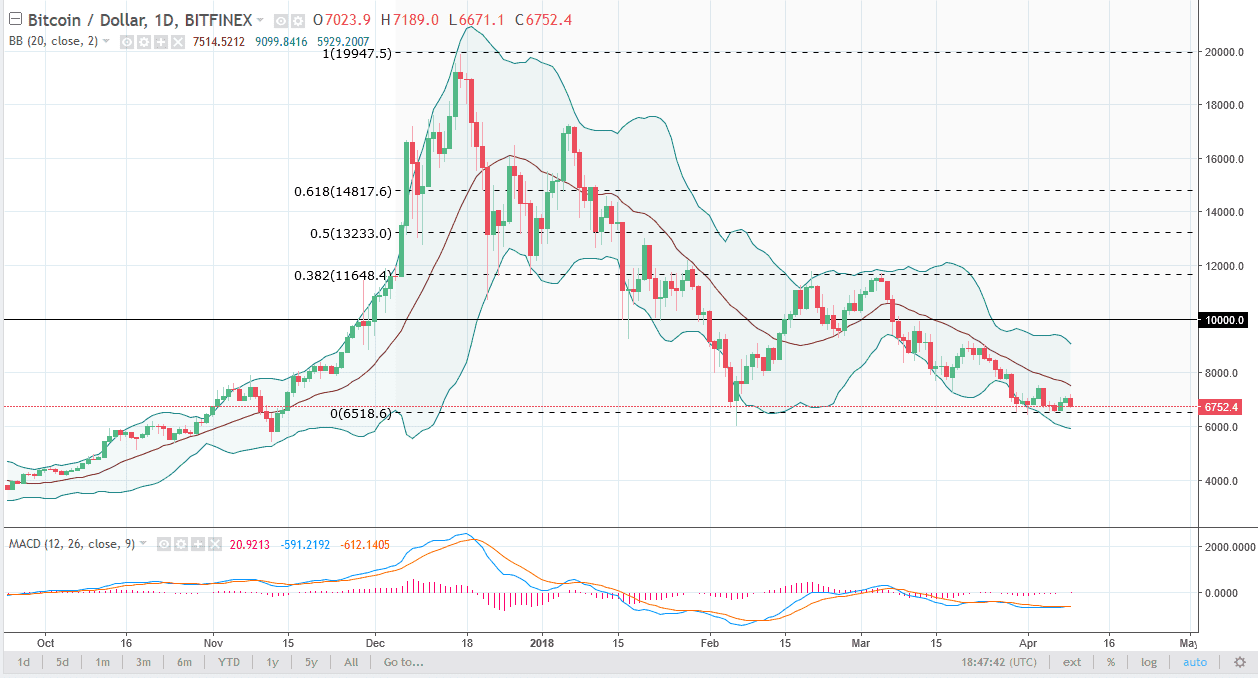

BTC/USD

The Bitcoin markets have been negative yet again during trading on Monday, as the BTC/USD pair tried to rally, but then rolled over to show signs of exhaustion yet again. We lost more than 3%, and it looks as if we are going to go looking towards the $6500 level. I believe there is support at the $6000 level under there, and therefore if we break down below there I think that the BTC/USD pair will go much lower, perhaps down to the $4000 level. Rallies are to be faded, at the very first signs of exhaustion. I have no interest in buying Bitcoin, it seems as if it cannot find its footing, and that being the case it’s likely that we will continue to see a serious lack of confidence. A breakdown below the $6000 level I believe will bring in fresh money to the downside yet again.

BTC/JPY

Bitcoin markets also tried to rally against the Japanese yen on Monday but rolled over as well. This is interesting to me, because the Japanese yen struggled in the Forex markets. Because of this, it’s likely that the BTC/JPY pair will continue to struggle as even with a softer yen, it still shows signs of selling. If there is some type of run to the yen in the Forex markets, this pair will break down significantly, with the first sign of negativity being a breakdown below the ¥700,000 level. Once that happens, I expect to see the selling accelerating, and that we would probably go to the ¥600,000 rather quickly. I have no interest in buying this market until we can break above the ¥1.1 million level, something that seems very unlikely to happen anytime soon. Bitcoin will continue to find reasons to fall from everything I see on these charts.