Gold prices ended Tuesday’s session up $3.11, marking the third consecutive rise, as a weaker U.S. dollar index provided support to the precious metal. The greenback fell after an official from the European Central Bank said that policy makers there would end bond purchases this year. Traders and investors are awaiting inflation data and minutes from the latest Federal Reserve Open Market Committee (FOMC) meeting.

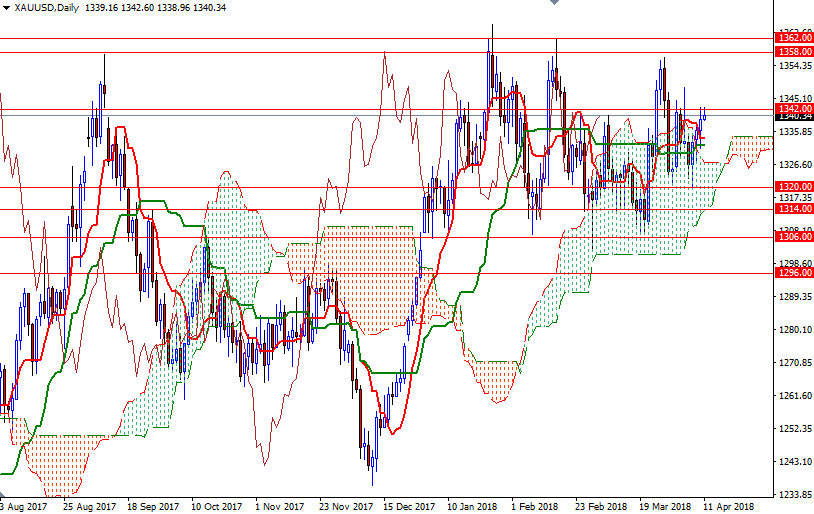

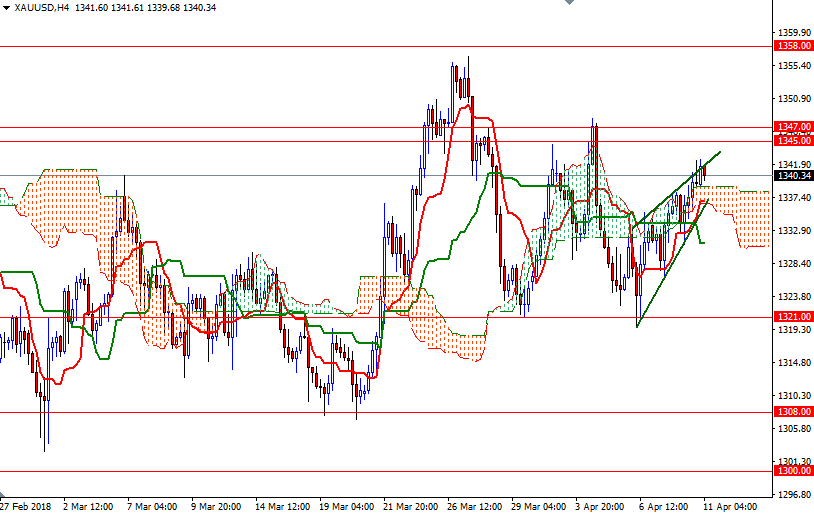

The near-term technical posture for gold has improved recently, which is apparently inviting chart-based buyers but there are stiff chart resistance levels not too far from here that could cap the market ahead of important events. XAU/USD is trading above the daily and the 4-hourly Ichimoku clouds and we have positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) on both charts.

To the upside, the initial resistance stands at 1342, the confluence of a horizontal resistance and the upper line of the rising wedge. The bulls have to confidently lift prices above 1342 to march towards the 1347/5 area. If this resistance is broken, look for further upside with 1352 and 1358/6 as targets. However, if XAU/USD fails to pierce through 1342, we may head back to the 1337-1336.30 zone, where the bottom of the 4-hourly cloud sits. A break below 1336.30 indicates that the bears will be aiming for 1330.50-1329.50 (or possibly 1326.50) next. Below there, the 1321.50-1320 zone stands out as a key technical support.