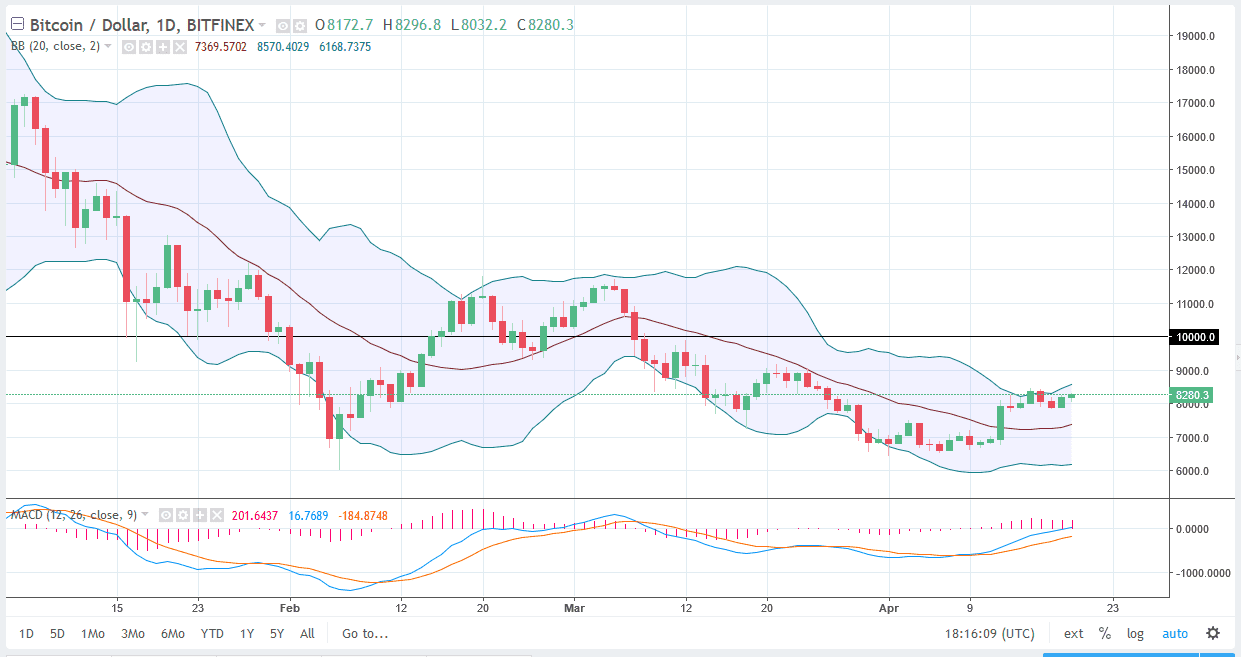

BTC/USD

Bitcoin was slightly positive during the session on Thursday, gaining over 1%. However, there seems to be a bit of resistance at the $8400 level, so I think we may continue to go back and forth. If we can break above the $8400 level, the market will probably go to the $9000 level next. The alternate scenario is that we roll over here and go looking towards the $7800 level. I think short-term back and forth trading is probably going to continue to be what we see, but if we break down below the $7800 level, I think we will then go looking towards the $7000 level underneath. Alternately, if we can break above the $8400 level, I think that Bitcoin will go hunting the $9000 level. I believe that this market continues to show plenty of short-term opportunities, but if you are longer-term incline, you will probably be looking at these little pullbacks as an opportunity to pick up a bit of value.

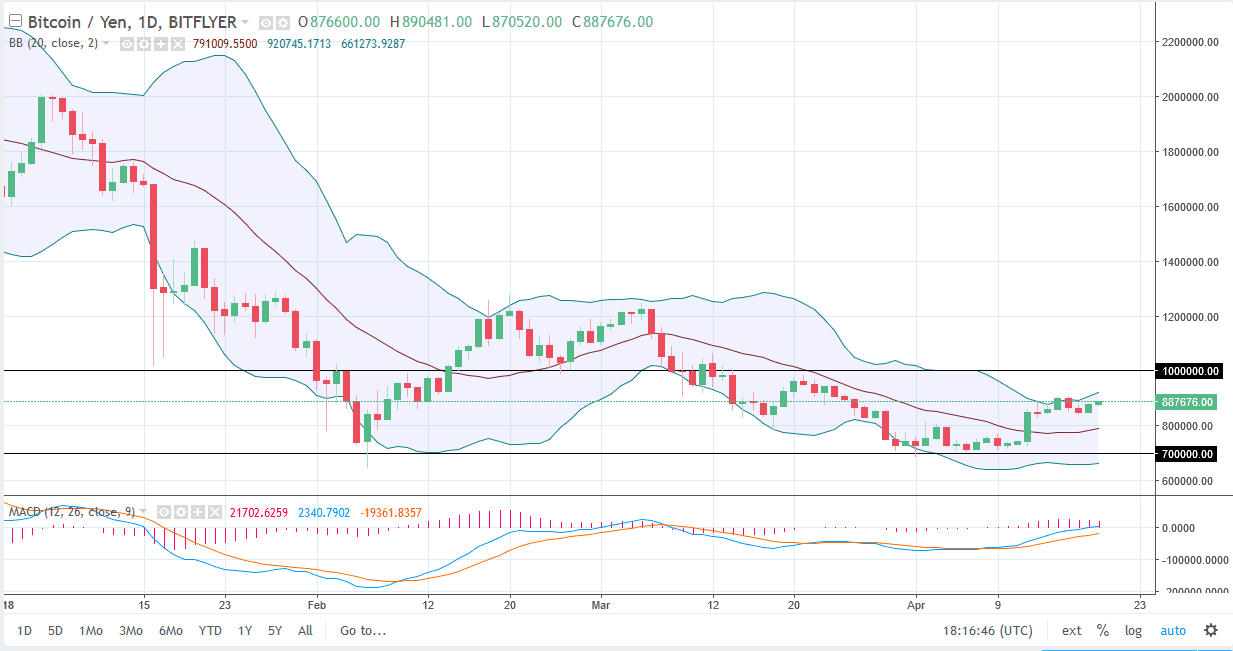

BTC/JPY

Bitcoin went back and forth during the trading session in a very tight range on Thursday. If we can break above the ¥100,000 level, I think we will go looking towards the ¥1 million level next. I think that clearing that level would then allow the market to go to the ¥1.25 million level. Ultimately, this is a market that I think is essentially consolidating, using the ¥700,000 level on the bottom as support, and the ¥1 million level on the top as resistance. We are essentially in the middle of the overall range, so this may be part of why we are struggling to find traction in either direction, as the market is trying to figure out where wants to go next. In the meantime, scalping is possible.