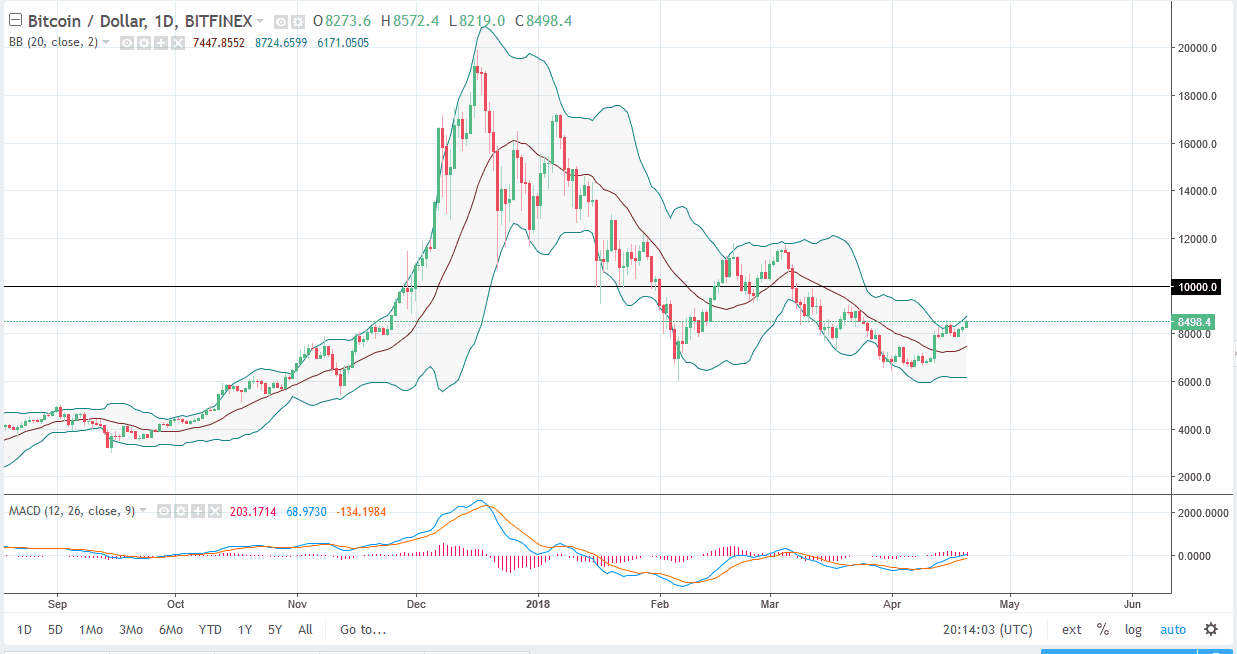

BTC/USD

Bitcoin rallied against the US dollar during trading on Friday, reaching towards the $8500 level. If we can break above that level, the market should continue to go higher, perhaps testing the $9000 level over the weekend. I think that the $10,000 level above is massive resistance, so it’s not until we break above there that the market will be free to go much higher. If we do clear that area, I think that $12,000 is certainly in the books. Alternately, if we pull back from here we could see a test of the $8000 level, perhaps even the $7500 level. I think we are trying to form some type of bigger base in the market, but these turnarounds are typically very choppy in nature. Bitcoin continues to be very bullish in general, but certainly has a lot of work ahead of it to continue the move higher.

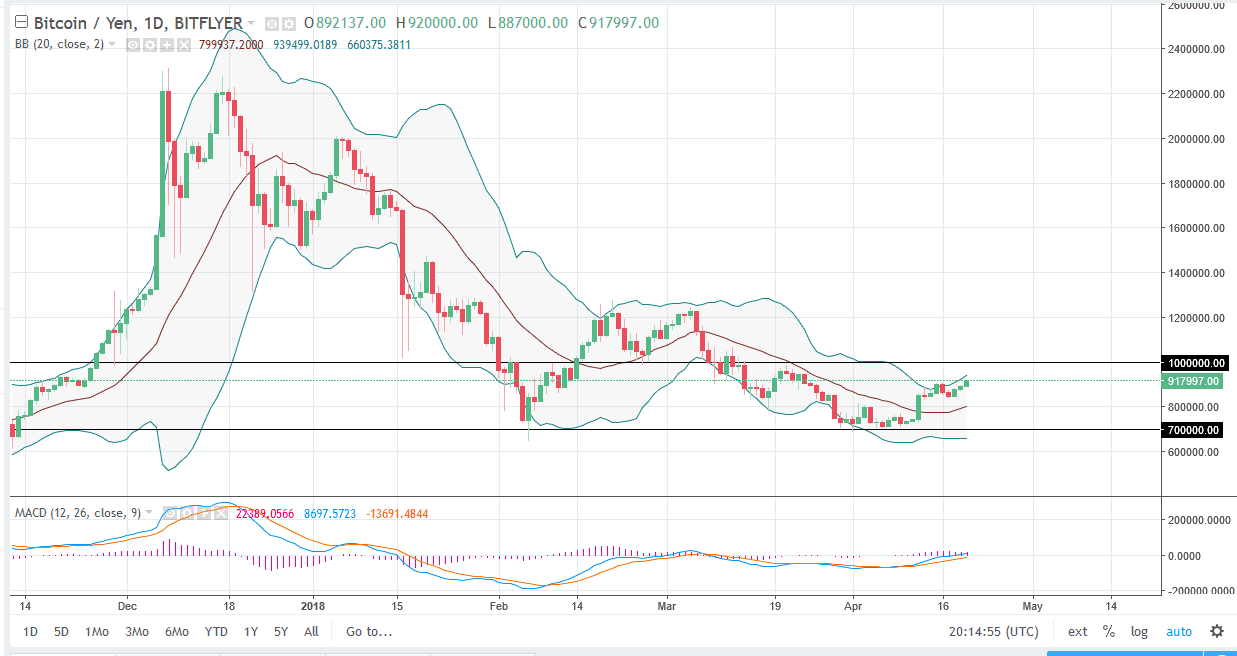

BTC/JPY

Bitcoin also rallied against the Japanese yen during the day, breaking above the ¥900,000 level. This is a strong sign, but I think there is a significant amount of resistance near the ¥1 million level, extending to the ¥1.25 million level. I think that it is only a matter of time before the buyers come in on dips, but if we were to turn around and break down below the 850,000 level, we could unwind a bit. I think there is a significant “floor” in the market near the ¥700,000 level. I think we will try to continue to go higher, but it is going to take a significant amount of momentum to finally break out to the upside. The Japanese yen lost some value during the trading session in the Forex world, so it makes sense that we should continue to see buying pressure here as well.