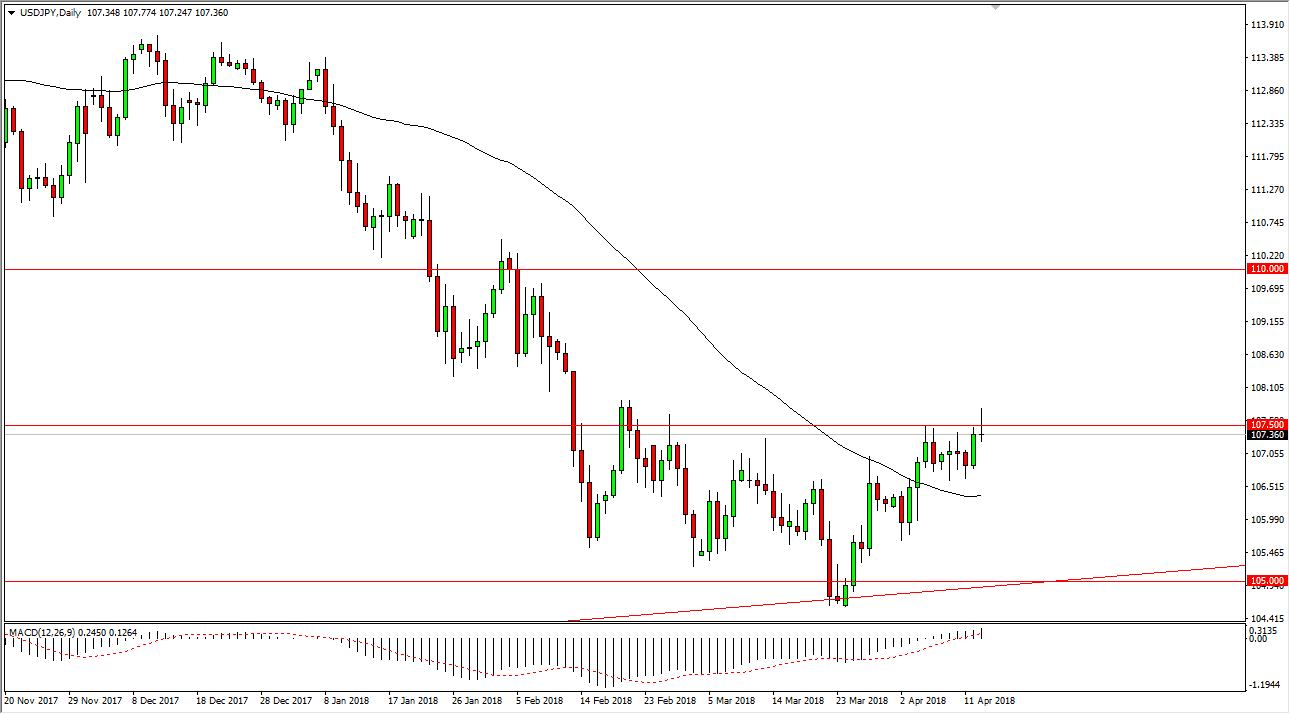

USD/JPY

The US dollar has rallied significantly during the trading session on Friday, breaking above the 107.50 level before turning around and forming a bit of a shooting star. The shooting star of course is a negative sign, but I don’t think we are going to break down significantly. I think that we will pull back towards the 50 EMA underneath, near the 107 level. If we can break above the 108 level, then the market goes to the 110 level after that. Ultimately, this market is very sensitive to risk appetite, so keep an eye on the idea of any type of trade war between the United States and China. Beyond that, I believe that the tensions between the US and Russia, as well as the situation in Syria could cause issues. However, it looks as if we have been trying to find some type of base, so I think eventually the buyers will return.

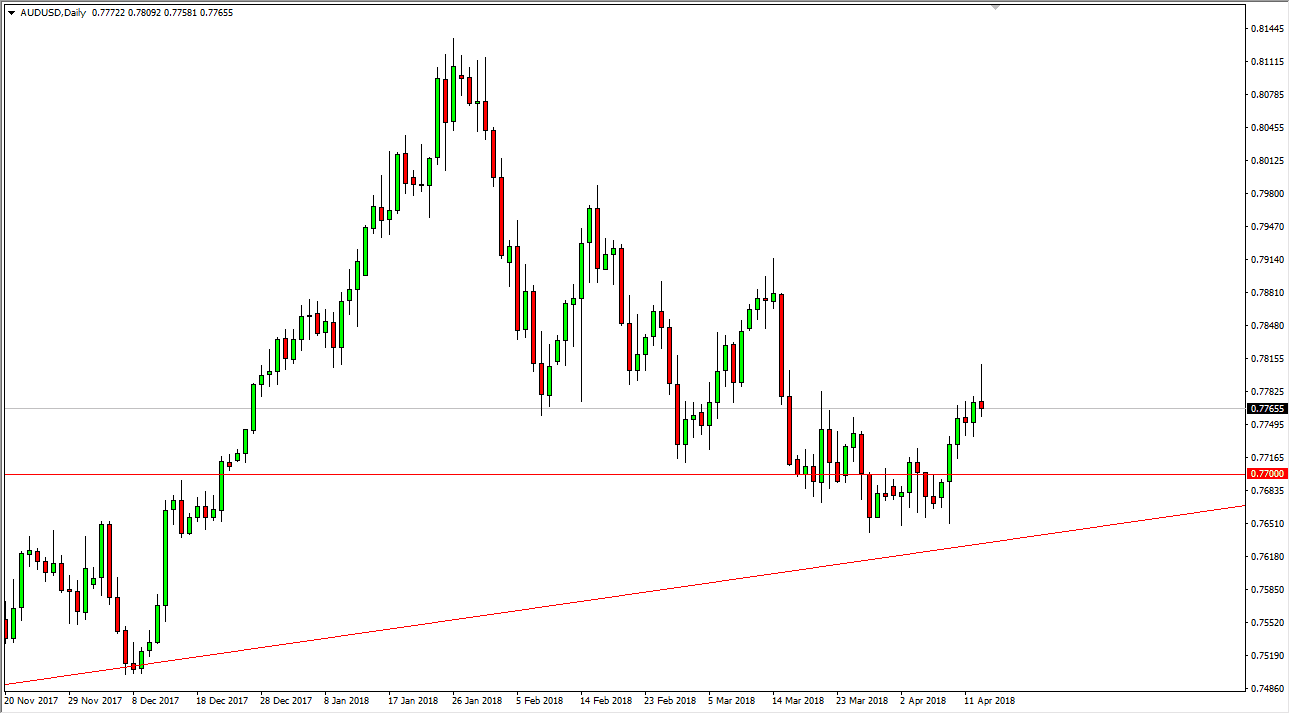

AUD/USD

The Australian dollar initially tried to rally during the day as well but found the area above the 0.78 level to be far too resistive to continue going higher. We formed a shooting star over here as well, but we have recently found a significant bottom near the major uptrend line that extends back to the end of 2015. By doing so, I think that the market will eventually continue to the upside and I look at this pullback as a potential buying opportunity, especially near the 0.77 handle. The alternate scenario would be a break above the top of the shooting star for the day on Friday, and that of course is a buying opportunity as well, as it shows an extension of bullish pressure and the market breaking through resistance. I have no interest in selling into we break down below the uptrend line.