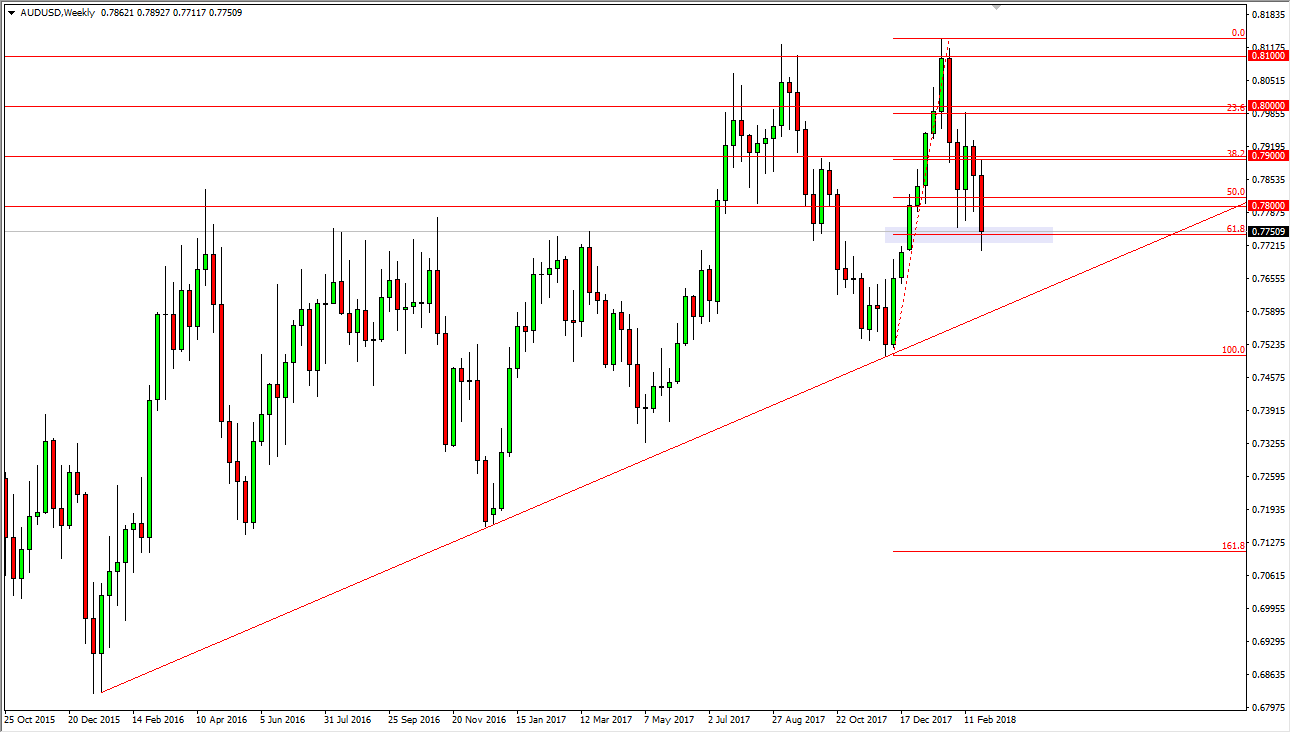

AUD/USD

The Australian dollar initially tried to rally during the week but found enough resistance at the 0.79 level to roll over. At this point, we are testing the 61.8% Fibonacci retracement level, and I think that if we break down below the lows of this past week, we will probably go looking towards the 0.76 level, where it should coincide nicely with the uptrend line. Alternately, we will probably try to grind our way towards the 0.78 level. Pay attention to gold, it has the usual correlation.

