Gold prices ended Thursday’s session down $6.36 an ounce as a rising dollar and signs the U.S. is looking to resolve the trade dispute with China dented demand for safe-haven assets. Traders await the Labor Department’s employment report, which is arguably the most important U.S. data point of the month, and Fed Chairman Jerome Powell’s appearance later in the day. If fresh data give the Fed more confidence that the economy is strong enough to endure higher interest rates, investment demand may weaken further.

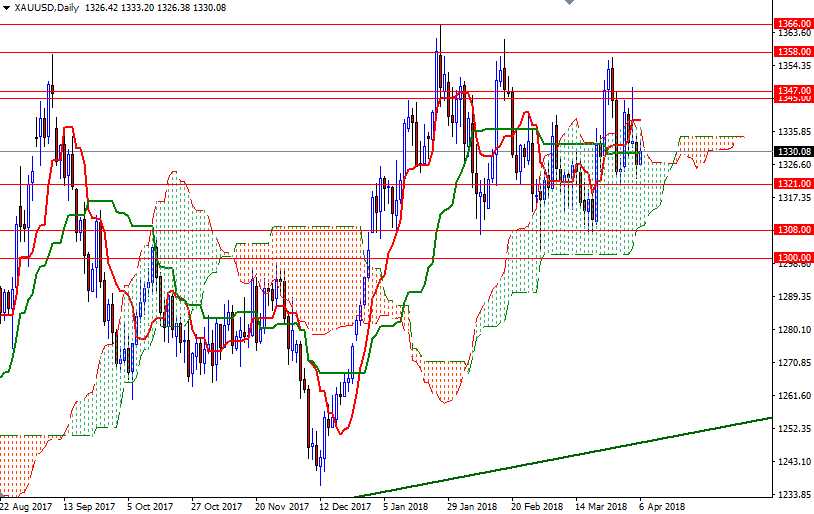

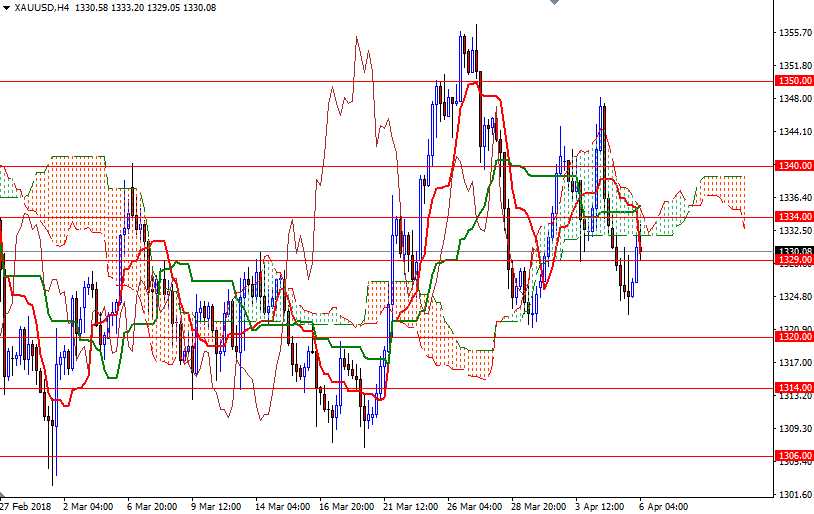

The key levels remains unchanged, as the market is stuck in a relatively tight range. The area occupied by the 4-hourly cloud (1334/2) continues to act as resistance and buyers step in when prices come closer to the support in the 1321/0 area. Technically, trading below the Ichimoku cloud on the H4 chart and a negative Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) cross suggest that the bears have the near-term technical advantage.

The bulls have to break through 1334/2 to make a move towards the next barrier at 1340. A sustained break above 1340 paves the way for a test of 1347/5. If this resistance is broken, expect a push up to 1352/0. To the downside, keep an eye on the support in the 1321/0. The bears have to capture this strategic camp to pull prices lower. In that case, the next stop will be 1316/4.