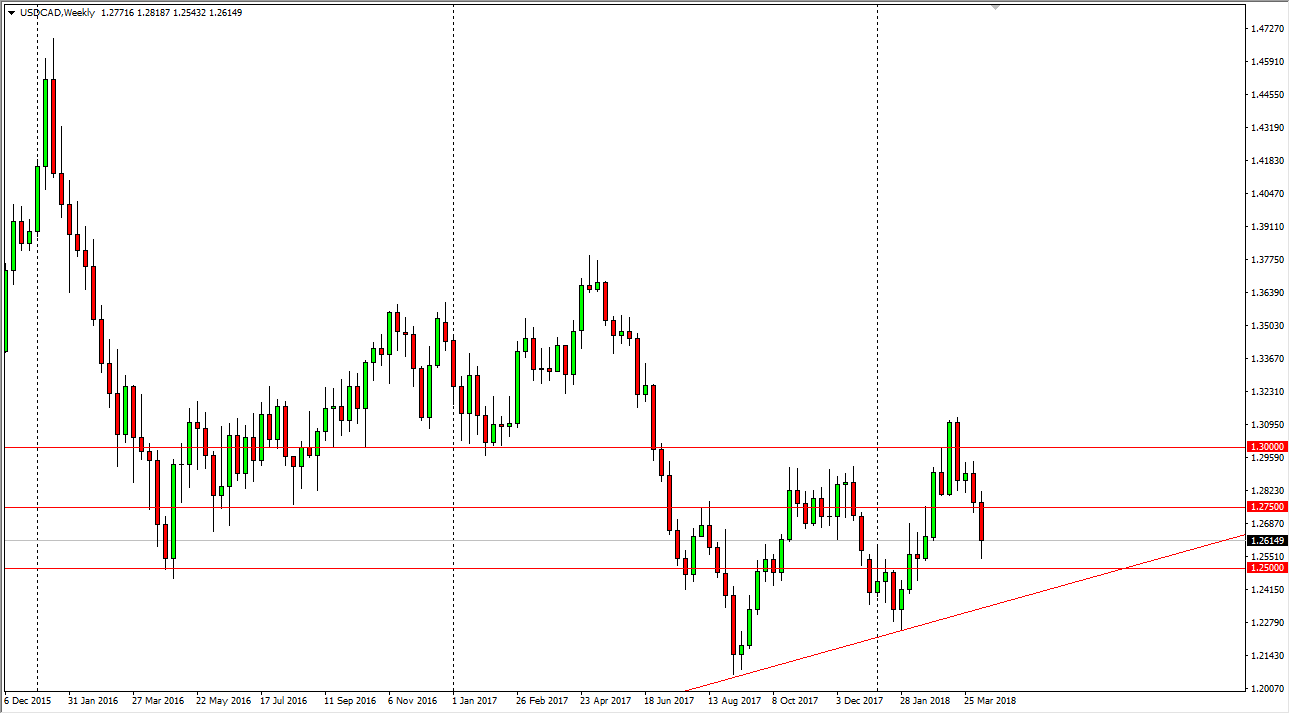

USD/CAD

The US dollar has fallen during most of the week against the Canadian dollar, but towards the end of the week, we did start to see a bit of buying. I think that the 1.25 level will cause a bit of support, but more importantly we have a major uptrend line underneath that should continue to push this market to the upside. The market bouncing from that uptrend line would be a very bullish sign, as it would be “higher lows.” Because of this, I think we will initially pulled back, but then I think eventually the buyers will return. If we break down below the uptrend line, this market could unwind to the 1.20 level.