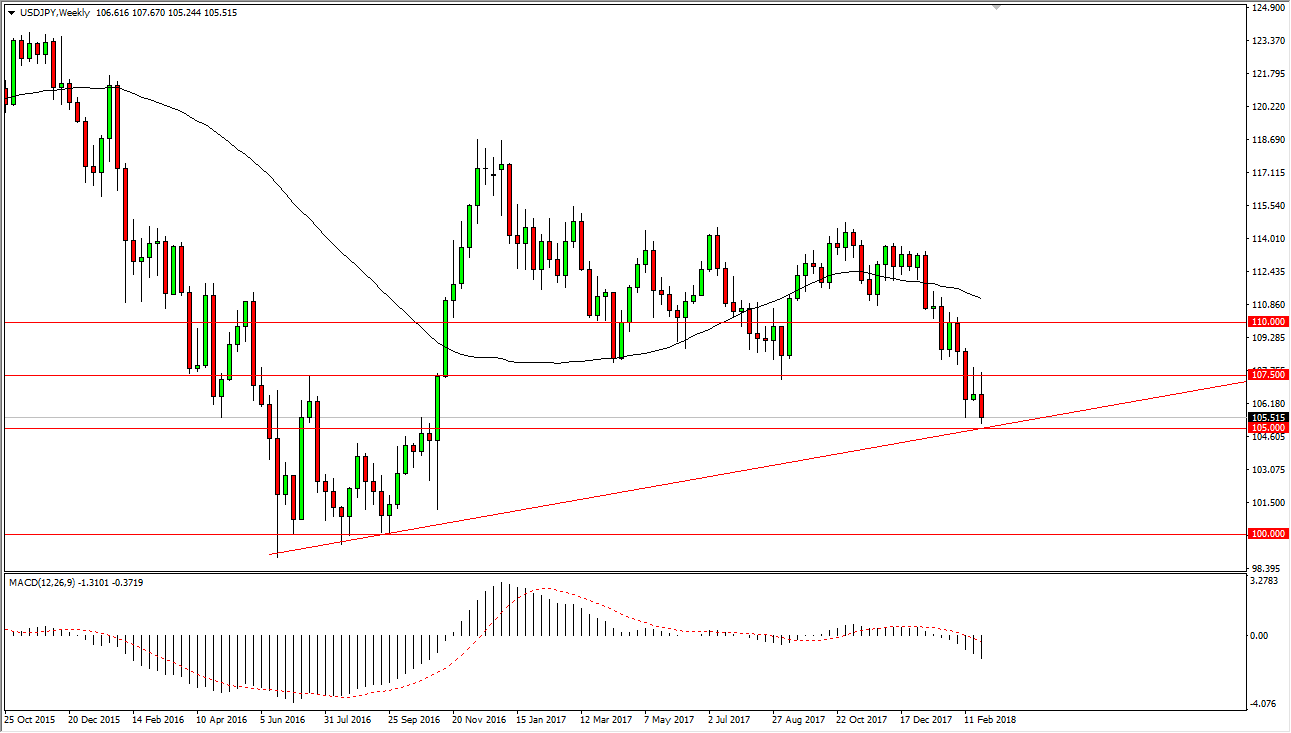

USD/JPY

The US dollar tried to rally initially against the Japanese yen during the week but found the 107.50 level to be far too resistive. We rolled over, and as a write this article it looks very likely that we are going to test the 105-level underneath. That is an area that’s not only psychologically important, but also where the uptrend line crosses. If we break down below that area, the market unwinds and goes down to 100 over the next several weeks. Otherwise, we will probably consolidate.

