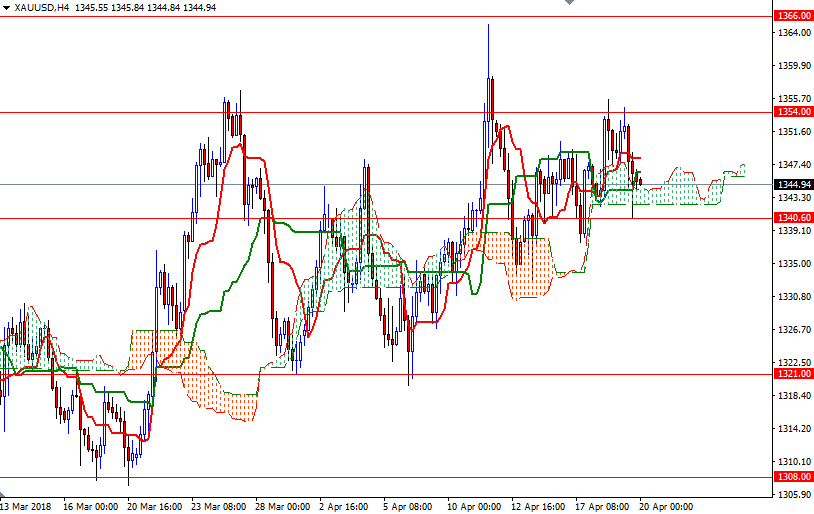

Gold prices fell $4.02 an ounce on Thursday, ending a four-day streak of gains, as geopolitical tensions eased and the dollar strengthened on the back of solid U.S. economic data. XAU/USD initially tested the resistance at $1354, but it was unable to pass through. As a result, prices broke below $1347 and visited the support in the $1342.38-$1340.60 area as anticipated. In economic news, the Labor Department reported that the number of first-time applicants for jobless benefits fell last week for the third time in four weeks and the Federal Reserve Bank of Philadelphia said the index measuring manufacturing activity in the region climbed to 23.2 from 22.3 the prior month.

Short-term charts suggest that the market is likely to pay another visit the 1342.38-1340.60 area unless prices get back above 1348/7. XAU/USD is trading below the Ichimoku clouds on the M30 and the H1 time frames. In addition to that, we have negative Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses on both charts. Breaking down below 1340.60 could increase speculative selling and drag the market towards 1334/2. On its way down, expect to see some support at 1338.

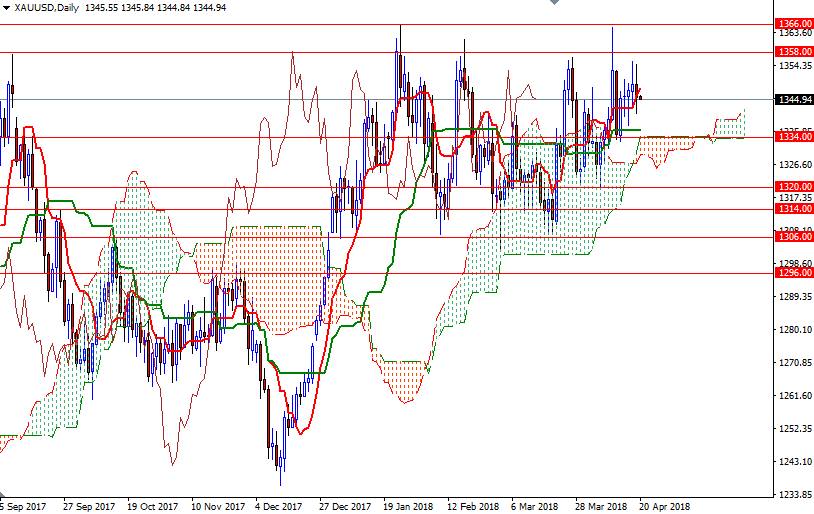

However, if the bulls gather their strength and push prices above 1348, they may have a chance to make a move to the 1351/0 area, where the top of the hourly cloud sits. Penetrating this barrier could trigger a push up to 1354. The bulls have to lift prices above 1354 to challenge a strategic resistance in the 1359/8 zone.