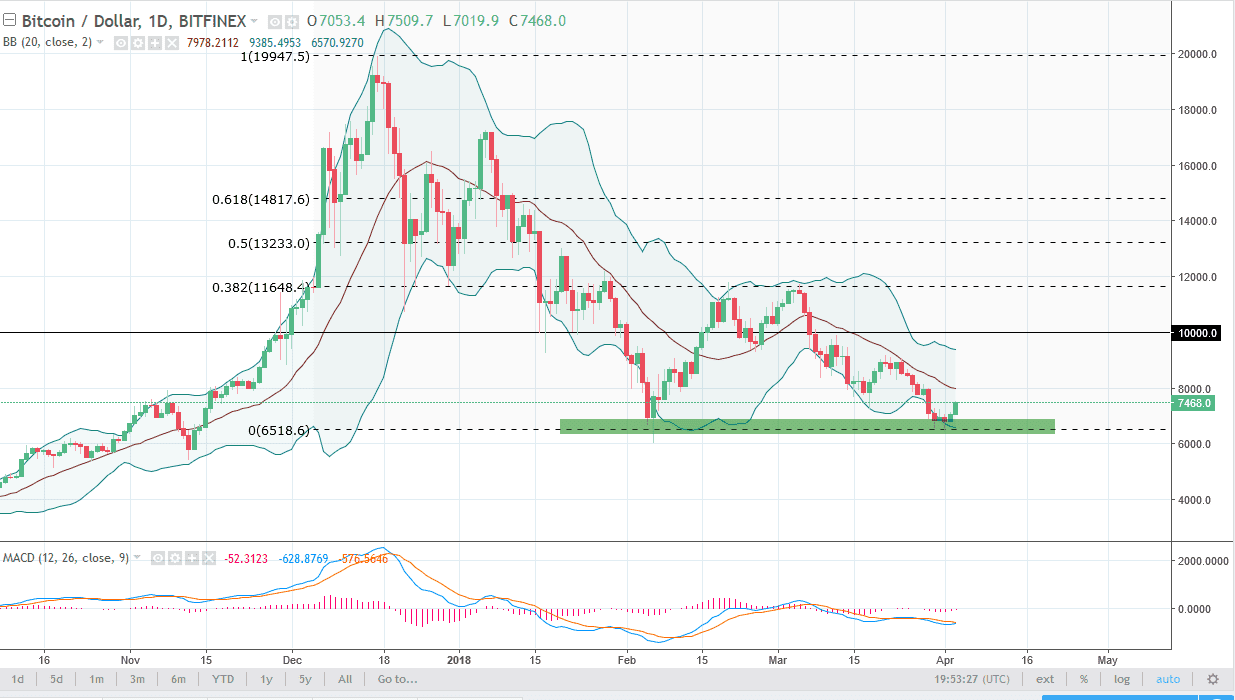

BTC/USD

Bitcoin traders rallied during the day on Tuesday, gaining about 6%. This is a very bullish sign, and now that we are approaching the $8000 level, we will also be testing the 20 SMA, which is in the middle of the Bollinger Bands. Ultimately, this is a market that I think continues to see bearish pressure longer term, so this rally, although nice, suggests to me that it’s more of a dead cat bounce, and that sellers will be looking for reasons to short this market above. If we were to roll over and break down through the lows, that’s obviously catastrophic and should send going down to the $4000 level. We don’t have the exhaustive candle that I would like to see to start shorting yet though, so I would be doing so right here. I anticipate that the $8000 level will bring out some sellers, and $9000 most certainly will.

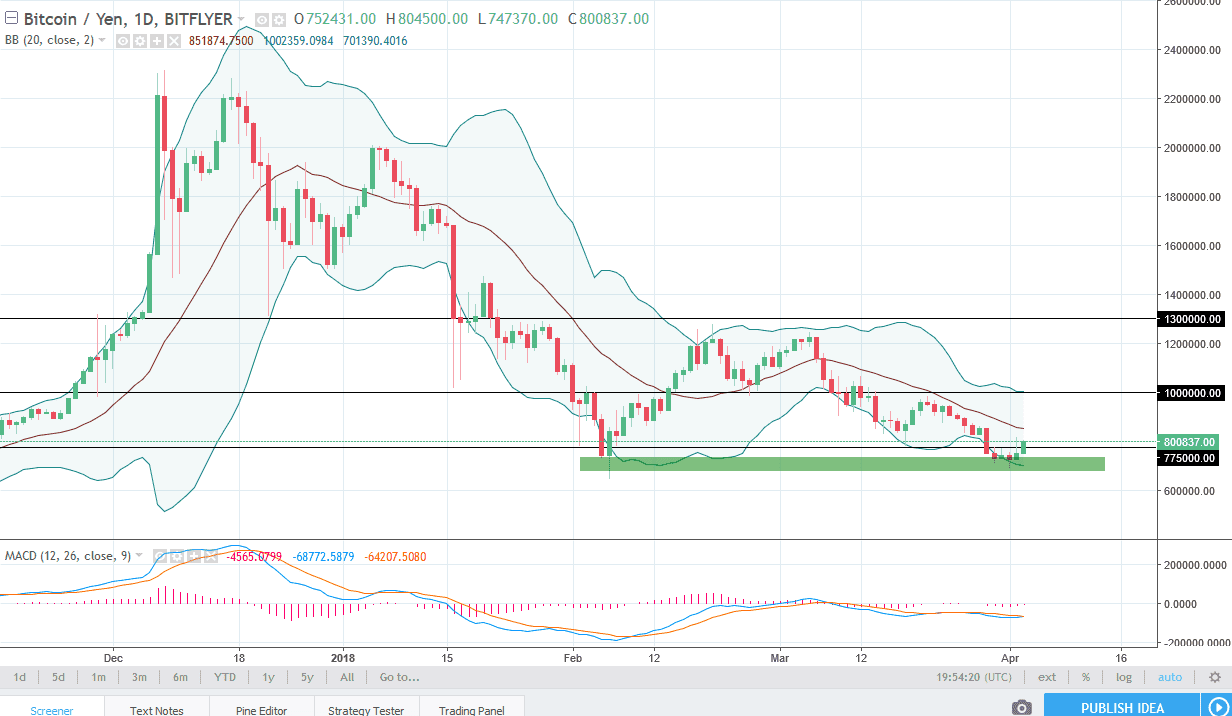

BTC/JPY

Bitcoin also rallied against the Japanese yen, reaching above the ¥775,000 level, testing the top of the shooting star from the Monday session. If we can break above that, the market could go higher, perhaps reaching towards the ¥1 million level over the longer term. However, it seems that every time Bitcoin looks as if it is ready to pick up a bit of momentum to the upside, there’s another selloff. At this point, I don’t know that there are a lot of people willing to throw large amounts of money into this market, and I think it will continue to struggle every time it tries to go higher. Obviously, if we break down below the lows here, that would also be catastrophic. In the meantime, I’m waiting for and exhaustive candle that I can start selling on the daily charts to take advantage of what is a very negative market.