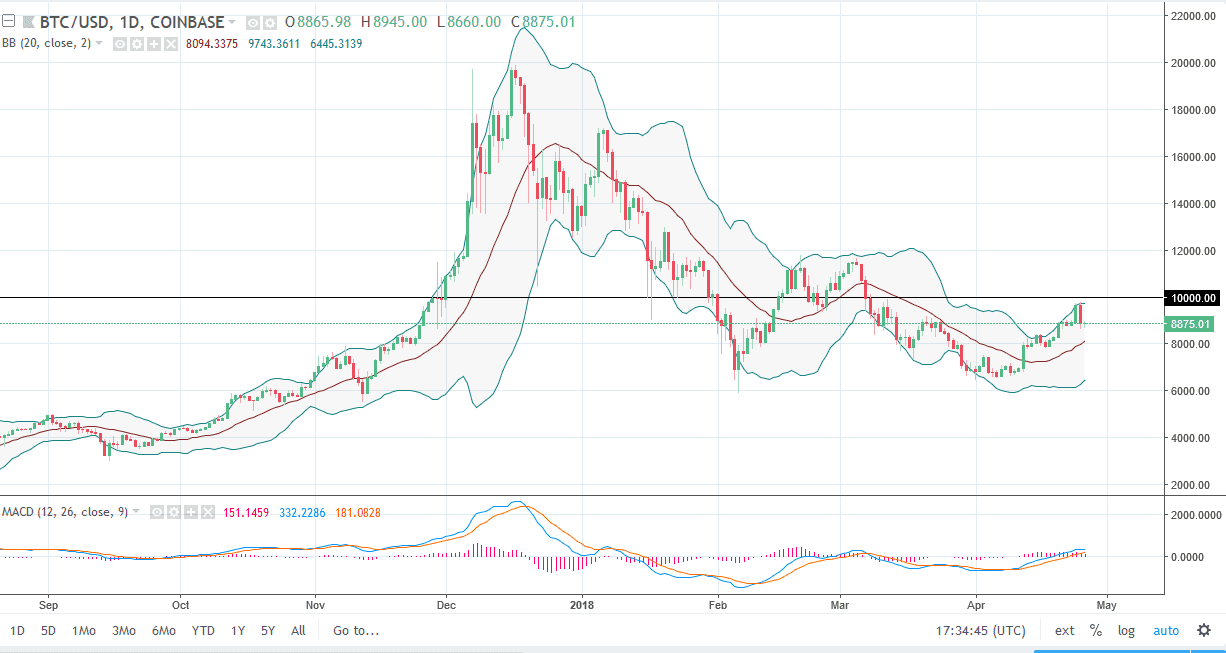

BTC/USD

Bitcoin has been extraordinarily quiet during the Thursday session after selling off on Wednesday. We had tried to break above the $10,000 level during the session on Tuesday, but then gave back those gains rather quickly. When you look at the recent action, we have essentially formed a shooting star if you extrapolate the price action over the last couple of days. This suggests that perhaps we may pull back from here, but I think that the $8000 level underneath should offer significant support. I think that pulling back from here could be an attempt to build up the necessary momentum to finally clear the $10,000 level, which might take several times. However, if we were to break down below the $80,000 level, we could go down to the $6000 level next. I think the market is trying to build up the necessary momentum to go higher, but this may be a very messy next few days.

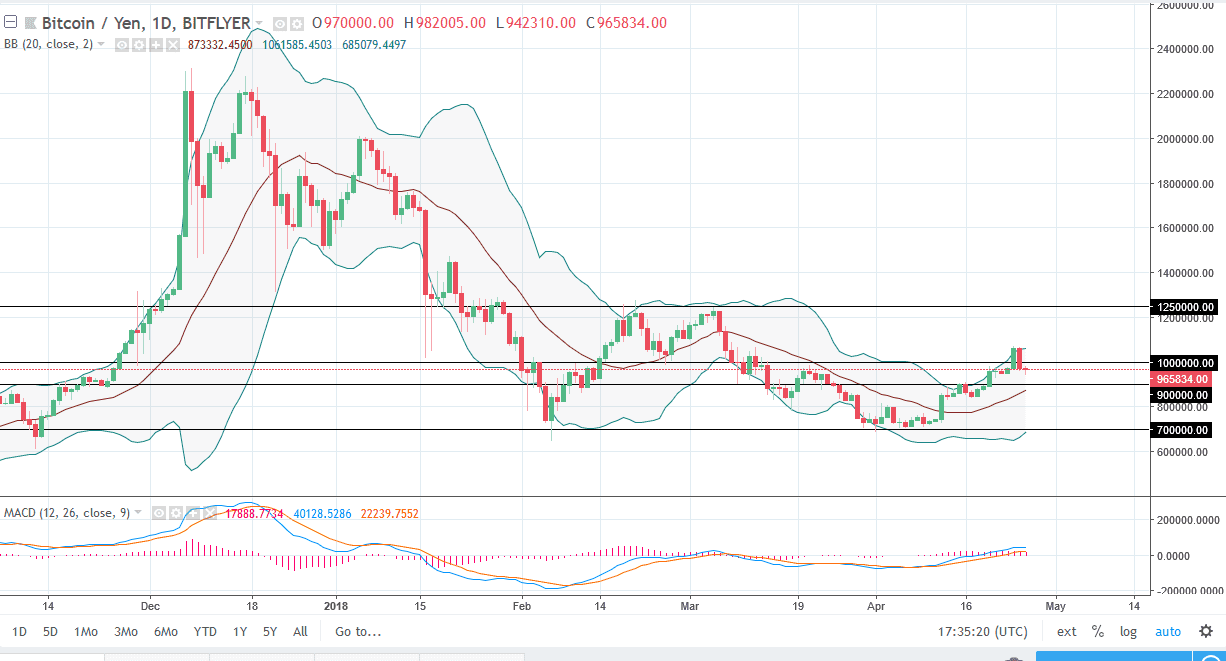

BTC/JPY

Bitcoin fell slightly against the Japanese yen during the trading session on Thursday, as we hang about the ¥950,000 level. The ¥1 million level above is resistive and I believe that it is a bit of a zone the reaches towards the ¥1.1 million level. I think that as we continue to go back and forth, it will be very choppy. I think that the ¥900,000 level underneath would be support and breaking below there could open the door to the ¥800,000 level, possibly even the ¥700,000 level. If we can finally break above the ¥1.1 million level, then the market is free to go to the ¥1.25 million region. I believe that this market will continue to be very back and forth, trying to build up the necessary momentum to finally take off to the upside.