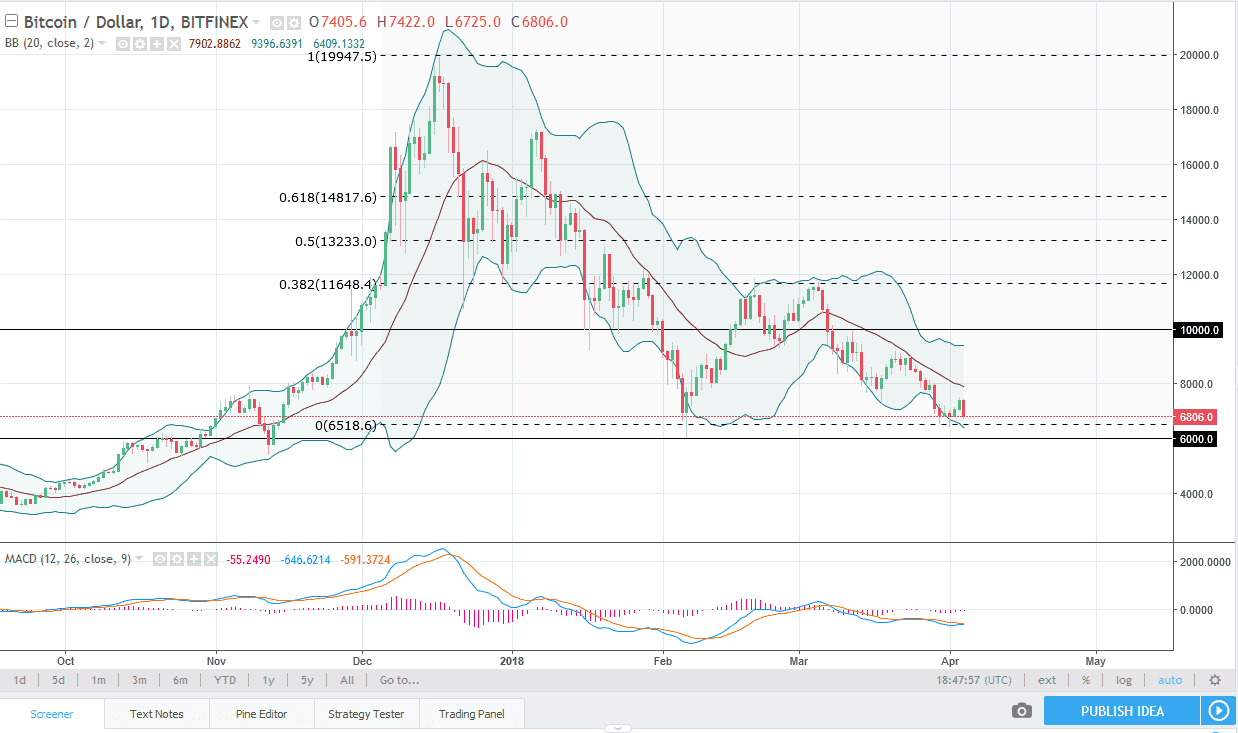

BTC/USD

Bitcoin markets fell during trading on Wednesday, as we continue to see weakness in this market. We’ve lost 7% as the Americans were closing out the day, and I think that the $6000 level should continue to be supportive, and I think a breakdown below there would be catastrophically negative. I believe at this point, we should see plenty of negative pressure every time we rally, and I’m willing to start shorting this market on signs of exhaustion. If we did breakdown below the $6000 level, I anticipate that the next support level will be closer to the $4000 level, although there would of course be noise. Retail traders have stepped away from Bitcoin recently, and I think that the large majority of retail traders that were involved are hanging on to negative positions, praying for some type of bounce. Obviously, that is an untenable situation to be in.

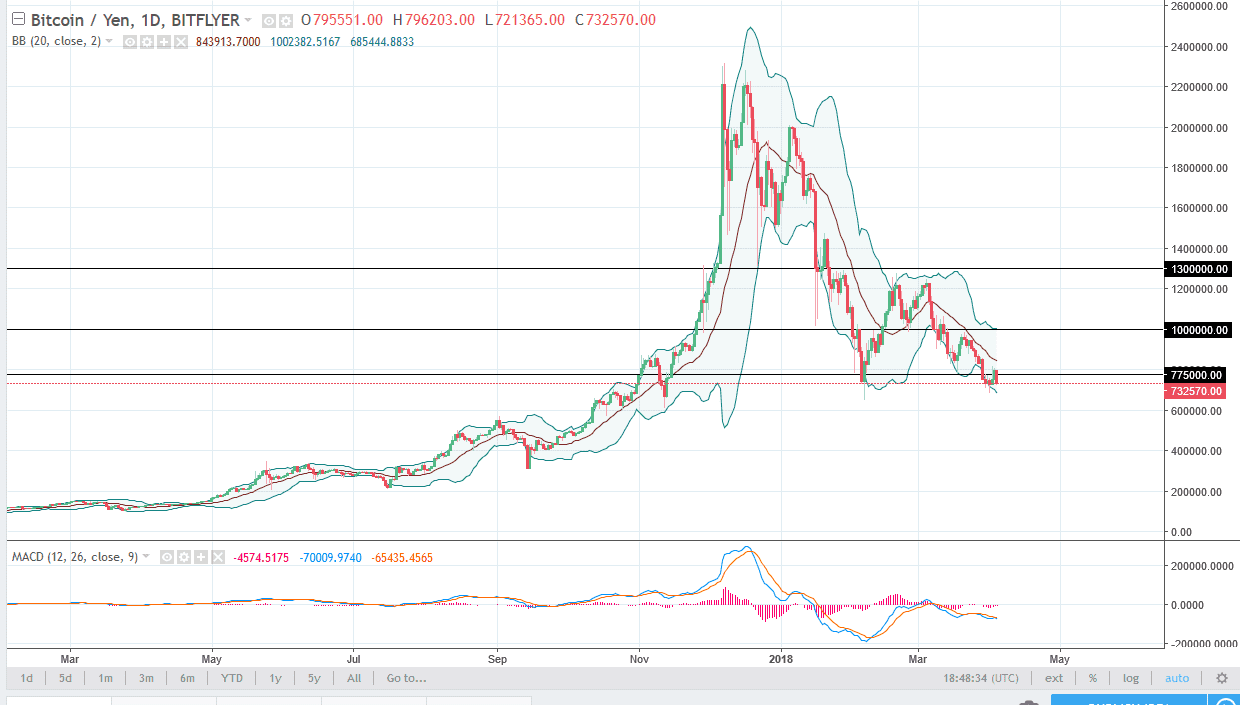

BTC/JPY

Bitcoin broke down significantly during the trading session against the Japanese yen as well, and it looks likely that we would unwind down to the ¥600,000 level. I think that this shows just how difficult things are going to be to pick up momentum to the upside, and I believe that the market continues to be very noisy, and I still prefer selling rallies, and after the recent move that we had over the last couple of days, I thought that perhaps it would be a nice trade to wait for exhaustion after a significant rally, but we didn’t get that, and this shows that the market is even more bearish than I had originally anticipated. A breakdown below the ¥600,000 level unwinds this market drastically, reaching towards the ¥400,000 level. It’s not until we break above ¥1.1 million that I would be a buyer.