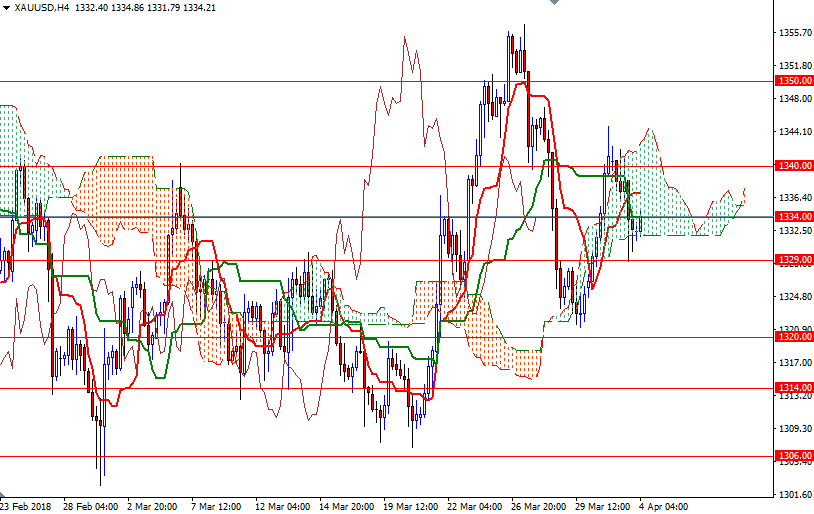

Gold prices dropped $7.98 an ounce on Tuesday, pressured by climbing stocks and a strong dollar. Some chart-based selling was also behind gold’s 0.59% drop yesterday. XAU/USD headed back to the anticipated support in the $1329-$1328 area after the market failed to climb above the 4-hourly Ichimoku cloud. The market will focus on upcoming economic releases, particularly U.S. monthly employment report, and a speech from Federal Reserve Chairman Jerome Powell on Friday.

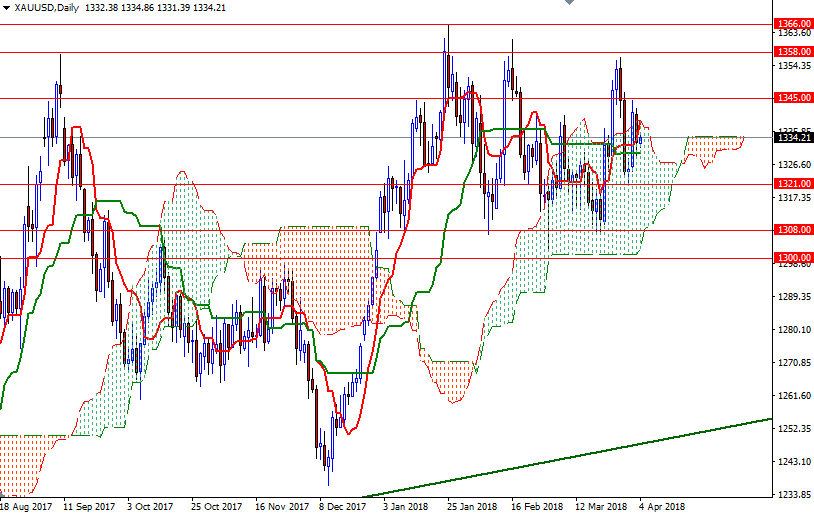

The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned on the daily and 4-hourly charts, but prices are moving inside the Ichimoku clouds, indicating that the market is looking for a direction. At this point, the bulls will have to lift prices above the 1342/0 to gain momentum for 1352/0. If they capture this strategic camp, the 1358 level will be the next target. A break up above 1358 implies that the bulls are aiming for 1366

To the downside, the initial support stands in the 1329/8 area, where the daily Kijun-Sen resides. If XAU/USD falls through 1329/8, it is likely that the market will test the support at 1325 next. A break down below there could foreshadow a move to 1321/0.