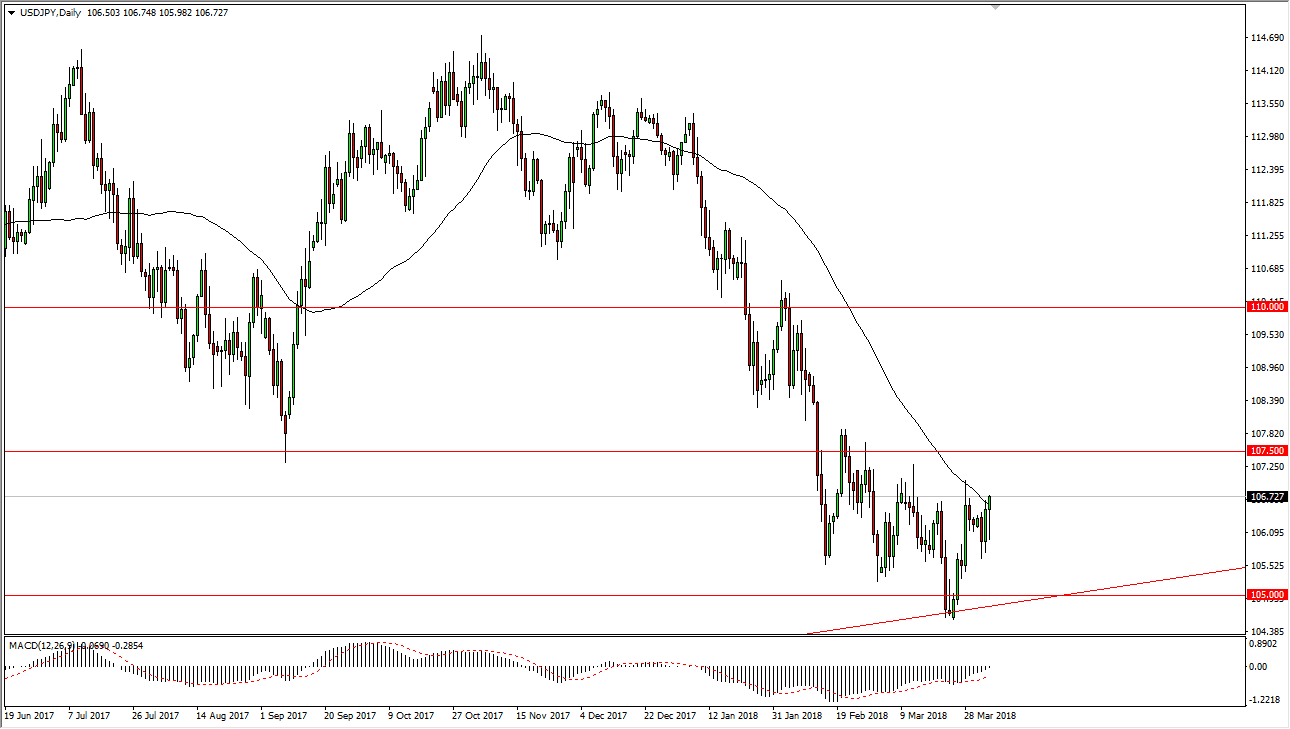

USD/JPY

The US dollar initially fell during trading on Wednesday, but rallied quite nicely, right along with the US stock markets as fears of an escalating trade wars seem to be softening a bit. I believe that the hammer forming on the daily chart could send this market to the upside, perhaps reaching towards the 107.50 level. If we can break above there, the market could then go to the 110 handle. Ultimately, I think that short-term pullbacks should be buying opportunities, as it is an area that has shown a large amount of volatility and support. I believe that the support starts at the 105 handle, and the uptrend line of course should continue to keep this market afloat. If we break down below that area, then we could unwind down to the 101 handle. However, it looks as if the market is trying to build up the upward momentum necessary.

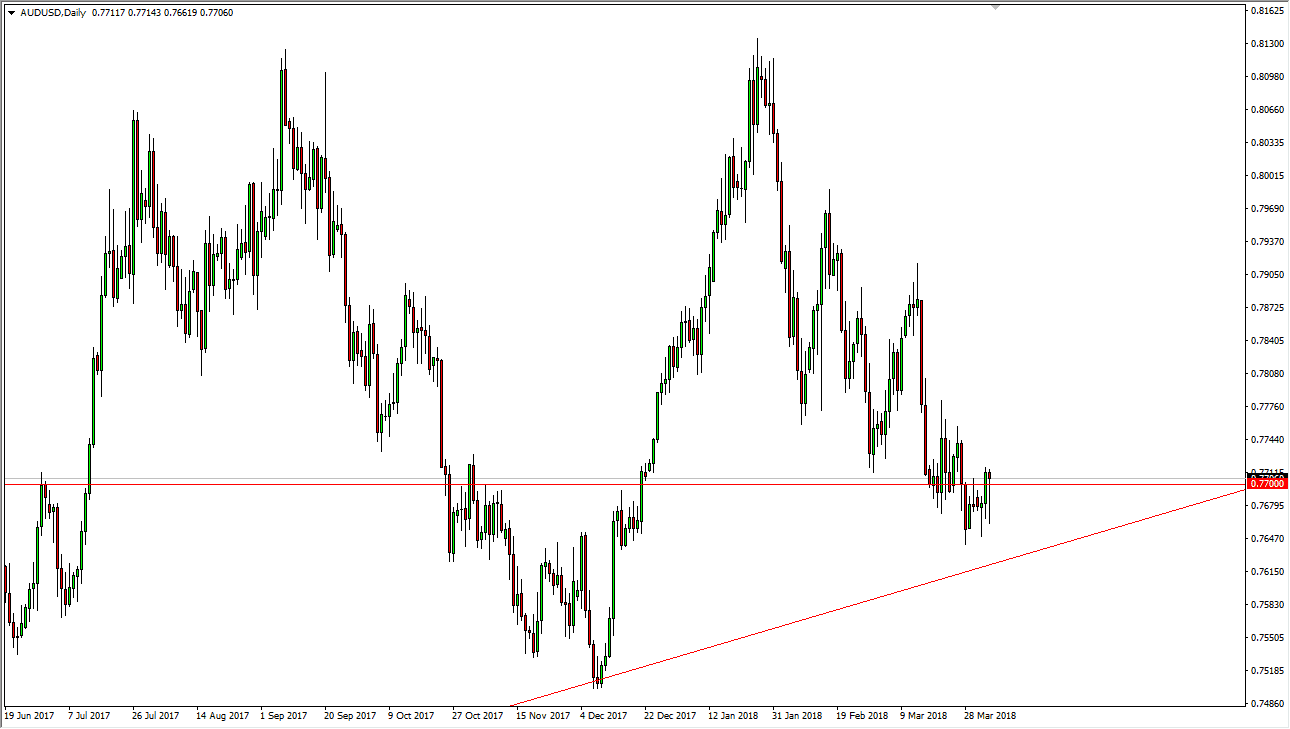

AUD/USD

The Australian dollar initially fell during the trading session as well on Wednesday but turned around to form a nice-looking hammer. The hammer sits at the 0.77 level, an area that is psychologically important, as well as structurally. The uptrend line just below on the daily chart extends back to the last few months of 2015, and that of course is a very important line. I think that the jobs number coming out on Friday will of course have its influence, but I think we’re trying to build up enough momentum to rally and continue this nice channel that we have seen over the last couple of years. If we were to break down below the uptrend line, the market will probably then unwind down to the 0.75 handle, perhaps even lower than that. Volatility will continue to be an issue, but ultimately, I believe that the Aussie is trying to pick up momentum.