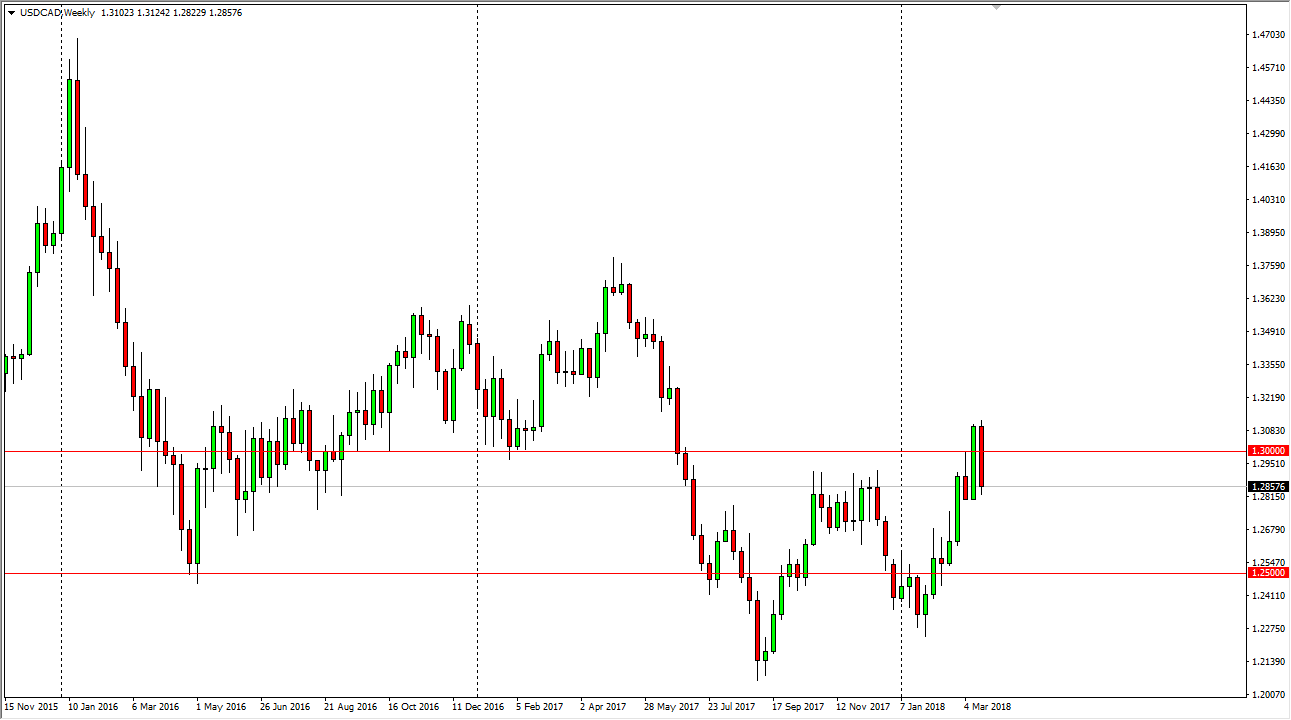

USD/CAD

The US dollar fell precipitously against the Canadian dollar as well markets have exploded, and close well below the 1.30 level. Because of this, I think we are going to bounce around and chop around a lot in the 1.2850 region. This is an area that was previous resistance, so now it will be supportive. I think that it is going to be a very difficult market to deal with. If you can break above the $70 level in the WTI Crude Oil market, that will break this market down. Just as the exact opposite can happen.

