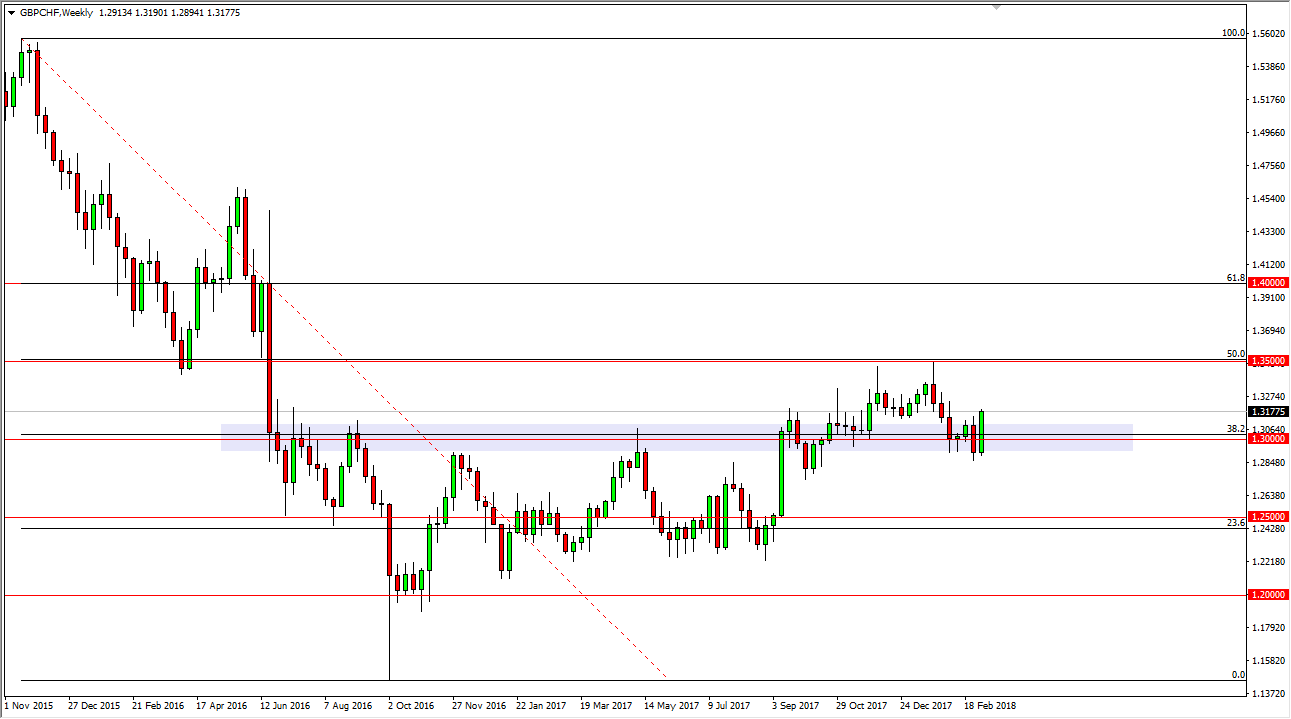

GBP/CHF

The British pound exploded to the upside during the week against the Swiss franc, showing signs of strength yet again. It looks as if the 1.30 level is going to offer support, and I think that pullbacks will bring in value hunters to try to reach towards the 1.35 handle. This is a market that of course has a lot of risk appetite attached to it, so pay attention to stock markets. If we start to see a lot of buying of risk assets, the market should continue to go higher.

