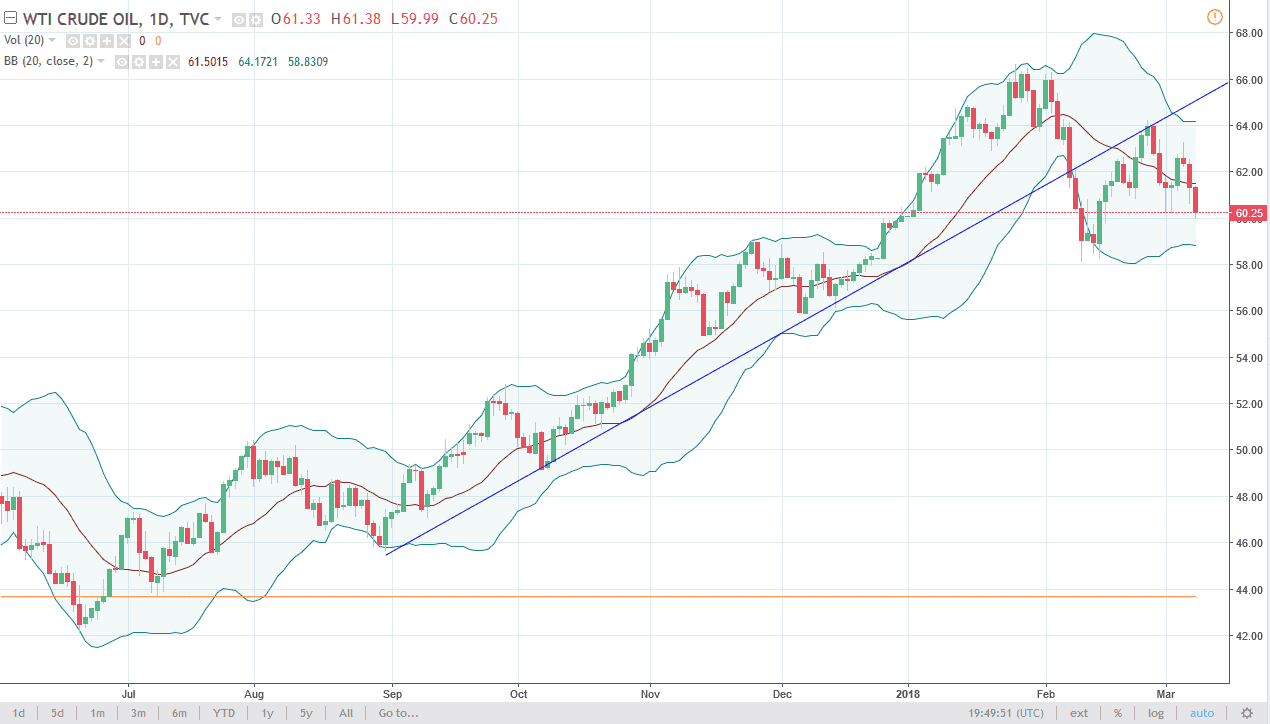

WTI Crude Oil

The WTI Crude Oil market fell again during the trading session on Thursday, dropping almost 2%. We are currently testing the $60 handle, and I believe that suggests that we are going to fall towards the $58 level next. If we bounce from here, it’s likely that we will find plenty of sellers above, as we have recently broken through a major uptrend line and therefore I think the sellers are going to continue to get very aggressive. A breakdown below the $58 level frees this market to go down to the $56 level, followed by the $55 level. At this point, I don’t have much in the way of an idea for buying, and at this point in time I think that the $64 level would offer a bit of a ceiling in this market.

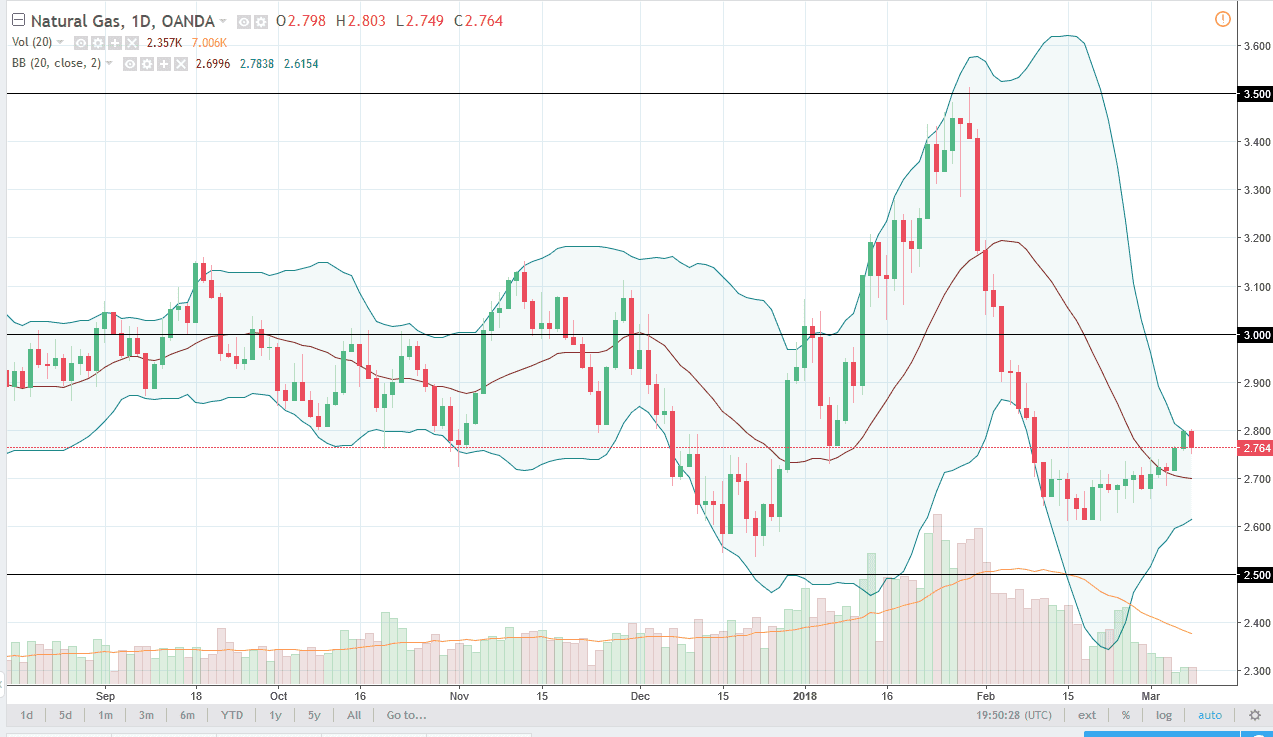

Natural Gas

The natural gas markets fell during the trading session on Thursday, wiping out the gains from the Wednesday session. We are currently testing the $2.75 level, but I think we will continue to find buyers on these dips, least in the short term. I believe that the market is still a bit oversold, so I think that the $3.00 level above will be the ceiling that should bring in a lot of sellers. Regardless, I like the idea of selling exhaustive candles that appear on the daily chart, as we most certainly have an oversupply of natural gas in general. The natural gas storage data came out during the Thursday session rather bearish, so it might be difficult to get to the previously mentioned $3 handle. Either way, the one thing I don’t want to do is buy this market, and I believe that we will eventually reach towards the $2.50 level underneath.