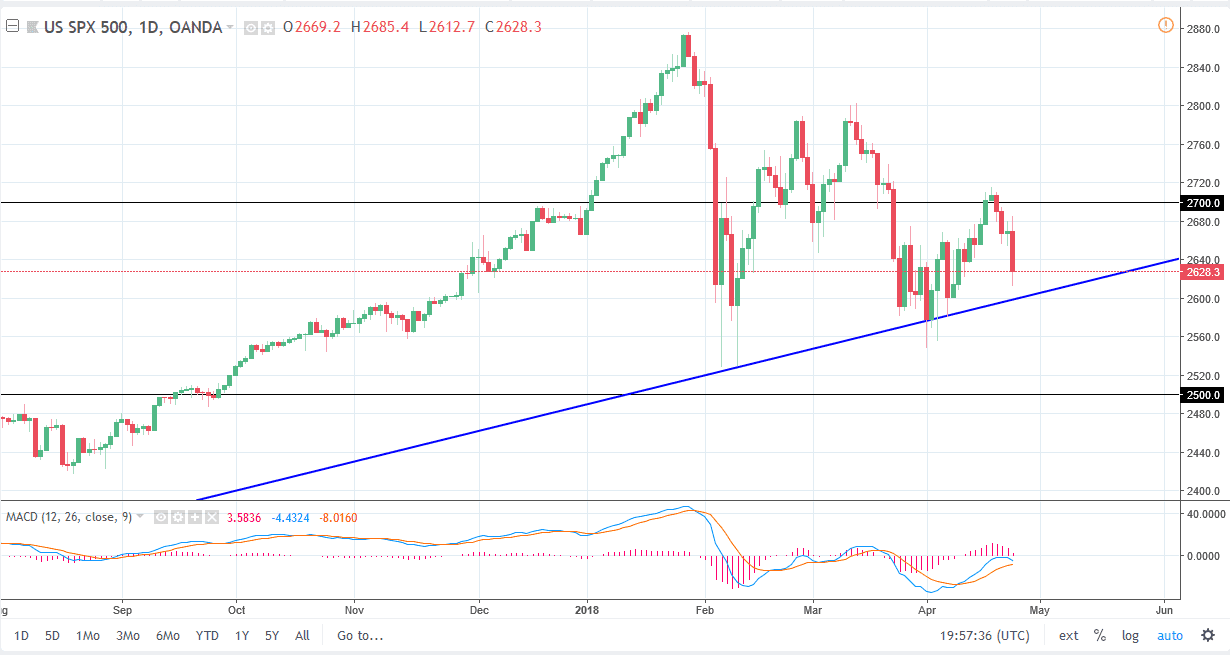

S&P 500

The S&P 500 initially tried to rally during training on Tuesday but found the 2680 level to be too resistive. We rolled over from there rather significantly, reaching towards the uptrend line underneath. We did hold above there, so that’s a good sign. I think that the market reacting to 10-year treasury yields breaking above 3% has been a bit overdone, and I anticipate that we will have buyers jumping into this market sooner, rather than later. Pay attention to the uptrend line, if it holds that’s a good sign and I am using 2600 as a proxy for that level. If we break down below there, the market probably goes down to the 2500 level. I believe in general, it’s only a matter of time before the buyers come back in based upon value hunting, but we are most certainly seen a lot of noise and fear in the market. You are going to be tested to say the least if you do choose to try to go in and go long in this market. Alternately, if we break down below the 2500 level, it’s likely that this market will unwind rather drastically and offer plenty of shorting opportunities.

NASDAQ 100

The NASDAQ 100 also try to rally initially during the day but found the 6700 level to be too resistive. We broke down significantly and reached towards the 6500 level. We did bounce back above there during the day though, and even though the candlestick is very ugly, we lost only 2% during the day. I think there is plenty of support underneath, but we are starting to put serious bearish pressure in the markets. It is because of this that I am very cautious right now. I need to see some type of supportive daily candle to start going long. I believe that it’s probably best to sit on the sidelines and wait right now.