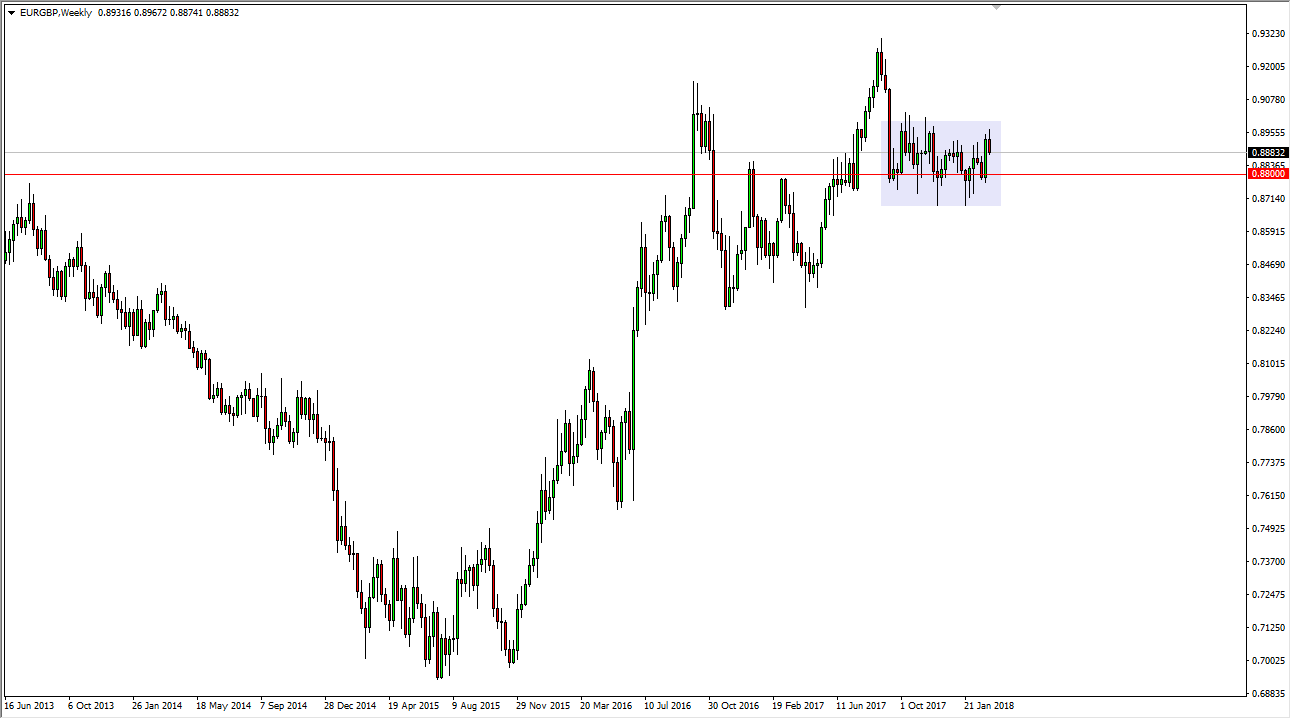

EUR/GBP

The EUR/GBP pair has initially tried to rally during the week but rolled over again to maintain the overall status quo. I believe that the market will continue to go back and forth, so look to shorter-term charge to trade this range. I think this range is going to be with us for some time, at least until we get some type of clarity from the negotiations between London and Brussels.

