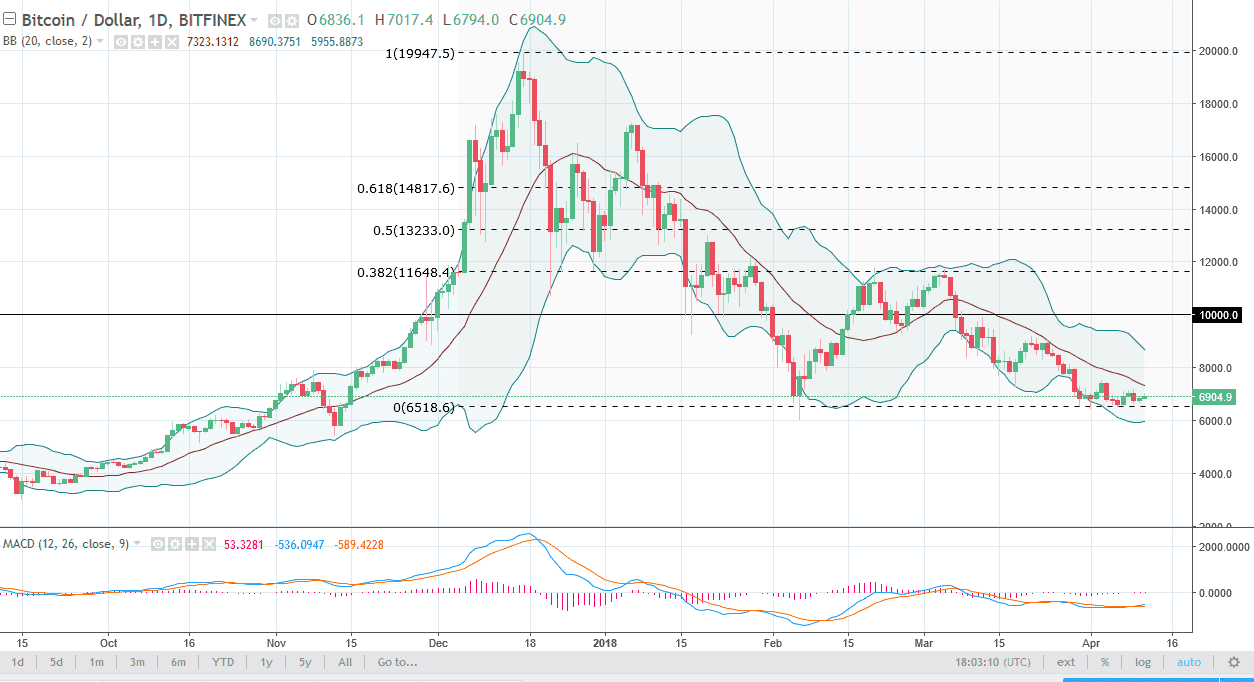

BTC/USD

Bitcoin rallied slightly during the trading session on Wednesday, which of course is better than it has been acting lately. The $6500 level has offered support, which I think that the market needs. The $6000 level below is the bottom of that support, so it’s not until we break down below that level that I think we are clear to start short selling with any type of gusto. However, the one thing that I would point out is that the range of trading has been rather tight over the last several sessions, so I think we are essentially looking at a market that is very stagnant. If we did rally from here, I think that there will be sellers coming back in on signs of exhaustion, and that’s exactly how I plan to play this market. However, if we were to break above the $8000 level, we could go looking towards the $9000 level.

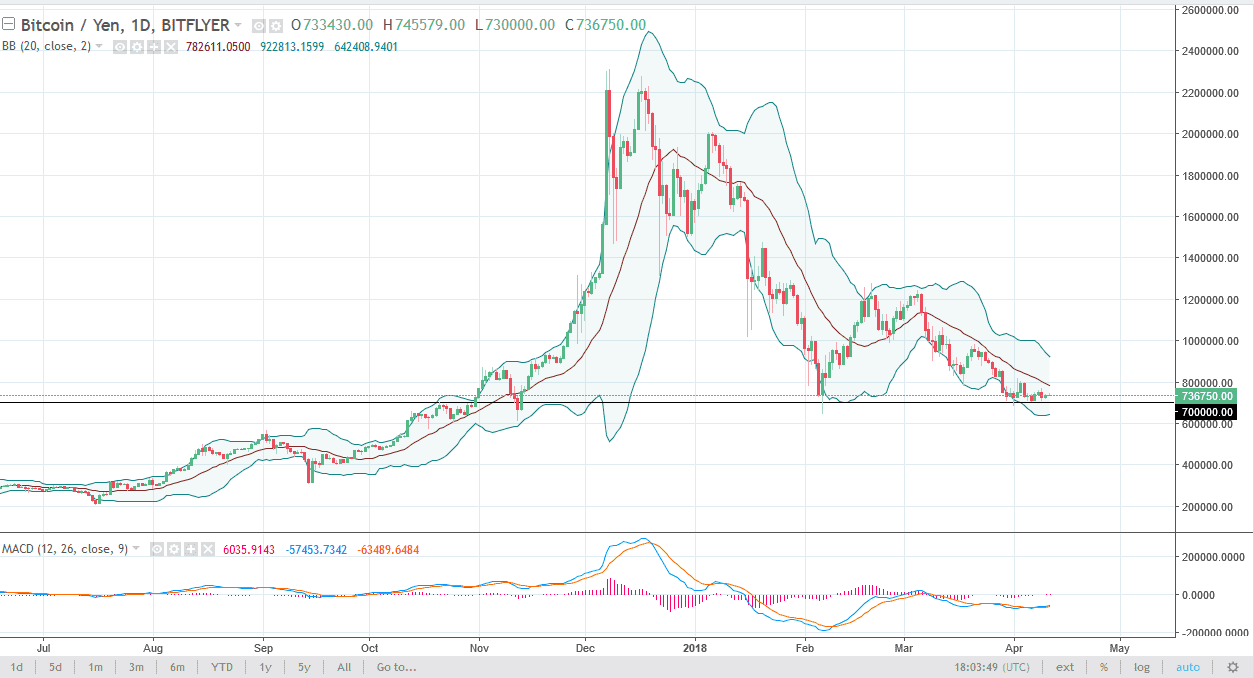

BTC/JPY

The Bitcoin market did very little against the Japanese yen as well, as we continue to see support at the ¥700,000 level. Ultimately, I think that if we break down below the ¥700,000 level, we probably will go looking towards the ¥600,000 level. Rallies at this point are selling opportunities until we can break above the ¥1.1 million level, something that doesn’t look very likely to happen. I’m looking for exhaustive candles to start shorting, or a breakdown. However, in the meantime it’s likely that we will continue to see a lot of choppiness and volatility, so I would keep my trading size rather small, as the choppiness could get you heard if you weren’t very careful. Pay attention to this chart, it typically tells us where the rest of the crypto currency markets are going.