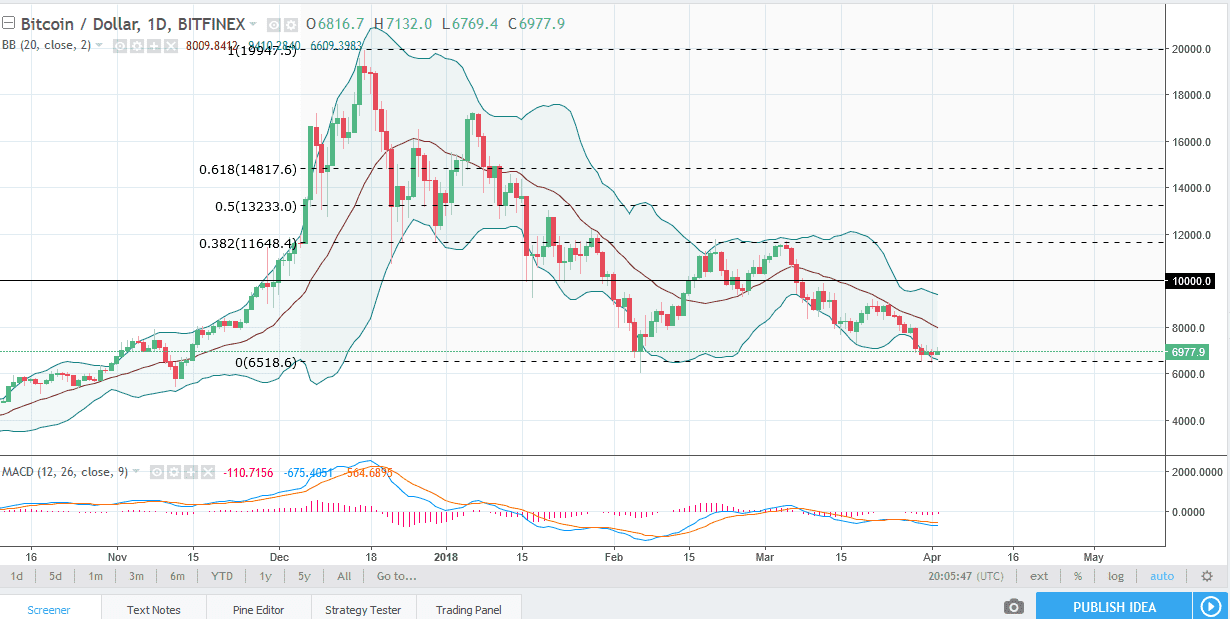

BTC/USD

Bitcoin rallied slightly against the US dollar on Monday but continues to be very soft in general. We are hovering above a major support level in the form of the $6500 level, but at this point I think the best thing we can hope for is a bit of stability. If we break down below the $6000 level, the market then should unwind rather drastically. From everything that I see in this chart, a rally will more than likely offer yet another shorting opportunity as this market cannot pick up enough momentum to rally for any length of time. $4000 makes a decent target but picking up a bit of momentum would be a nice opportunity, in the form of a rally of course. I’ve been bearish of Bitcoin for several months now, and although I think we will eventually turn around, typically these types of meltdowns need massive consolidation before people are comfortable enough to start trading to the upside again.

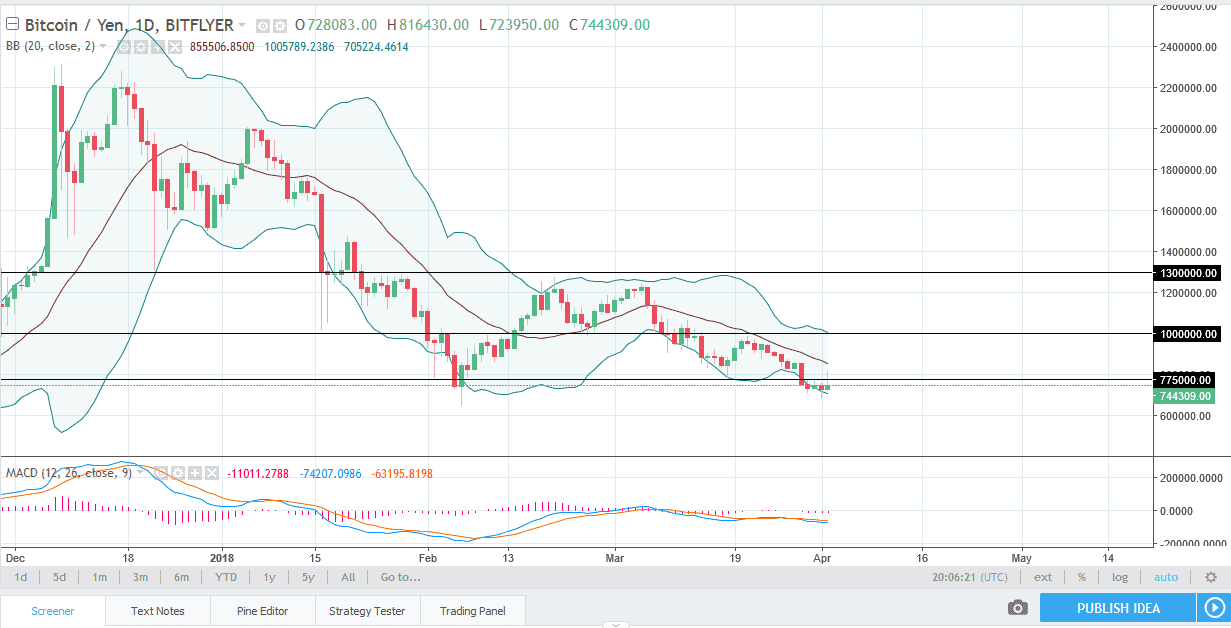

BTC/JPY

Bitcoin tried to rally during the day on Monday against the Japanese yen, but gave back most of the gains, as the ¥775,000 level offer too much in the way of resistance. It now is below the ¥750,000 level, and I think that if we break down below the bottom of the range for the weekend, we will probably go looking towards the ¥650,000 level, possibly even the ¥500,000 level given enough time. If we were to break above the top of the range for Monday, that would be a bullish sign, but I think that the resistance near the ¥1 million level will be far too difficult for the market to overcome, and therefore I believe that we will see sellers in this market sooner rather than later.