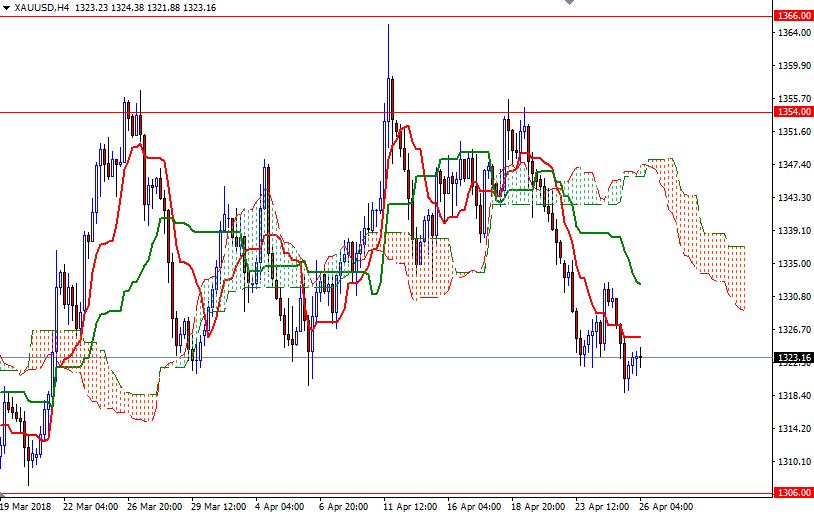

Gold prices settled at their lowest level since March 22 as a strengthening U.S. dollar weighed on the market. A rebound in equity markets worldwide also drew some investors away from gold. XAU/USD initially rose on Wednesday but it was unable to pass through. Consequently, the market erased the gains made in the previous session and tested the support in the 1321/0 area that I highlighted yesterday. Trading during the Asian session has been quiet as investors await for the European Central Bank’s policy meeting.

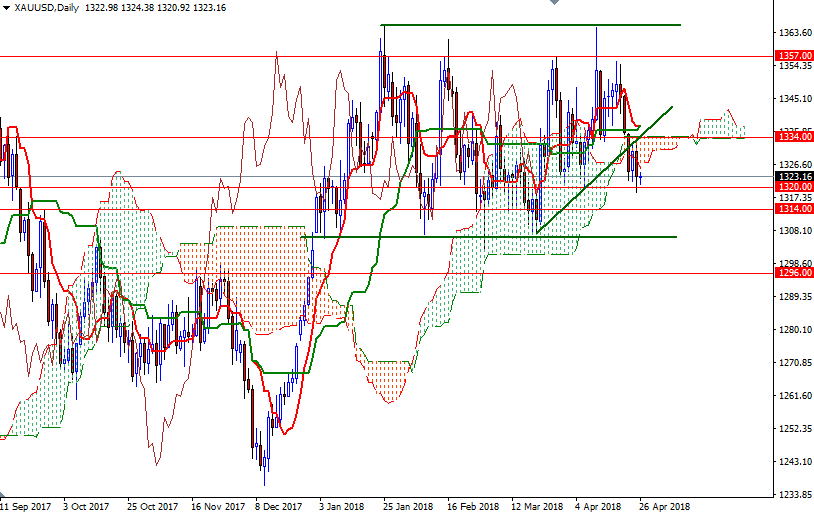

The long-term charts are still bullish, with the market trading above the weekly Ichimoku cloud, but the gold bears currently remain in control on the 4-hourly chart. The bulls have to overcome the initial barriers such as 1332 and 1336/4, to march towards the 1343/2 area. A daily close above 1343 would paves the way for 1348/6.

On the other hand, if the bears successfully drag prices below 1320, look for further downside with 1318.70 and 1314 as targets. A break below 1314 could foreshadow a drop to 1308/6. Below 1306, there is a strong support in the 1300-1296 area which has not been visited for a long while.