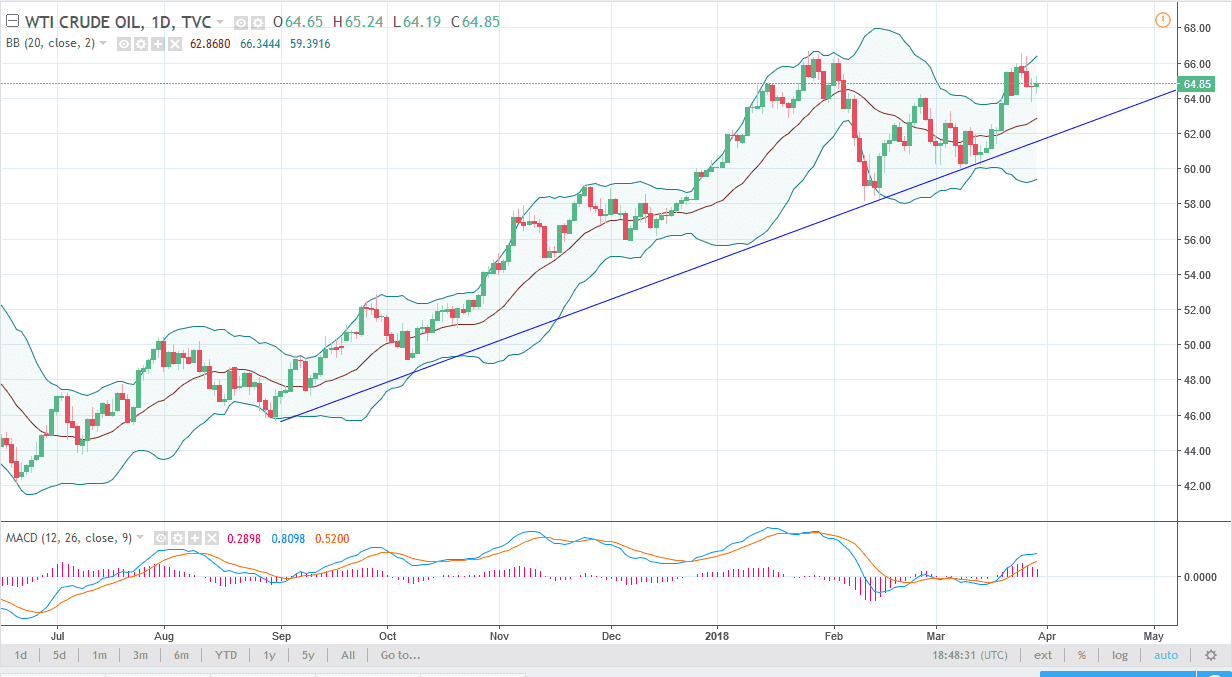

WTI Crude Oil

The WTI Crude Oil market had a choppy session on Thursday, going back and forth during the day, essentially doing nothing. The market is trying to stabilize a bit, but I think that we have a couple of noisy days ahead of us. There seems to be more of an upward pressure in this market, so I think that the uptrend line on the daily chart should continue to offer psychological support, perhaps even structural support. There does seem to be a significant amount of resistance at the $66.66 level, so if we were to break out above there, the market should then be free to go to the $70 handle. I look at short-term pullbacks as potential buying opportunities, but if we were to break down below the aforementioned daily trend line, then I think that would change everything in this market.

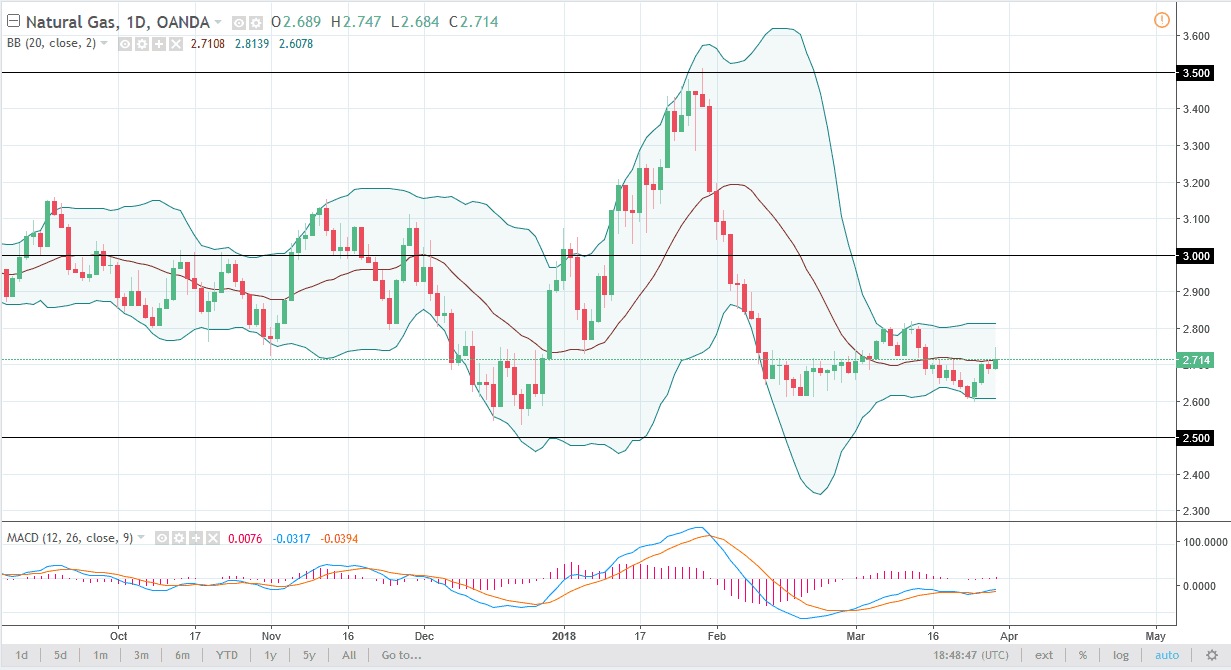

Natural Gas

Natural gas traders initially sent the market higher during the day on Thursday, reaching towards the $2.75 level. However, we have rolled over since then to show signs of weakness, so I think that the market will continue to bounce around drastically, but I think that the market should continue to go in a very erratic manner. I think that the $2.80 level would be an excellent place to start shorting, and if we get there I am more than willing to do so. Otherwise, if we break down below the bottom of the Wednesday candle, I think that a short-term selling opportunity will have presented itself, as we would then go down to the $2.60 level. The market continues to be bearish overall, so I look at any rally as an opportunity to take advantage of the overabundance of natural gas.