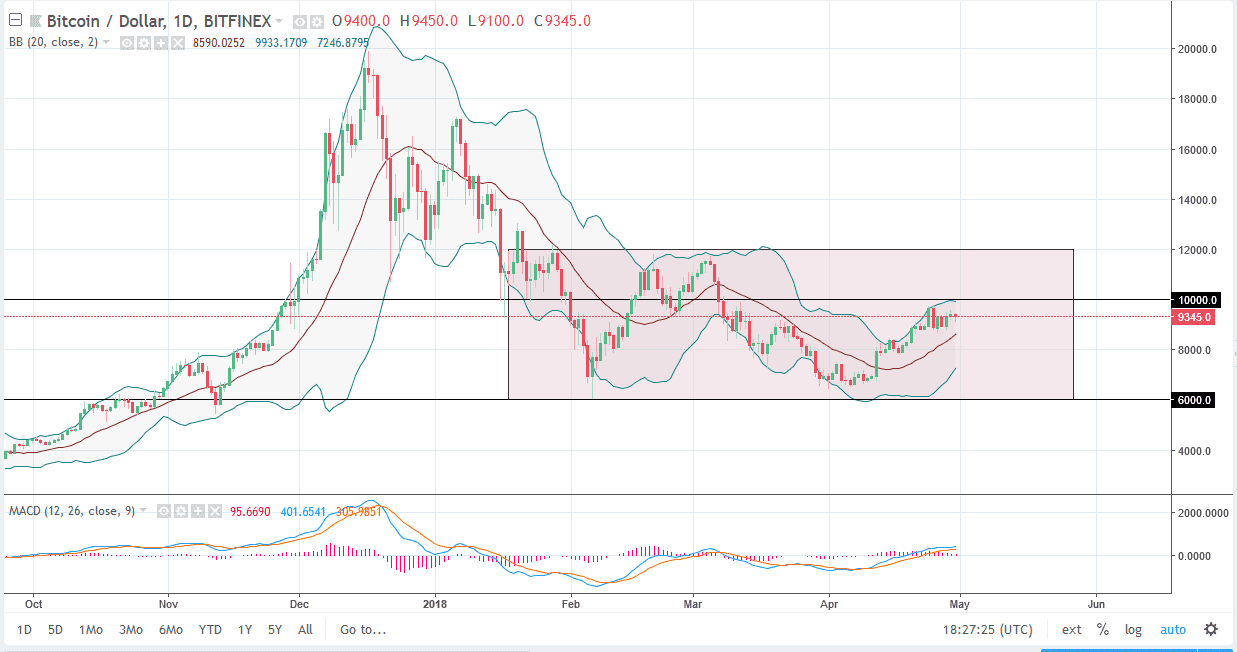

BTC/USD

Bitcoin markets did very little during the session on Monday, as we continue to grind sideways just below the $10,000 level. The $10,000 level is psychologically and structurally important, so it’s likely that we will continue to see this market struggled a breakout, and that short-term pullbacks could be opportunities to pick up value. However, I think if we break down below the $9000 level, we probably go to the $8000 level next, followed possibly by the $6000 level which is the bottom of the overall consolidation area that we have been in for some time. Ultimately, this is a market that I think is going to be very quiet, at least until we can get some type of momentum above the $10,000 level, offering a move to the $12,000 level. Longer-term, we need to break above the $12,000 level, in order to keep Bitcoin afloat. If we failed there again, it’s very likely that we will break down rather significantly longer term. Because of this, I think the next couple of months are going to be crucial for Bitcoin as well as many other crypto currency markets.

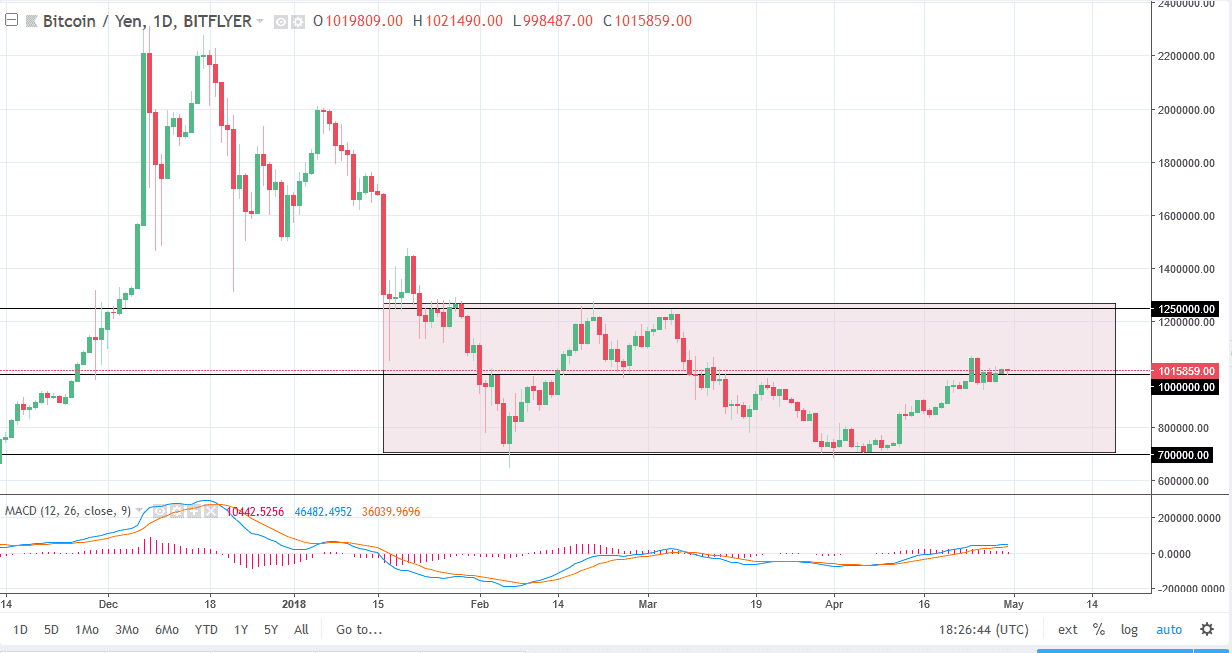

BTC/JPY

Bitcoin also did almost nothing against the Japanese yen, as we continue to hover around the ¥1 million level. That’s an area that has a lot of importance tied to it, and of course a lot of it being psychological. However, I think if we can continue to go higher, we would then go to the ¥1.25 million level. If we can break above there, the market is likely to continue much higher, perhaps reaching towards the ¥1.5 million level, and the ¥2 million level. Otherwise, we will pull back and go looking for support at the ¥700,000 level. This is a market that is consolidating and is essentially a “fair value” proposition right now, keeping big-money out.