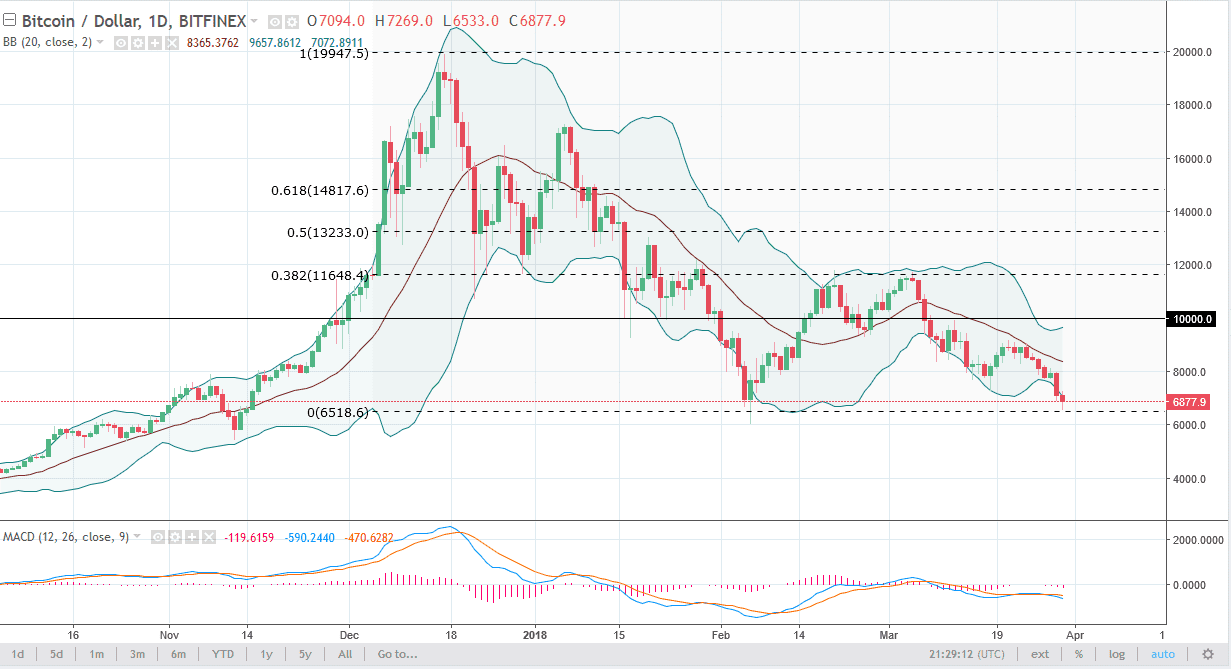

BTC/USD

Bitcoin fell initially during the trading session on Friday, reaching down towards the $6700 level. However, we did bounce a bit towards the end of the day, showing a potential hammer. If we can break above the top of the hammer, the market could go to $8000. I believe that the $8000 level above will offer resistance, just as the $9000 level will be. Ultimately, if we break down below the bottom of the hammer for the session on Friday, then I think we go to the $6000 level next. Any bounce at this point in time should be and I selling opportunity given enough time. I have no interest in buying Bitcoin until we can break above at least the $9000 level, as we continue to see this market sell every time we try to pick up. With this type of negativity in the market, I think it’s only a matter of time before the sellers will come back.

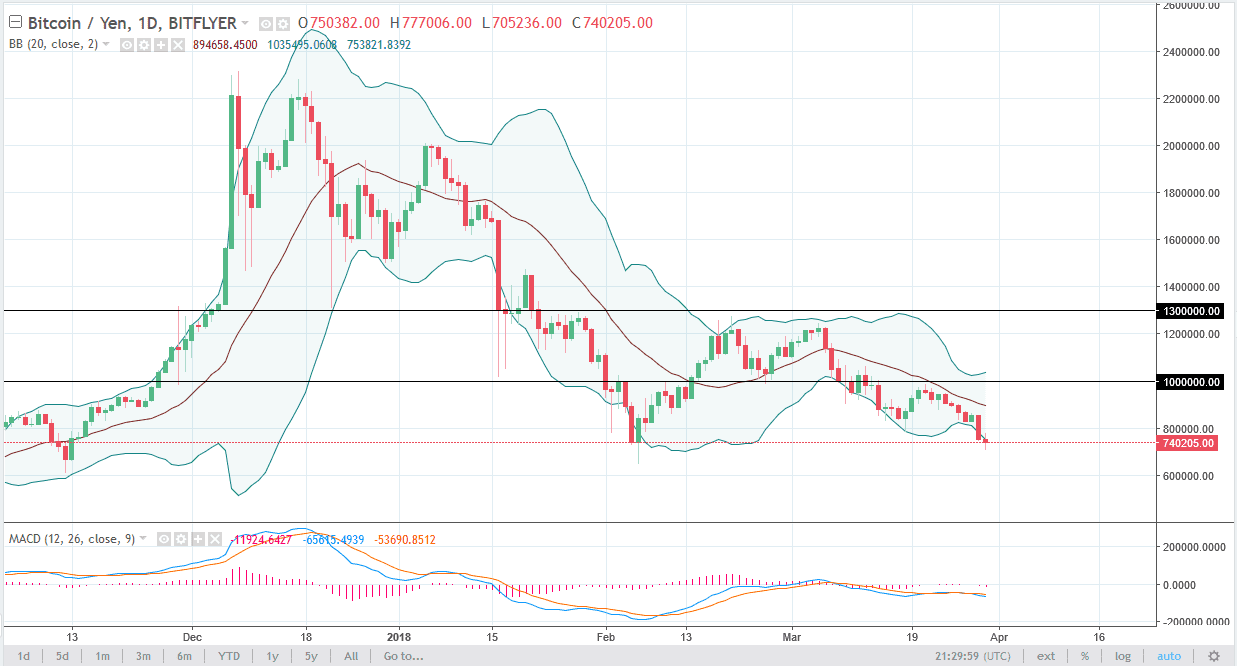

BTC/JPY

Bitcoin markets also were somewhat negative against the Japanese yen, but just like they did against the US dollar, we turned around to form a bit of a hammer. The hammer shows signs of life, and I think if we can break above the top of it, extensively the ¥800,000 level, the market could go to the ¥900,000 level, and of course the ¥1 million level after that. I believe that the area at ¥1 million is far too resistive for the market to go above, at least not unless we get some type of good news that could propel this market. If we break down below the candle for the Friday session, we will probably go down to the ¥650,000 level, possibly even lower than that. Pay attention to this chart, it could lead the rest of the crypto currency markets.