USD/JPY

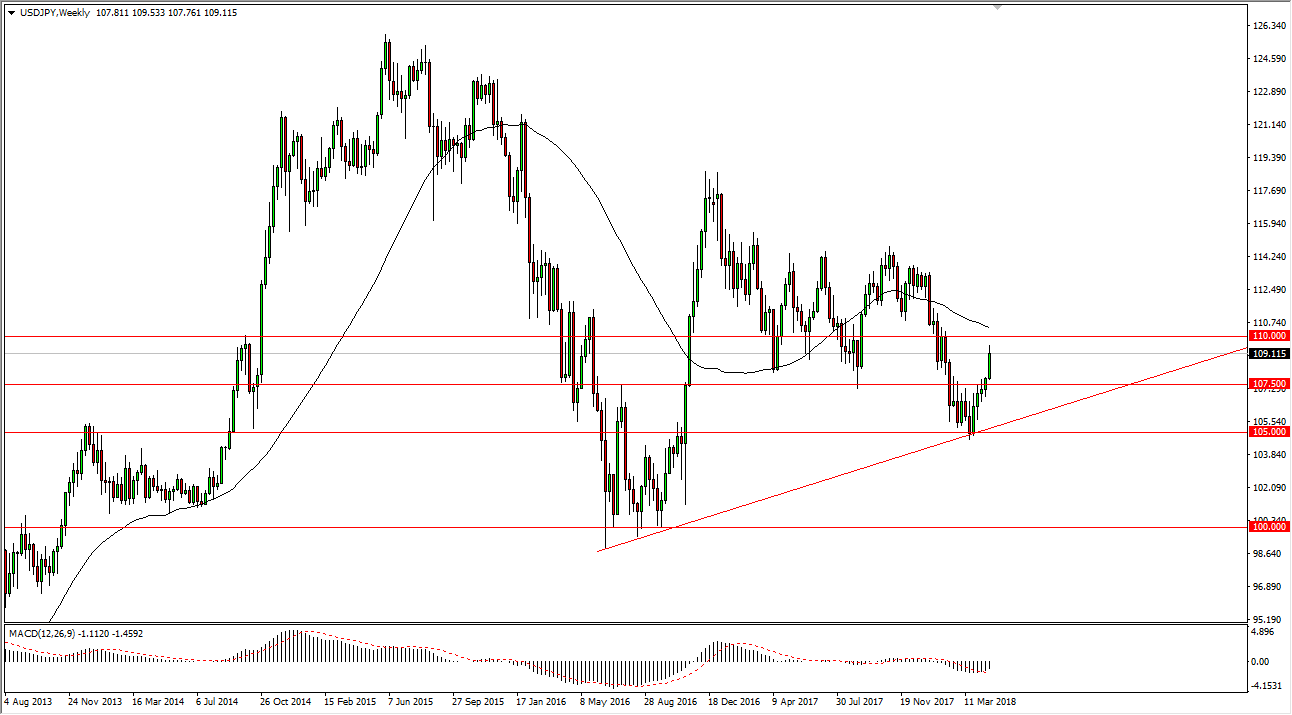

The US dollar rallied rather significantly during the month of April, reaching towards the 109.50 level during the last week. Ultimately, there is a lot of noise above, extending to the 110 handle so it’s not a huge surprise to me that during one of the last trading sessions of the month, we are starting to see sellers jump in. I think that in the short term we could see a pull back to the 107.50 level, an area that was previous resistance, as well as previous support. The uptrend line underneath offers a significant amount of support, closer to the 106 handle. We had recently bounce for the 105 level, which was crucial to save any attempt at bullish pressure.

If we finally break above the 110 handle, and we very well could this month, the market probably goes to the 112.50 level next. Beyond that, the market could then go to the 115 handle. I believe that the market continues to be very choppy, but overall, I do anticipate the buyers will come back, especially if the interest rates in America continue to rise. However, if stock markets rally that also puts downward pressure on the Japanese yen overall, sending this market higher. I believe that the market will eventually find buyers regardless, but if we were to break down below the uptrend line, that would be an extraordinarily negative sign and could break this market apart rather drastically. The 105 level would offer major support, but a breakdown below there would be nothing short of catastrophic. That would almost have to be in tandem with some type of major event or financial shock. I anticipate a lot of volatility over the next couple of weeks, but more than likely will give us an opportunity to go long.