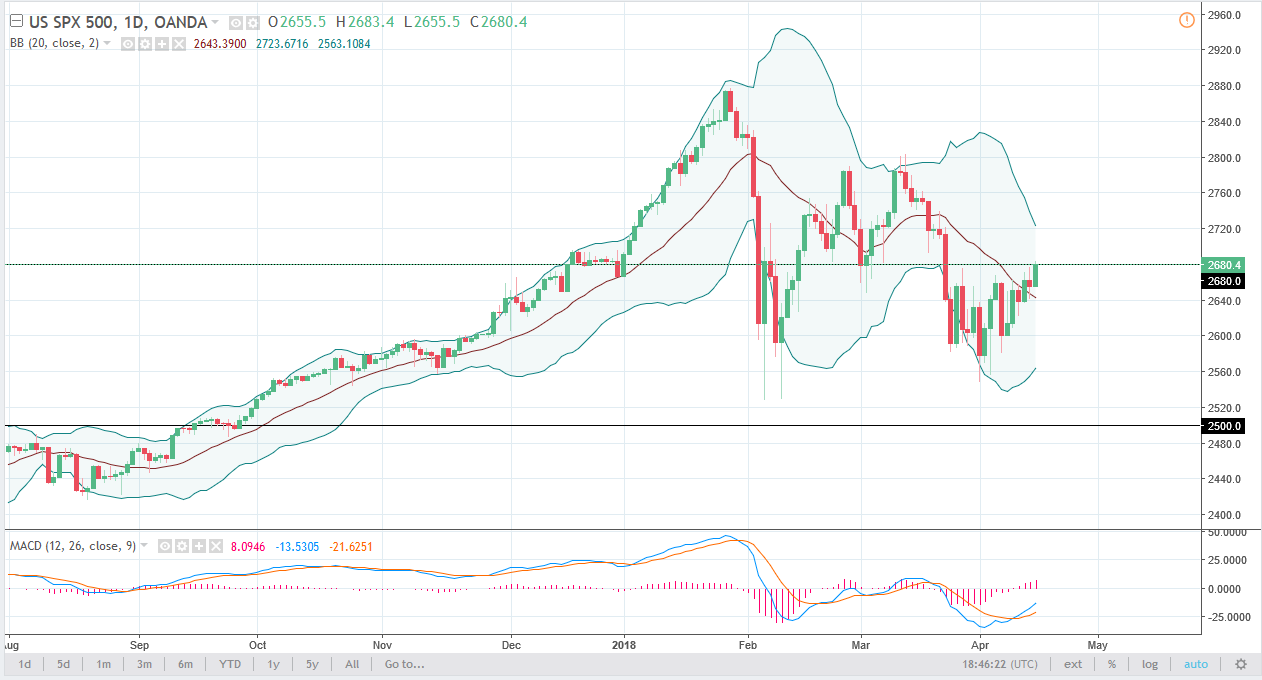

S&P 500

The S&P 500 rallied significantly during the trading session on Monday, gaining almost a full percent by the time we started to close out the session. The market looks likely to break above the 2680 handle, and that should send the market towards the 2700 level next. Beyond there, the market will go looking towards the 2800 level, but I would anticipate that we could get a few pullbacks occasionally. Those pullbacks should be buying opportunities though, and I like the idea of picking up value when it presents itself. If we can break above the 2800 level, the market should then eventually go looking towards the 3000 level, my longer-term target. I believe that there is a massive amount of support just below, extending down to the 2500 level. If we were to break down below that level, probably something to do with a trade war or an escalation in Syria, then we could breakdown rather rapidly.

NASDAQ 100

The NASDAQ 100 rallied significantly towards the 6700 level, an area that has been both support and resistance. If we can break above that level, then the market will go looking towards the 6800 level, the 6900 level, and then eventually the 7000 handle. When I look at this chart, it looks as if we are trying to form some type of “W pattern.” The 6300 level begins a significant amount of support down to the 6200 level, which being broken down below with send this market much lower, perhaps sending this market into a bit of a tailspin. The market should continue to find buyers on dips, especially if we can avoid some type of trade war which will directly affect tech stocks.