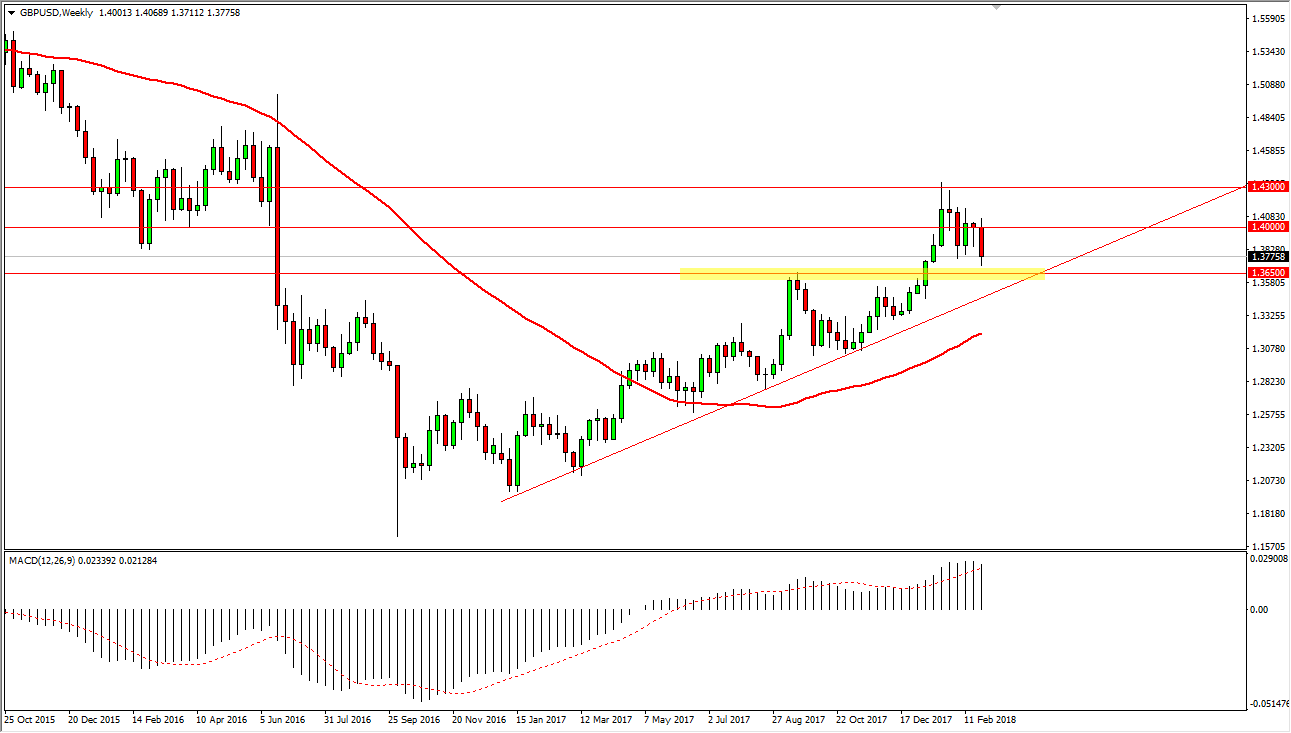

GBP/USD

The British pound initially tried to rally as well but found the area above the 1.40 level to be far too expensive for traders to hang onto. We are fallen significantly since then, breaking the bottom of the hammer from the previous week. While this is a negative sign, there is plenty of support at the 1.3650 level, and of course the uptrend line just below. Because of this, I think that eventually the buyers return, taking advantage of value at lower levels.

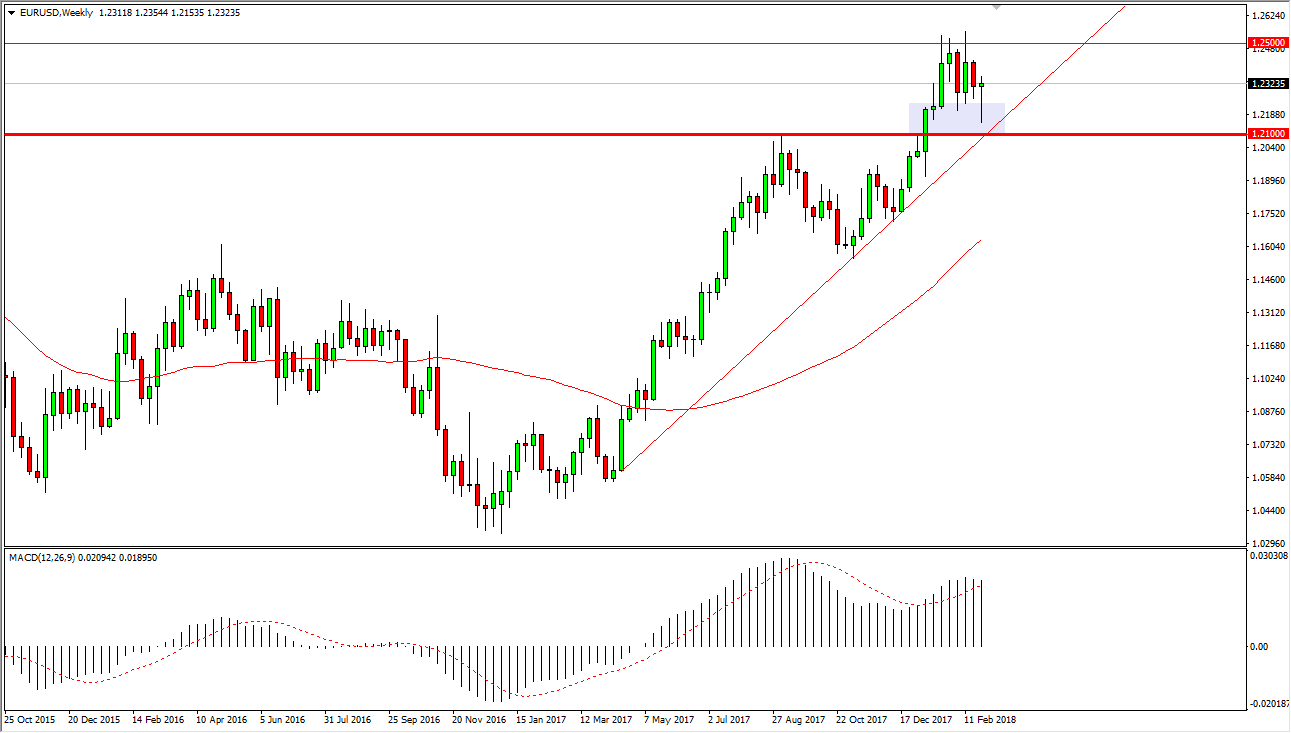

EUR/USD

Out of all the charts in this article, this is the most interesting one for me. We have fallen significantly during the week but turned around to form a nice-looking hammer. This hammer is based just above the 1.21 handle, an area that I think is the “floor” in the market. There is also the uptrend line just below, so I think that this market will find buyers on short-term dips and eventually go looking towards the 1.25 handle.