Gold prices rose $5.51 on Tuesday after a three-day streak of losses as a weaker U.S. dollar index and declines across global equity markets took some pressure off the metal. The U.S. dollar edged lower as investors locked in gains driven by rising Treasury yields. World stock markets were mostly lower yesterday. Asia-Pacific stocks are broadly weaker today following a sell-off in the U.S. stock market. In economic news the Conference Board reported that its consumer confidence index increased to 128.7 in April from a downwardly revised 127.0 in March.

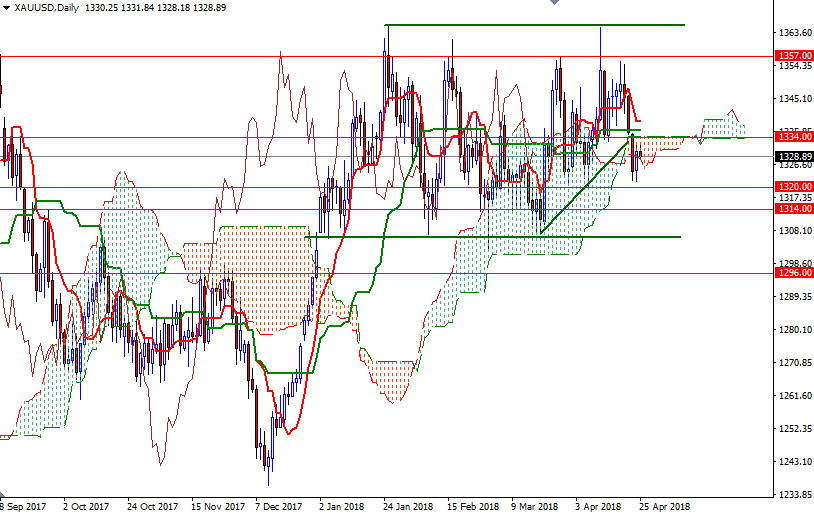

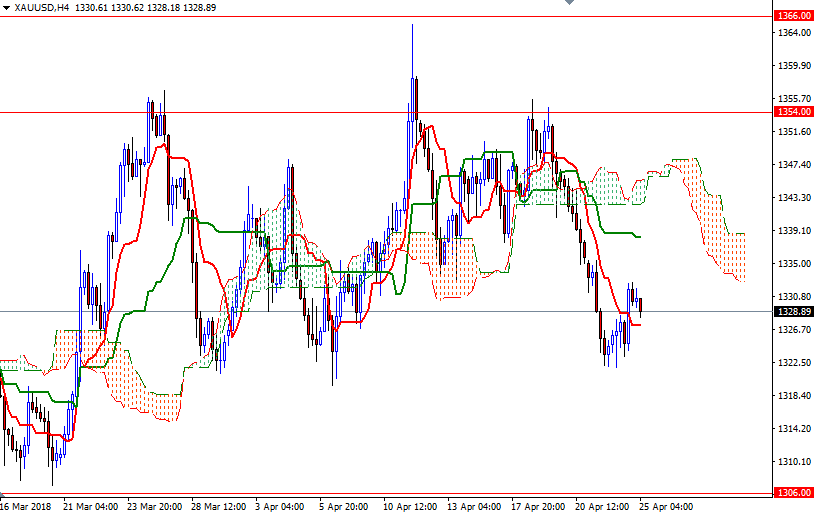

The support in the 1321/0 zone pushed prices higher but the market was unable to break through the anticipated resistance at 1332. Prices are trading below the 4-hourly cloud and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are negatively aligned. In other words, downside risks remain as long as the market continues to trade below the resistance in the 1336/4 area, the confluence of the daily Kijun-Sen and the top of the daily cloud. The bulls have to produce a daily close above 1336 to gain momentum for 1343/2.

Similarly, the bears have to overcome the key support in 1321/0 to increase pressure. If XAU/USD dives below 1320, then the 1314 level may be the next port of call. A daily close below 1314 implies that the bears will be targeting the 1308/6 area next.