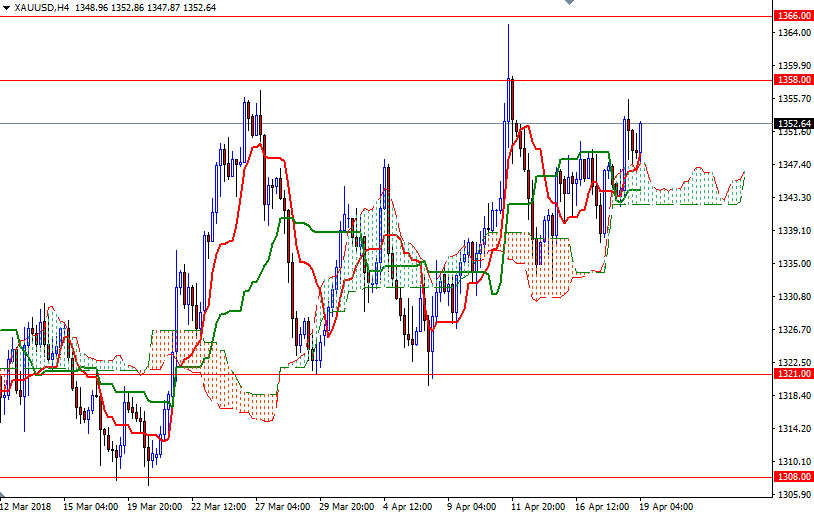

Gold prices advanced for a fourth straight session on Wednesday and settled at $1349.16 an ounce. XAU/USD initially pulled back to the bottom of the 4-hourly Ichimoku cloud but bounce up quite nicely from there and climbed back above the $1348-$1347 area. World stock markets were mostly higher again yesterday. Asia-Pacific stocks continue to rise today. I think the metal has showed a nice performance recently, given little risk aversion in the marketplace.

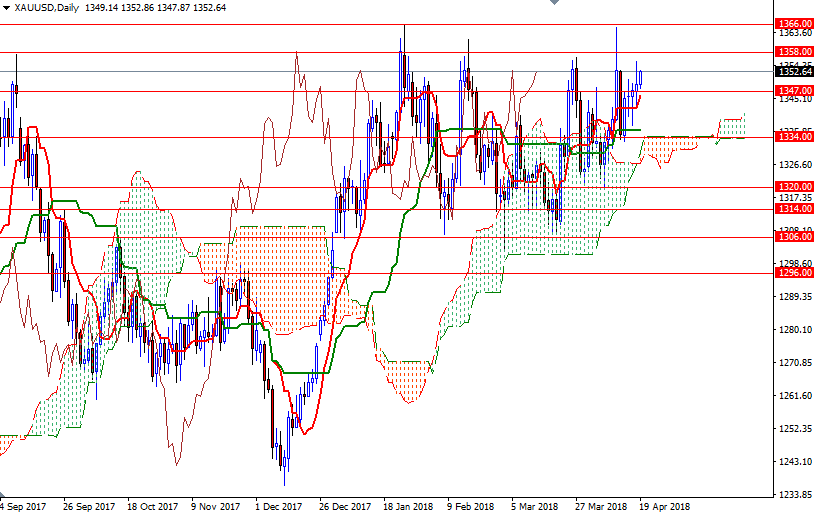

XAU/USD is residing above the Ichimoku clouds and the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned. The Chikou-span (closing price plotted 26 periods behind, brown line), which is above prices, also suggests that the bulls still have the overall technical advantage. If the market continues to trade above 1347 and overcomes the resistance at 1354, the bulls may have a chance to challenge yesterday’s high and then 1359/8. This area is be the key level for the bulls to pass in order to test 1362. A break through there could trigger a push up to 1366.

To the downside, the initial support stands in 1348/7, followed by 1345.50. Falling through 1345.50 indicates that the 1342.38-1340.60 area will be the next stop. The bears have to drag prices below 1340.60 to visit 1338. A daily close below 1338 could foreshadow a drop to 1334/2.