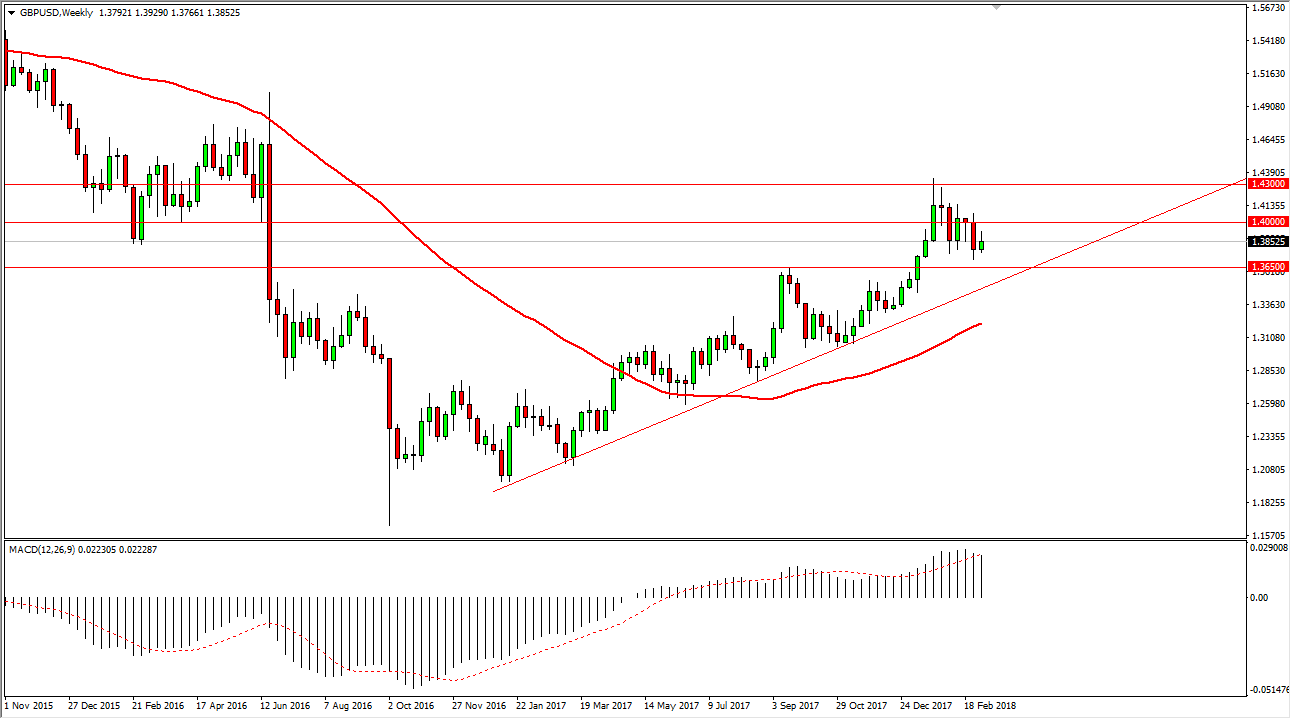

GBP/USD

The British pound initially rally during the week but gave back a little bit towards the end. I think that the market should probably drift a little bit lower from here, but that should be an exercise to build up the momentum, as I think the 1.3650 level underneath should be massively supportive. Ultimately, this is a market that should continue to find a bullish pressure and momentum to go higher. I believe that ultimately, we will go to the 1.43 level.

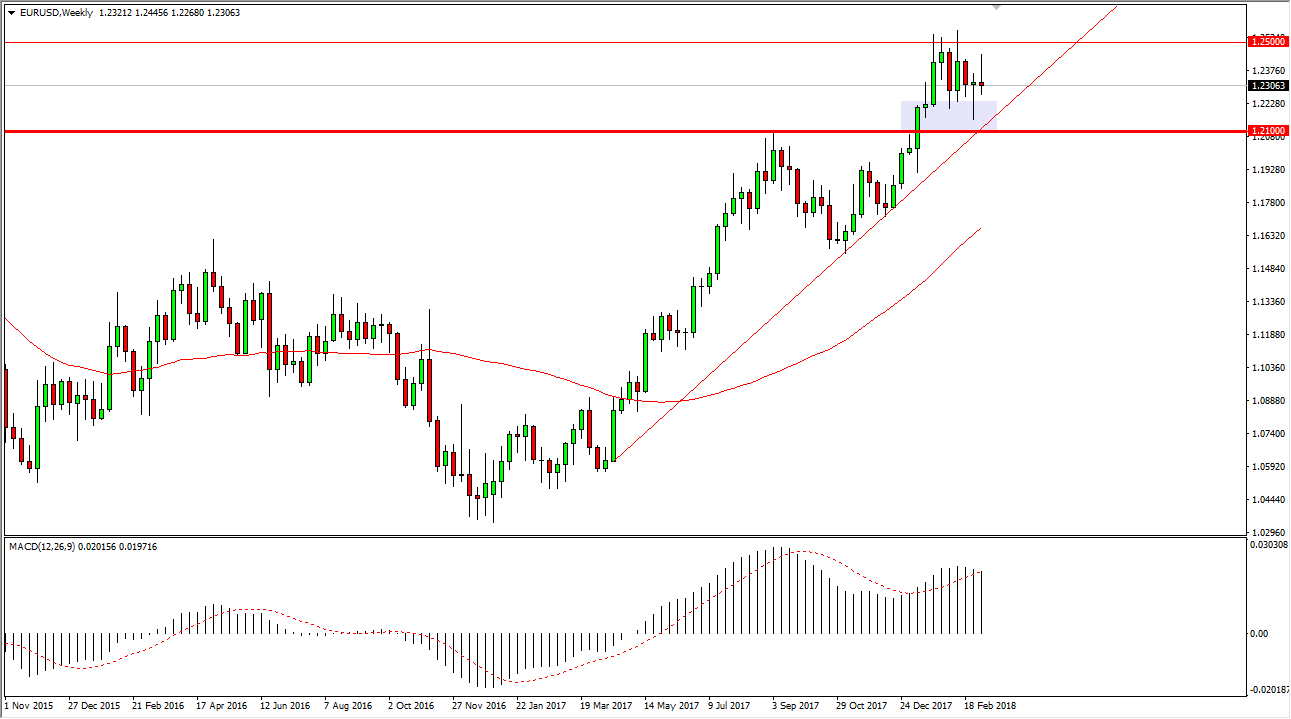

EUR/USD

The EUR/USD pair rally during most of the week but gave back quite a bit of the gains. We ended up forming a bit of a shooting star, but we have a hammer from the previous week that shows just how consolidated we are. Ultimately, we are still in an uptrend, so I like buying dips in this market, but I recognize that it will be very choppy and sideways trading.