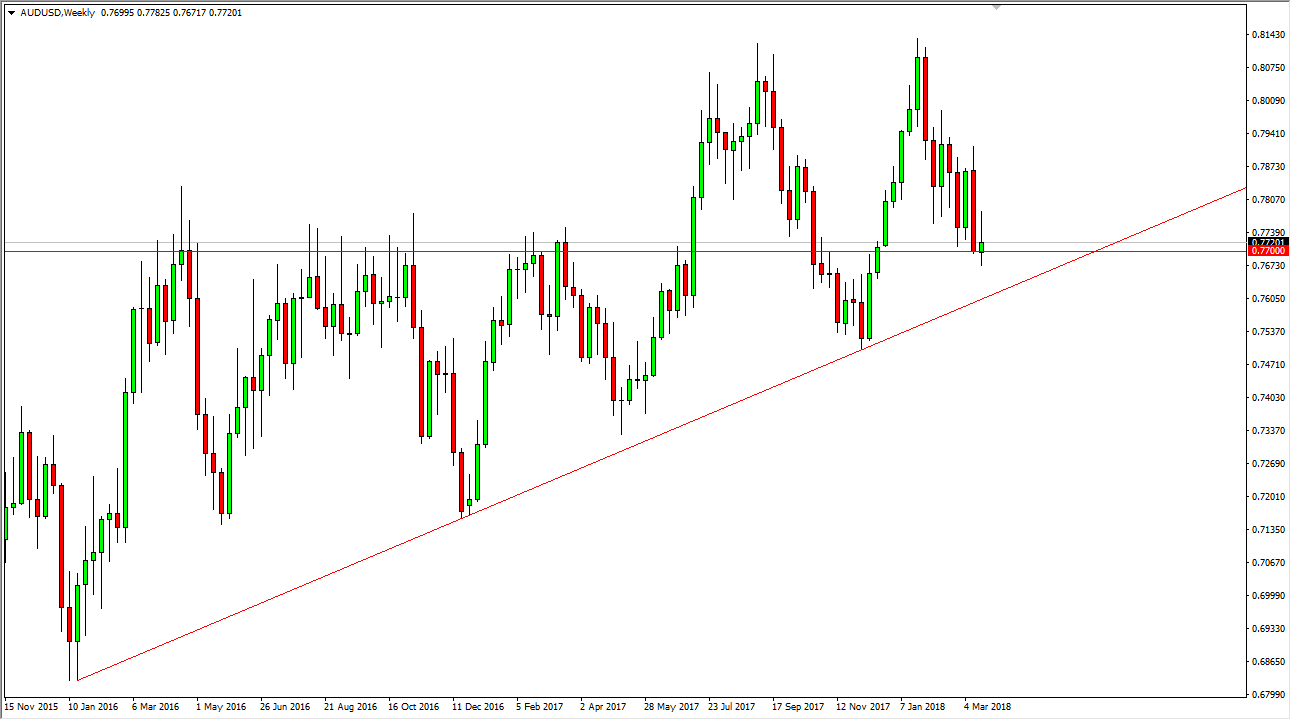

AUD/USD

The Australian dollar rolled over after initially rallying during the week, forming a shooting star sitting on the 0.77 handle. That’s a very negative sign, but as you can see the uptrend line underneath is just below at the 0.76 level that will offer support if we do break down. On the other hand, if we break above the top of the candle for the week, that should send this market towards the 0.79 level.

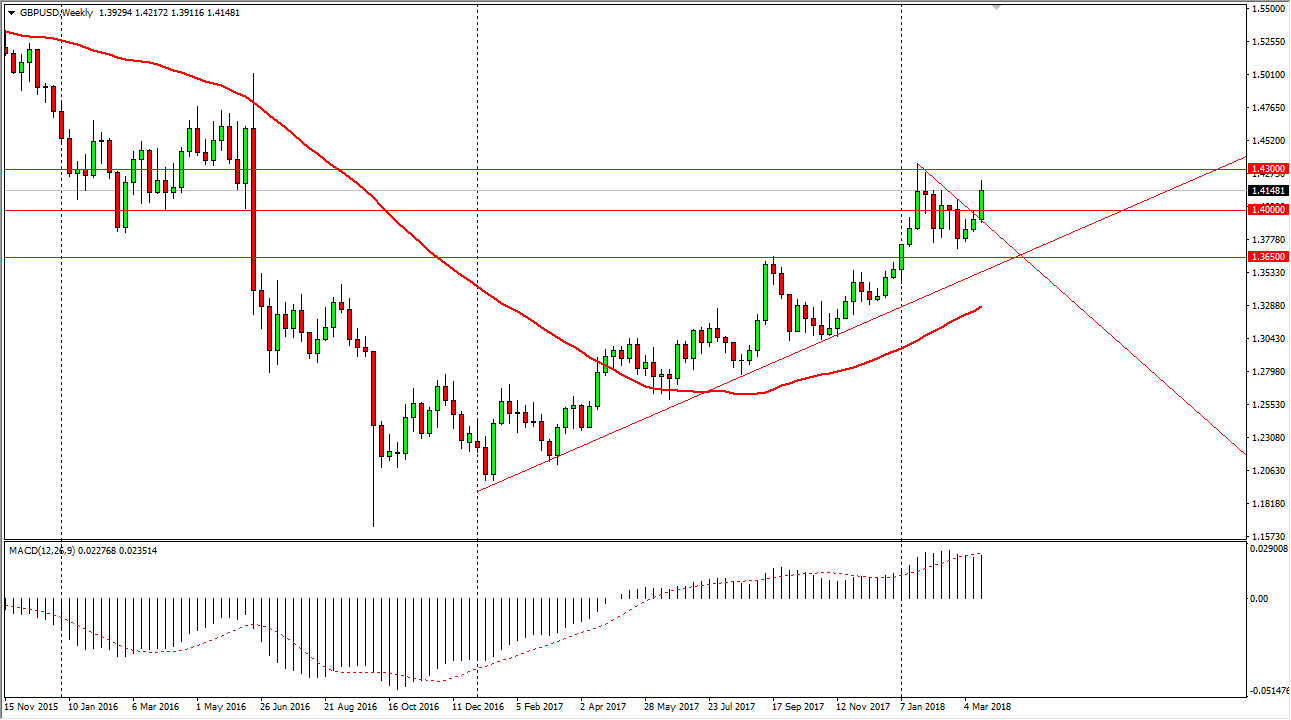

GBP/USD

The British pound broke out during the week, slicing through the 1.40 level, and then reaching towards the 1.42 level after that. I believe that every time we pull back, it’s likely that buyers will continue to jump into this market place as the British pound has been so bullish, and of course the Bank of England suggested this past week that interest rate hikes are coming.