Gold prices ended a choppy, two-sided trading session slightly higher yesterday as traders looked ahead to several speakers from the Federal Reserve. XAU/USD edged lower following a failure to break through the resistance in 1348/7. Prices dropped below the 1343-1341.60 zone and the market reached the 1338 level as anticipated. Ultimately, XAU/USD found enough support in the vicinity and recouped earlier losses. World stock markets were mostly higher yesterday. U.S. stocks rose, driven by strong corporate earnings.

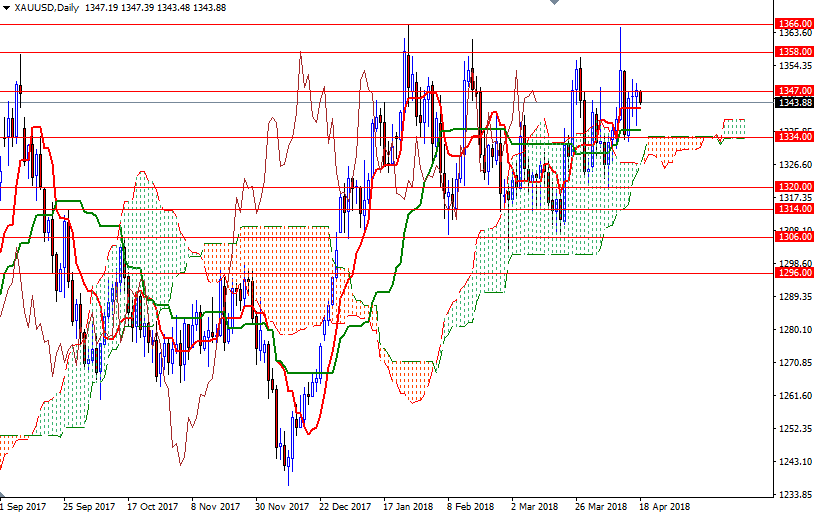

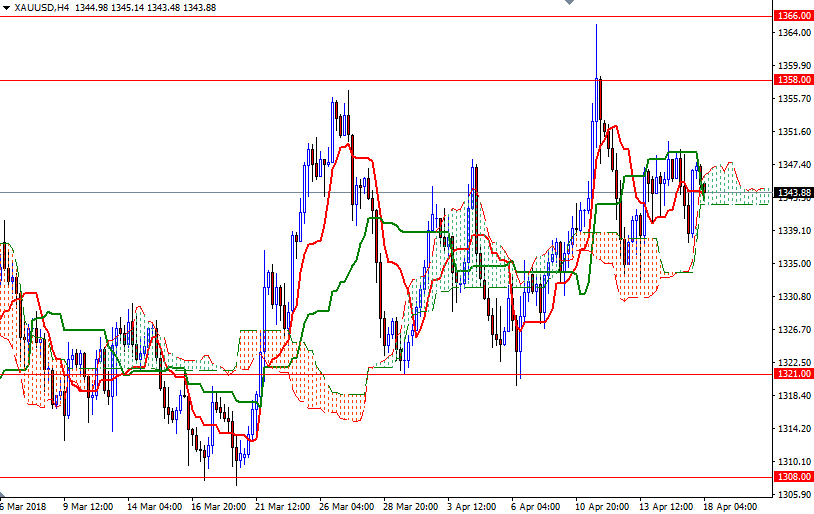

The market is trading within the borders of the Ichimoku clouds on the 4-hourly and the hourly charts, indicating sideways trading in the near term. The intra-day key levels almost remain the same as the market is trapped in a relatively narrow range. The bulls will need to confidently push prices above 1348 to tackle the next barrier in the 1353/1 zone. If this resistance is broken, the market will be aiming for 1359/8.

However, if XAU/USD continues to trade below 1348, keep an eye on the support in 1341.60-1340.60, the bottom of the hourly cloud. A break below 1340.60 indicates that the market will revisit 1348. Down below, the 1334/2 area stands out as a strategic support and the bears will have to produce a daily close below there to gain momentum for 1327/6.