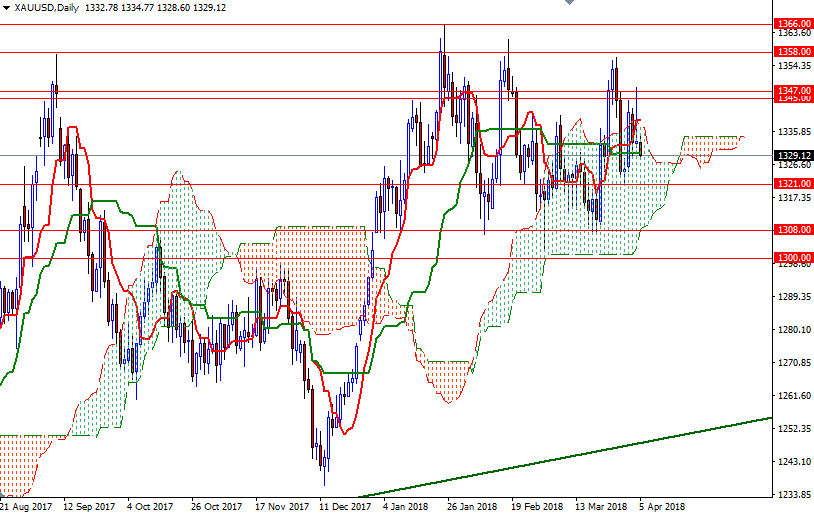

Gold prices ended Wednesday’s session nearly unchanged as investors remained cautious ahead of the release of key economic data. XAU/USD tested the resistance in the $1347-$1345 zone as expected after prices climbed above $1342 but the market gave up the majority of gains after the ADP reported the private sector added 241000 jobs in March, well above consensus estimates of 208000. ADP’s data is treated as a kind of preview for the monthly government report, though these figures aren’t always accurate in predicting the outcome. World stock markets were mostly higher yesterday. Markets in the Asia-Pacific region seems steady today.

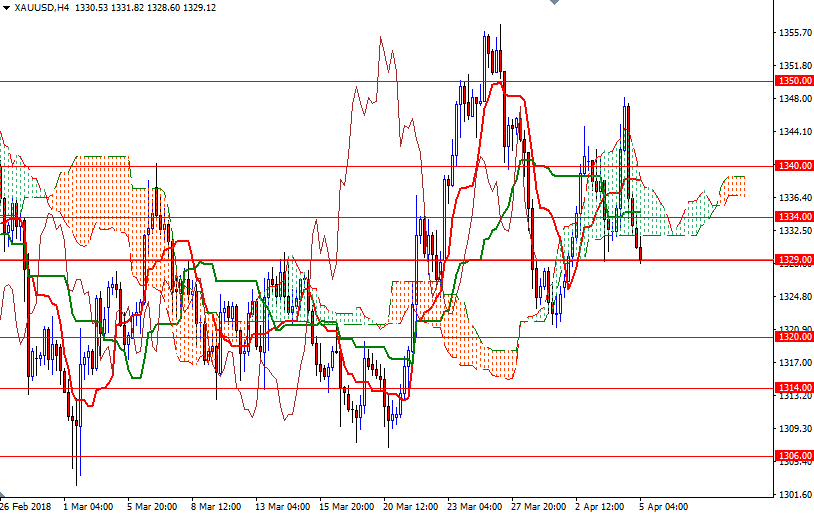

The market is currently in the process of testing the support in the 1329/8 zone. The tall upper shadow of yesterday’s candle suggests that the short-term technical outlook is deteriorating. Trading below the Ichimoku clouds on the H4 and H1 time frames also puts the aforementioned support at around 1328 in danger. If this support fails to produce a meaningful rebound, XAU/USD will grind lower to 1325. A break down below 1325 would open up the risk of a drop to 1321/0.

To the upside, the initial resistance sits in 1334/2. However, note that the daily and the 4-hourly cloud overlap in the 1338-1332 region. The bulls have to push prices above 1338 to challenge the bears waiting around the 1342 level. If XAU/USD gets back above 1342, it is likely that the market will retest the resistance in 1347/5.