Gold prices are lower in Asia trade, trading down 0.17% at $1333.75 an ounce, as investors grew cautious ahead of major economic data and minutes from the U.S. Federal Reserve’s latest policy meeting. Asia-Pacific stocks are higher today as fears surrounding a trade war between the U.S. and China receded after Chinese President Xi Jinping promised to lower import tariffs. The markets have not reacted significantly to Trump’s comments on Syria.

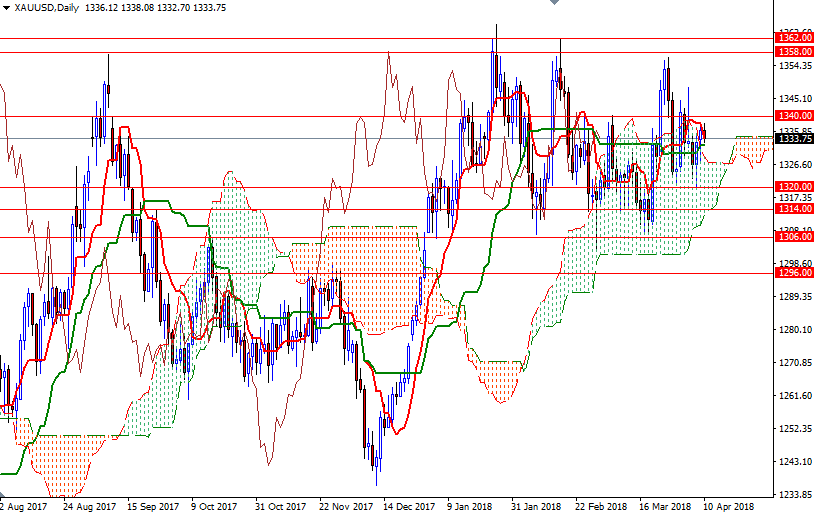

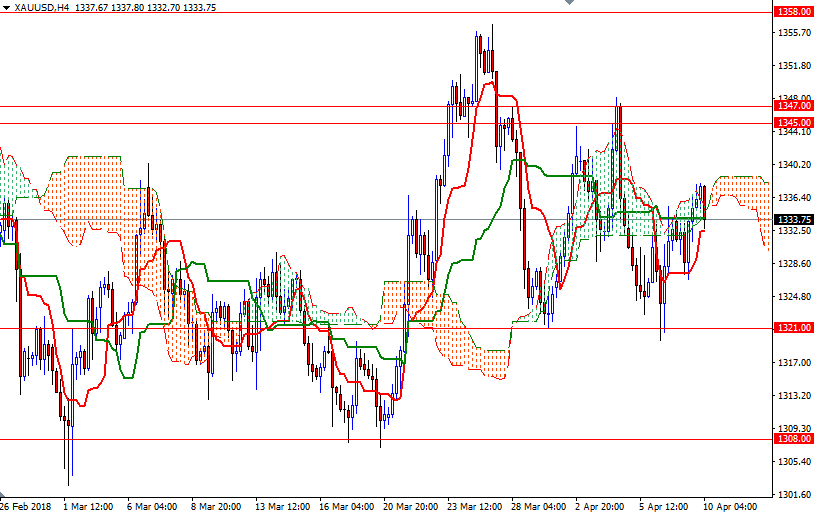

Last Friday’s payrolls report has provided a boost to gold, but still we are stuck in a relatively tight trading range. The weekly Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-day moving average, green line) lines are flat, indicating lack of real momentum. XAU/USD is trading above the Ichimoku clouds on the daily chart, but failed to penetrate the 4-hourly cloud. There is a wedge formation on the H1 chart and it appears that the market is about visit the lower line at 1331.

If this support is broken, the market will continue to move towards the hourly cloud, which occupies the area between 1329.70-1326.50. A successful break below 1326.50 may extend losses and take us back to the 1321.50-1320 area. The bears have to pull prices below 1320 to make an assault on 1316/4. To the upside, the initial resistance sits approximately at 1338.75, the upper line of the wedge. The bulls have to take out this barrier to test 1342/0. A break through there brings in 1347/5.