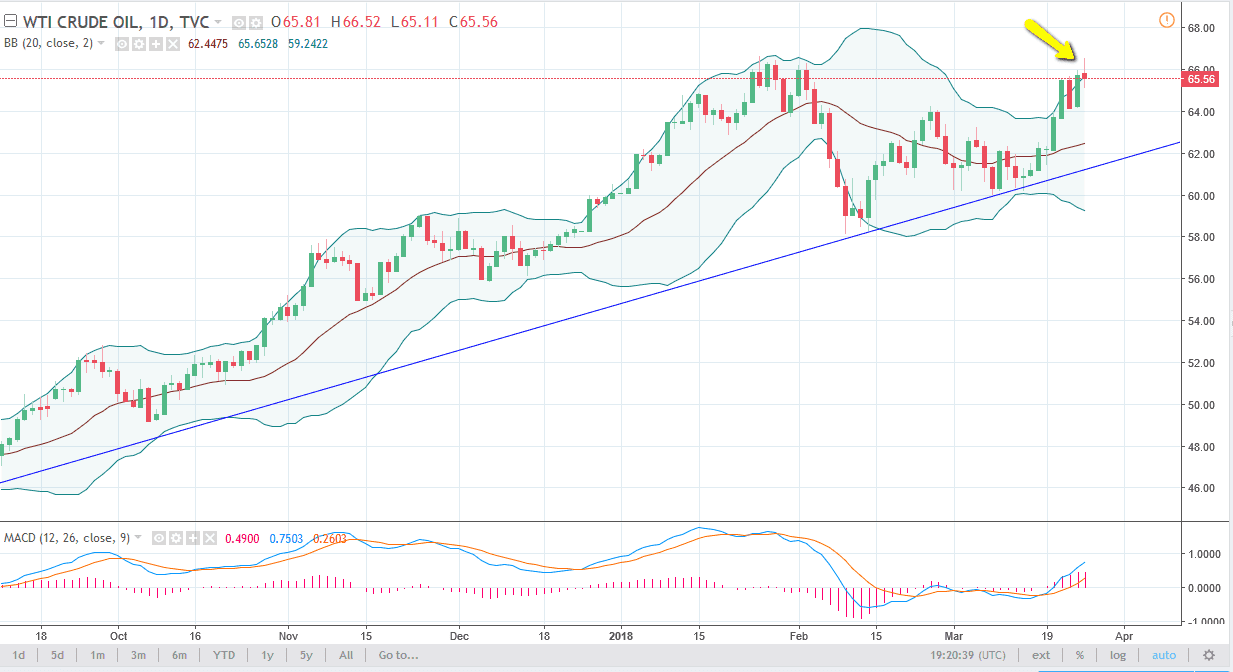

WTI Crude Oil

The WTI Crude Oil market has been very noisy during the trading session on Monday, breaking above the $66 level, before running into a buzz saw of resistance. By turning around the way it did, we ended up forming a shooting star. That shooting star suggests that we need to pull back, perhaps trying to find some type of value underneath. The uptrend line on the chart of course will continue to keep this market bullish, so I think this pullback will eventually offer enough value to attract people. If we break down below the uptrend line, the market unwinds rather rapidly. However, I think the only thing you can count on is a significant amount of noise in this market, as we have a lot of conflicting issues, including tensions in the Middle East rising, while demand has been falling in North America.

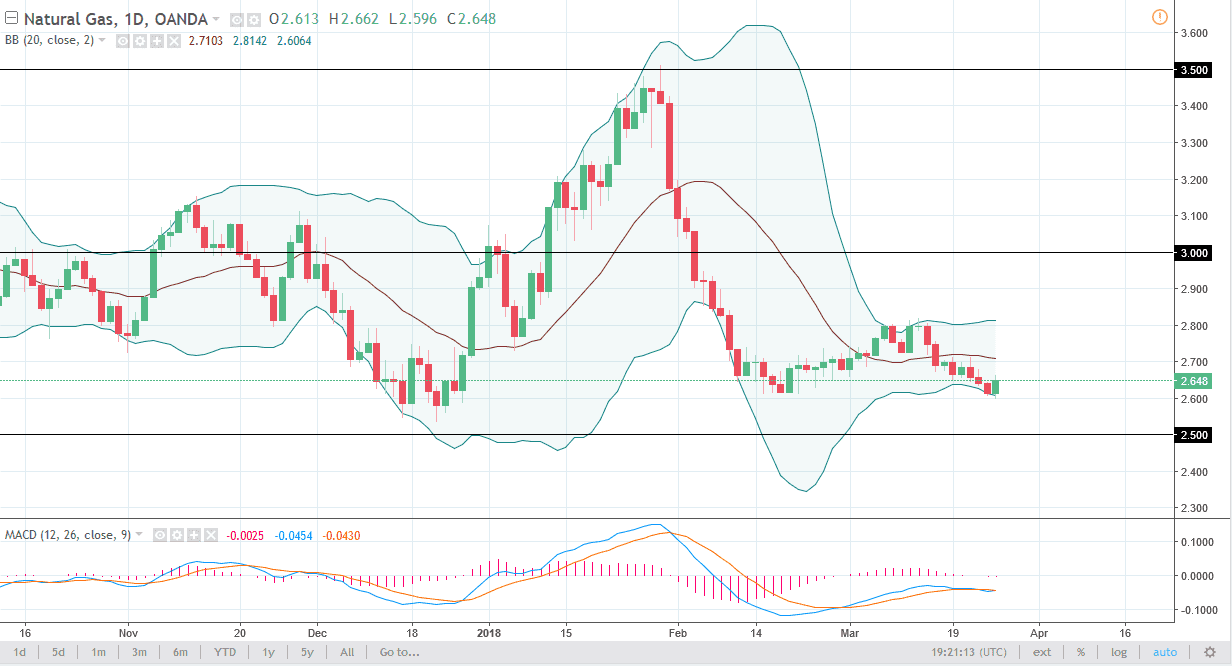

Natural Gas

Natural gas markets rally during the trading session on Monday, using the $2.60 level as support. The market bouncing the way it did is a bullish sign, but I think that the overall trend is obvious, that rallies get sold. That’s exactly how I am going to trade this market, so I look at this as an opportunity to sit back and allow the market to rise to higher levels that I can take advantage of. If we rally a bit, that should be an opportunity to take advantage of the first signs of exhaustion. That exhaustion shows that the longer-term downtrend very much intact. I think that the demand for natural gas will continue to go lower, or at the very least the supply will continue to grow. In the end, that means the same thing and that means lower natural gas pricing.