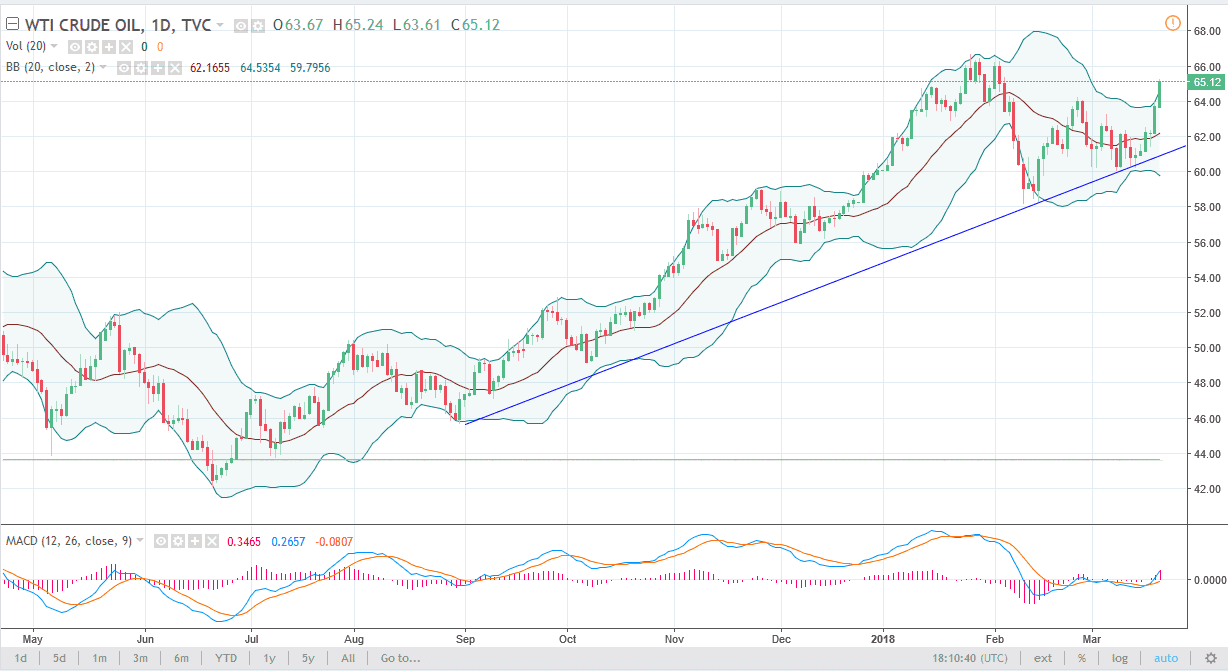

WTI Crude Oil

The WTI Crude Oil market has had a strong session on Wednesday, breaking above the $65 level. At this point, it looks as if we will continue to find the buyers on short-term dips, as the uptrend line has certainly held true. I think that the market will struggle a little bit with the $66.50 level, but at this point it does look as if the buyers are in control. Even if we pull back, I think there are plenty of buyers underneath, and I think short-term we will continue to see this market show signs of strength. If we were to break down from here, it’s not until we clear the uptrend line that I would think about selling. Oil markets are bit overbought at the moment, but I think we will eventually have value hunters coming back.

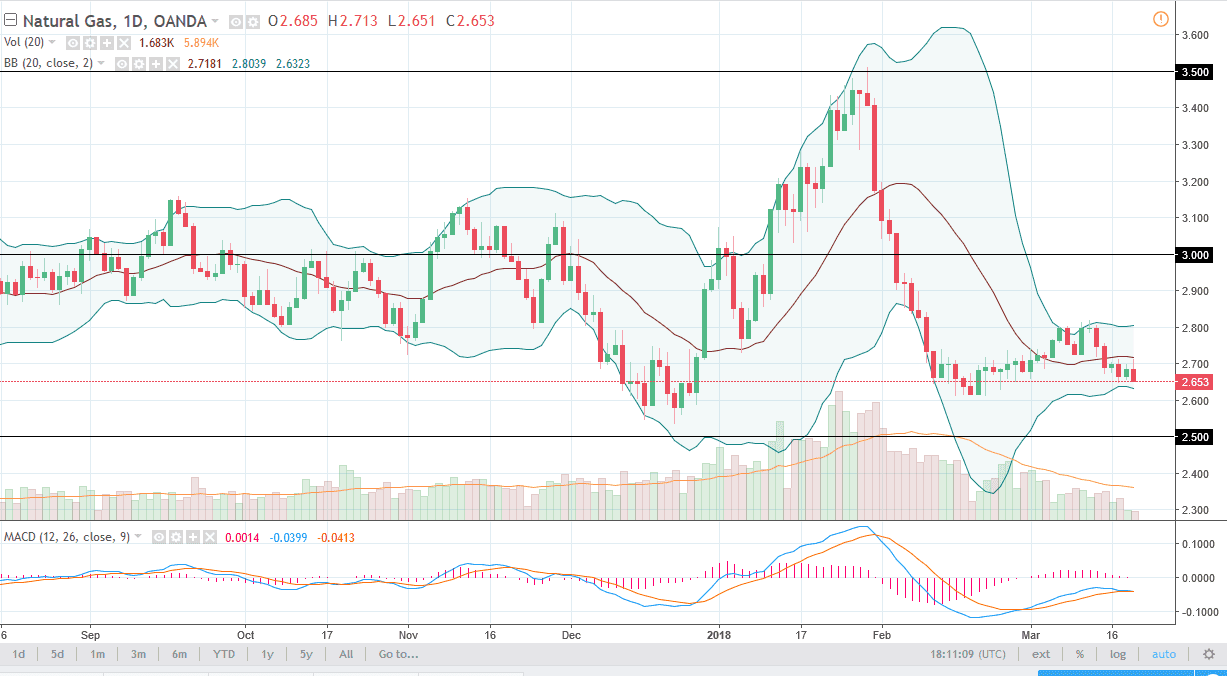

Natural Gas

Natural gas markets initially tried to rally on Wednesday but failed and rolled over at the 20 SMA. We have now broken towards the lows of the last couple of sessions again, and it looks as if we may be trying to target the $2.60 level. I think that every time this market rallies, you should be looking for selling opportunities as there is so much negativity around natural gas. While we have had colder temperatures in the northeastern part of the United States lately, we have not had a sustained cold snap, so demand is limited to short-term burst. Ultimately, I think there’s plenty of selling pressure at the $2.80 level, and of course the $3 level. The $2.50 level underneath is a massive floor in the market, and if that were to be broken down below, that would be disastrous for this market. I believe selling the rallies is the best way to play natural gas.