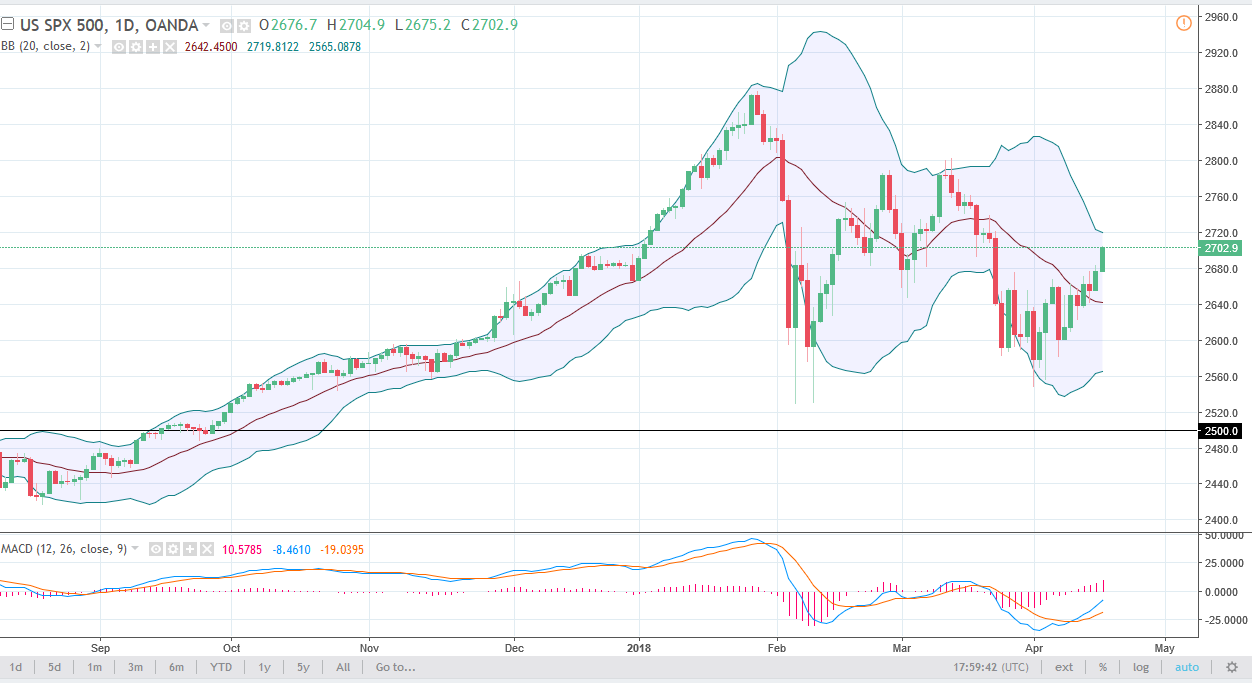

S&P 500

The S&P 500 rallied significantly during the trading session on Tuesday, breaking above the 2700 level. The market looks likely to continue to go to the upside, as breaking above the 2680 handle was important. I think that the market will now more than likely go towards the 2800 level. I believe the pullbacks will offer value, and if we can stay out of some type of trade war, the market should continue to see money flowing into the S&P 500 as it is more of a “risk on” move. I believe that the market should continue to be volatile, so look at pullbacks as potential value that we can take advantage of. If we can break above the 2800 level, the market will be free to go much higher. However, I think we have a lot of work to do to get past that level.

NASDAQ 100

The NASDAQ 100 has shown a very bullish pressure, breaking above the 6700 level and even more impressively, breaking above the 6800 level. I think short-term pullbacks from here should find plenty of support, especially near the 6700 level. Ultimately, I believe that buyers are coming back into this market place, as we have formed a large “double bottom” underneath that show signs of strength. I believe that the market will try to get towards 7000, and if we can stay out of some type of trade war, that should benefit the NASDAQ as we not only have decent earnings coming out of the United States, but we also have a market that looks like we are trying to find risk appetite to take advantage of. I believe that clearing season is showing the way to the upside, and we will continue to see plenty of opportunity.