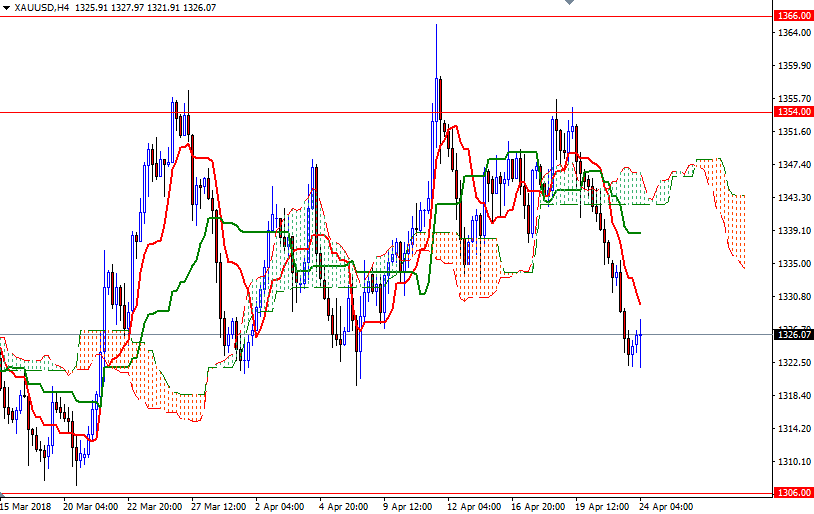

Gold prices dropped $10.49 an ounce on Monday, hitting the lowest level since April 4, as dollar strength put downward pressure on the precious metal. The dollar rallied to its highest level since January 12, boosted by rising Treasury yields. XAU/USD drifted lower and approached the strategic $1321-$1320 area after the market pierced below the support at $1334. U.S. economic data due for release Monday includes the Conference Board’s consumer confidence index and new home sales.

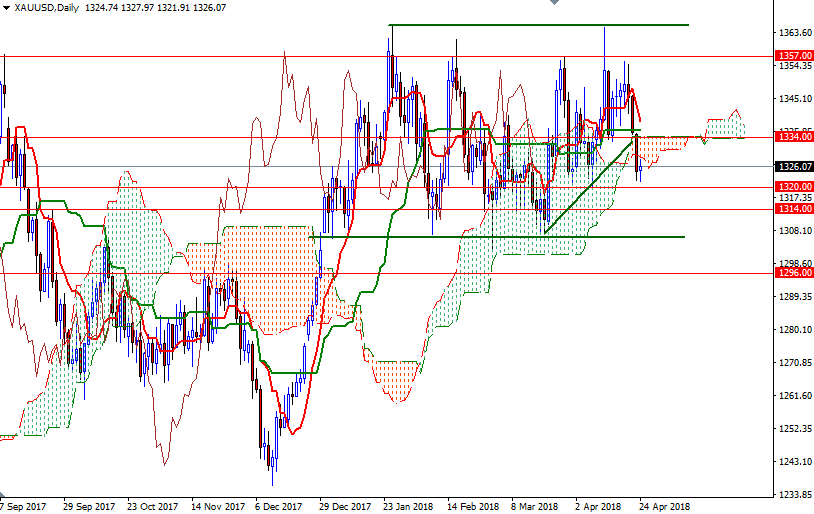

Gold prices are near unchanged in Asian trading today as the bears catch their breath. The market is trading below the daily and the 4-hourly Ichimoku clouds but the anticipated support in the 1321/0 zone remains intact. If the bulls continue to defend this camp, we may revisit the initial resistance sitting in 1330/29, where the bottom of the daily cloud resides. A break up above 1330 could see an extension to the 1332 level. Beyond there, the 1336/4 area, the confluence of the daily Kijun-Sen (twenty six-period moving average, green line) and the top of the daily cloud, stands out as a key technical resistance.

To the downside, the initial support stands in the aforementioned 1321/0 area. A breakdown below 1320 could spark a further selloff towards 1308/6. On its way down, support may be found at 1314.