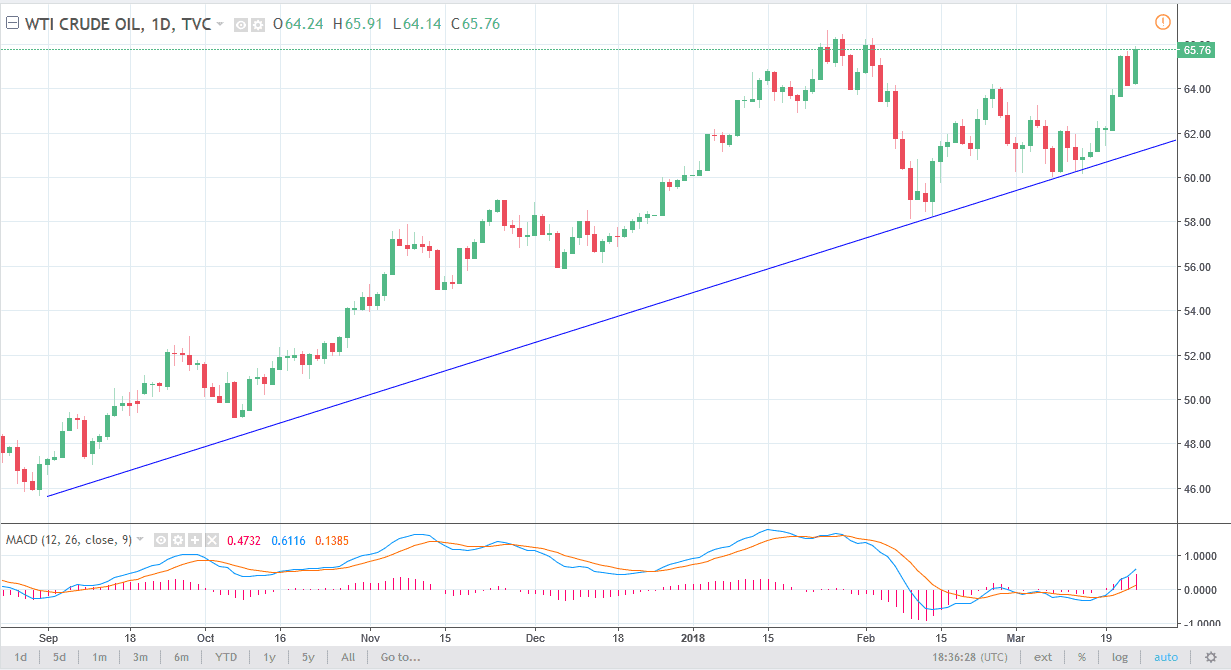

WTI Crude Oil

The WTI Crude Oil market had a bullish session on Monday, breaking over 2% to the upside. The market continues to reach towards the highs again, and if we can make a fresh, new high, I think that the market will continue the overall uptrend. I would not be surprised to see a short-term pullback though, as it gives us an opportunity to build up momentum to break out to the upside. We have gotten a little bit overextended and the short-term, but I think that we will continue to see buyers on dips as they appear. I believe that the $62 level underneath is massive support, and I think it’s only a matter of time before every time we pull back the buyers will continue to chase the trade. If we broke down below the trendline, that would obviously be a very negative sign.

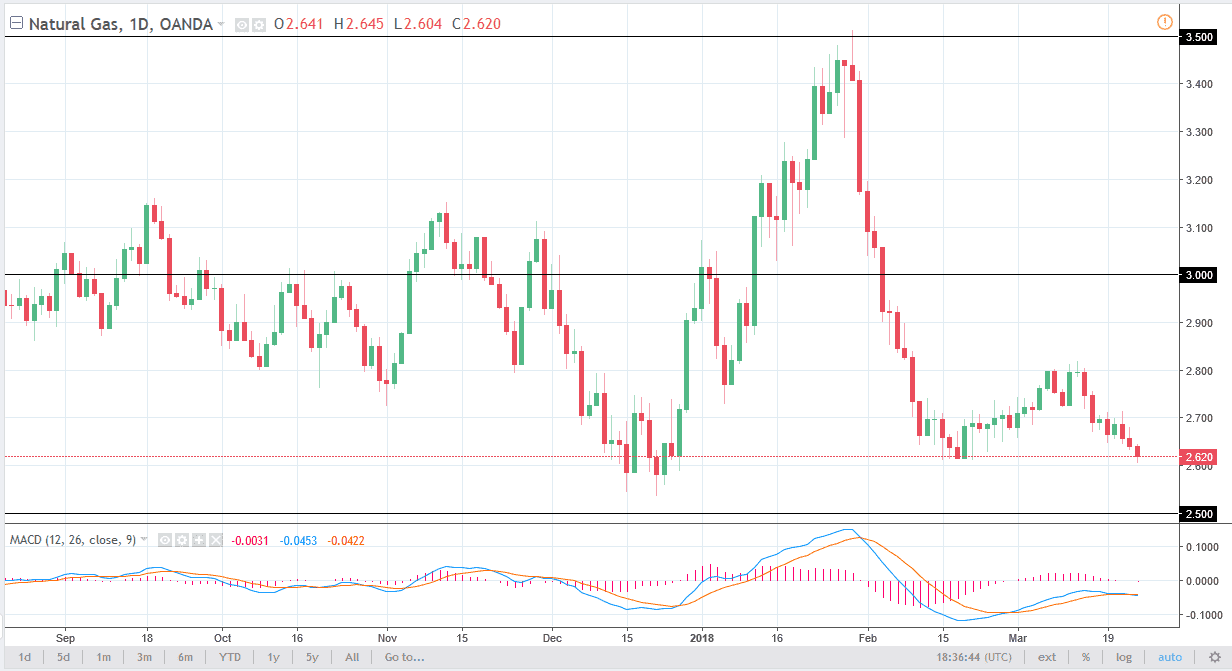

Natural Gas

Natural gas markets broke down during the session on Friday, reaching down towards the $2.60 level again. There is a significant amount of support below the $2.60 level extending down to the $2.50 level, so I think that it will be difficult to break down through that region, so I would anticipate that we would eventually get a bit of a bounce, but I look at that bounce is a potential opportunity. I love selling rallies that show signs of exhaustion against areas such as the $2.80 level, if we can get there. Either way, every time we rally I start to look for the market rolling over to get involved. I have no interest in buying natural gas, we are far too oversupplied in that market currently to speculate for gains.