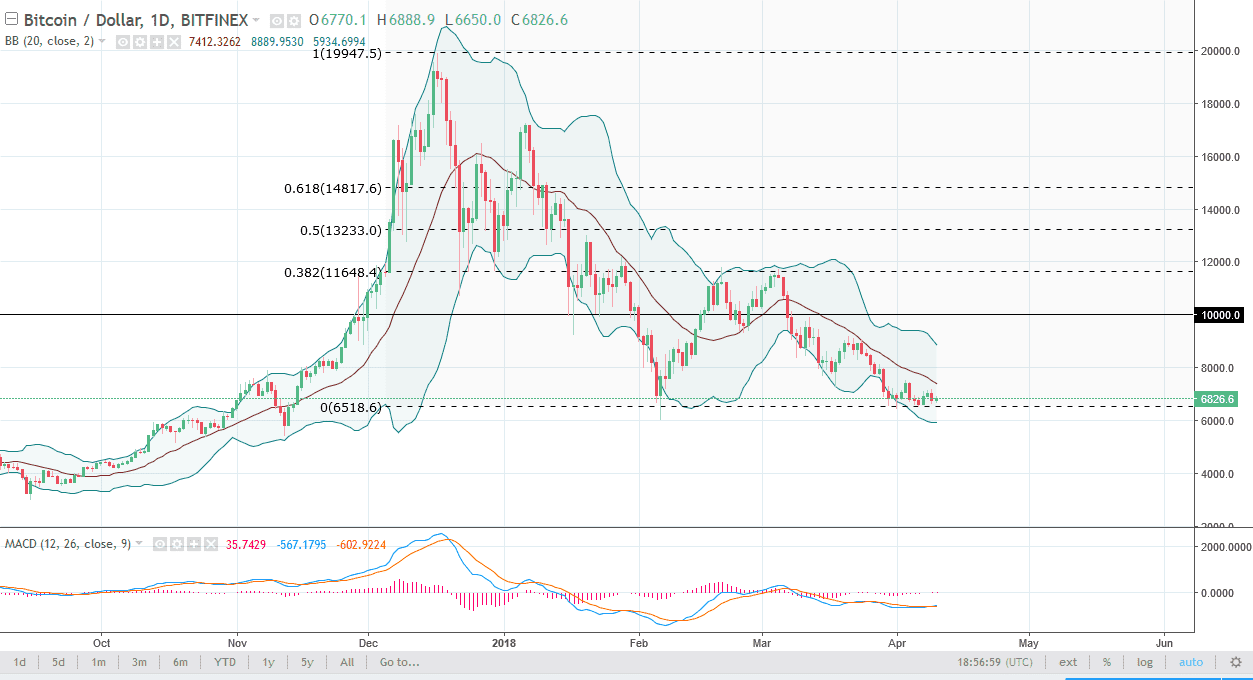

BTC/USD

Bitcoin rallied slightly during the trading session on Tuesday, as we have come close to a bottom. The market looks likely to find plenty of support just below, but if we were to break down below the $6000 level, it’s likely that the market would unwind rather drastically. At that point, I believe that the market will probably reach towards the $5000 level rather quickly. In the meantime, I look at rallies as selling opportunities as they have been so reliable. At the first sign of exhaustion on a daily candle, I am more than willing to start shorting again. I have no interest in buying Bitcoin, it is certainly struggling overall, and I believe will continue to do so as crypto currency markets in general have been battered lately. In fact, I don’t have a scenario quite yet that I’m willing to point out that gets me bullish. I would say this though, we are at a massive level that could eventually turn out to be an area of bottoming.

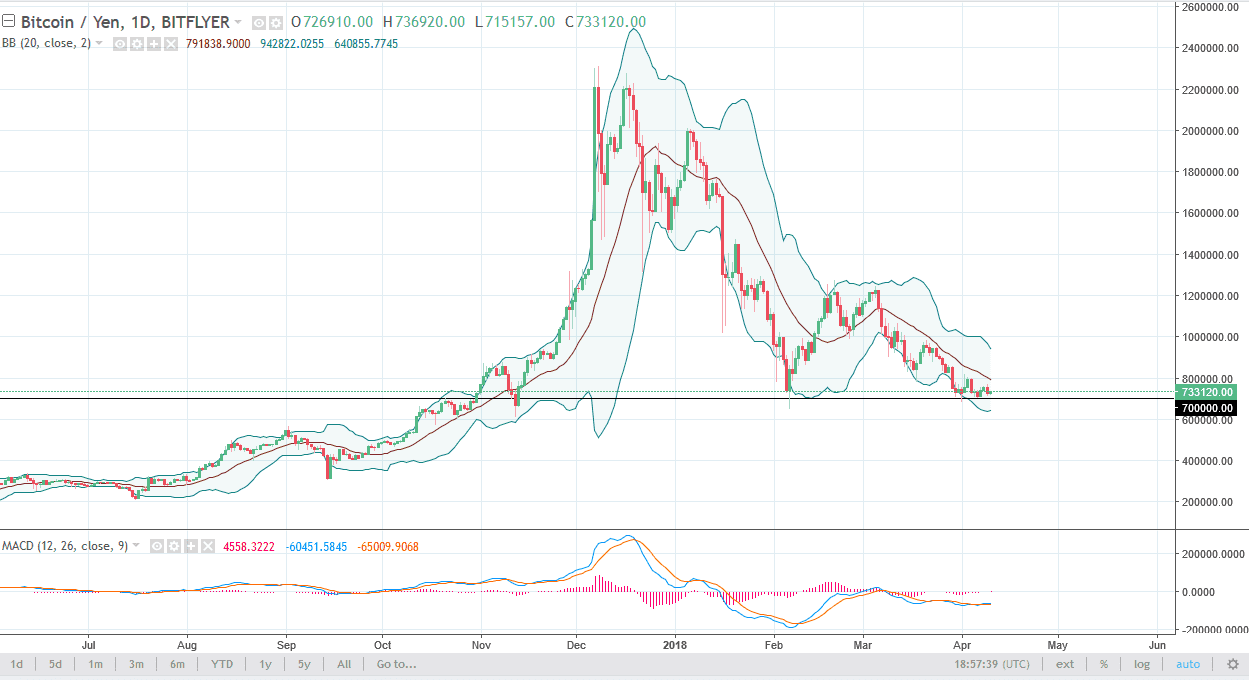

BTC/JPY

Bitcoin found a little bit of support against the Japanese yen as well, as the ¥700,000 level has shown signs of support. I believe that the market will look at this is a crucial area, but if we were to break down below the ¥600,000 level, we could unwind towards the ¥500,000 level. I think that this market more than likely will find sellers every time we rally, and that’s exactly how I’m looking at this market, one that I am selling every time we rally on the daily charts and shows signs of exhaustion. I believe that the 1.1 million level above could be the gateway for higher pricing, but it’s likely that we will struggle to get above there.