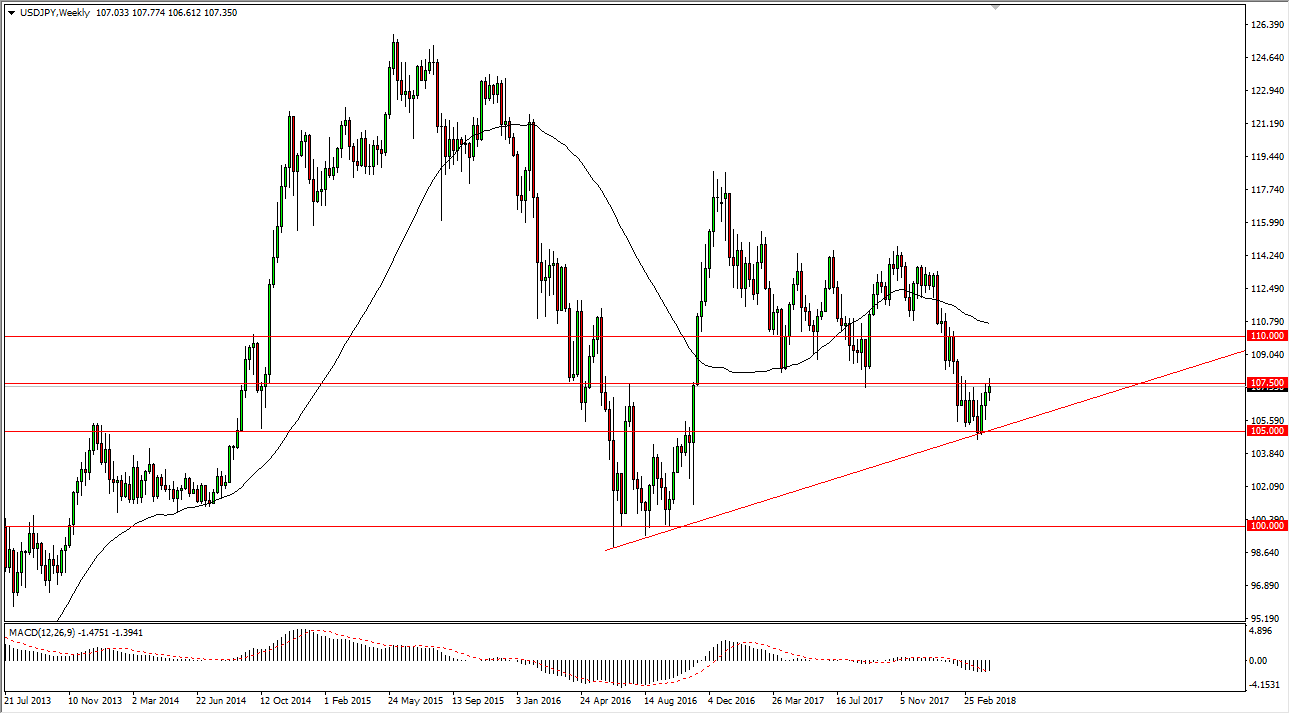

USD/JPY

The US dollar has gone back and forth against the Japanese yen during the week, breaking above the 107.50 level initially, but then broke towards the 108 level. If we can break above the 108 handle, the market should then go to the 110 level. The alternate scenario is that we break down below the bottom of the range for the week, but I think that the uptrend line underneath should continue to keep this market somewhat afloat.

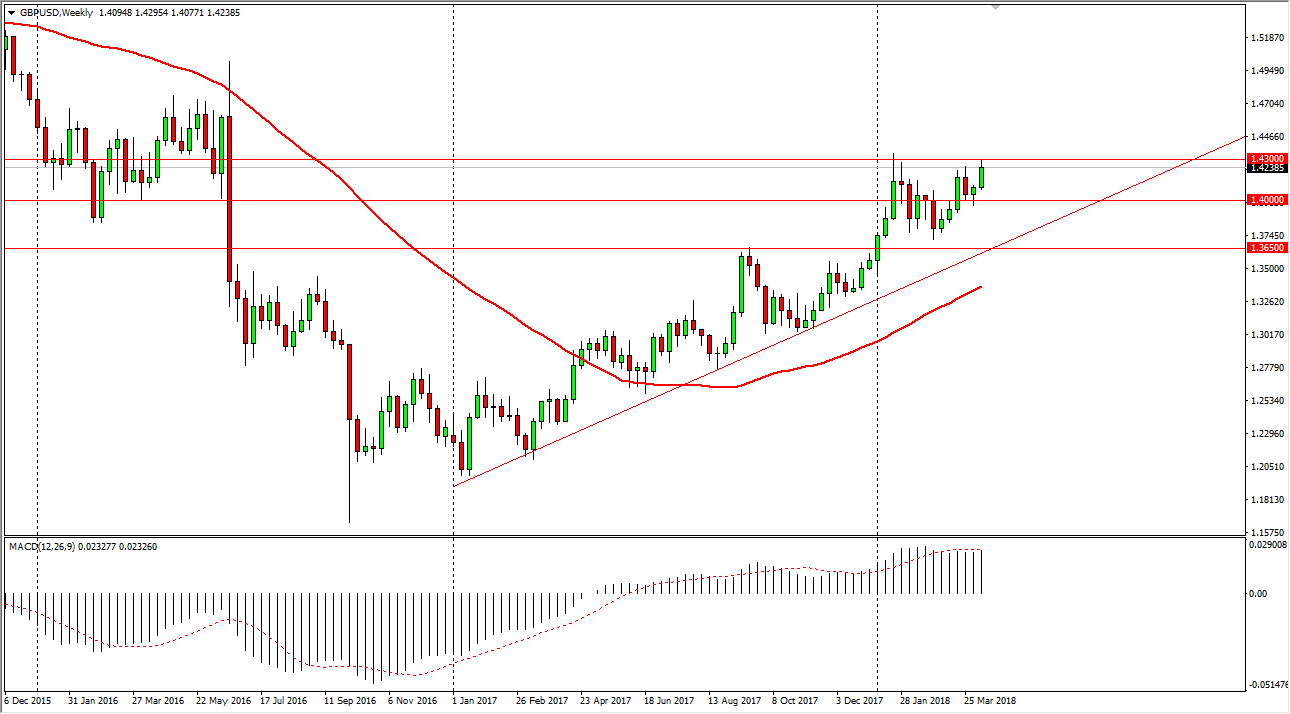

GBP/USD

The British pound had a good week, reaching towards the 1.43 level above. As an area that’s been resistance previously, and we did pull back from there on Friday. However, I think that the 1.40 level underneath should be supportive, so I think that we might get a little bit of softness initially, but then the buyers should come back to pick up a bit of value. If we can break above the 1.43 level, the market probably goes to the 1.45 level after that.

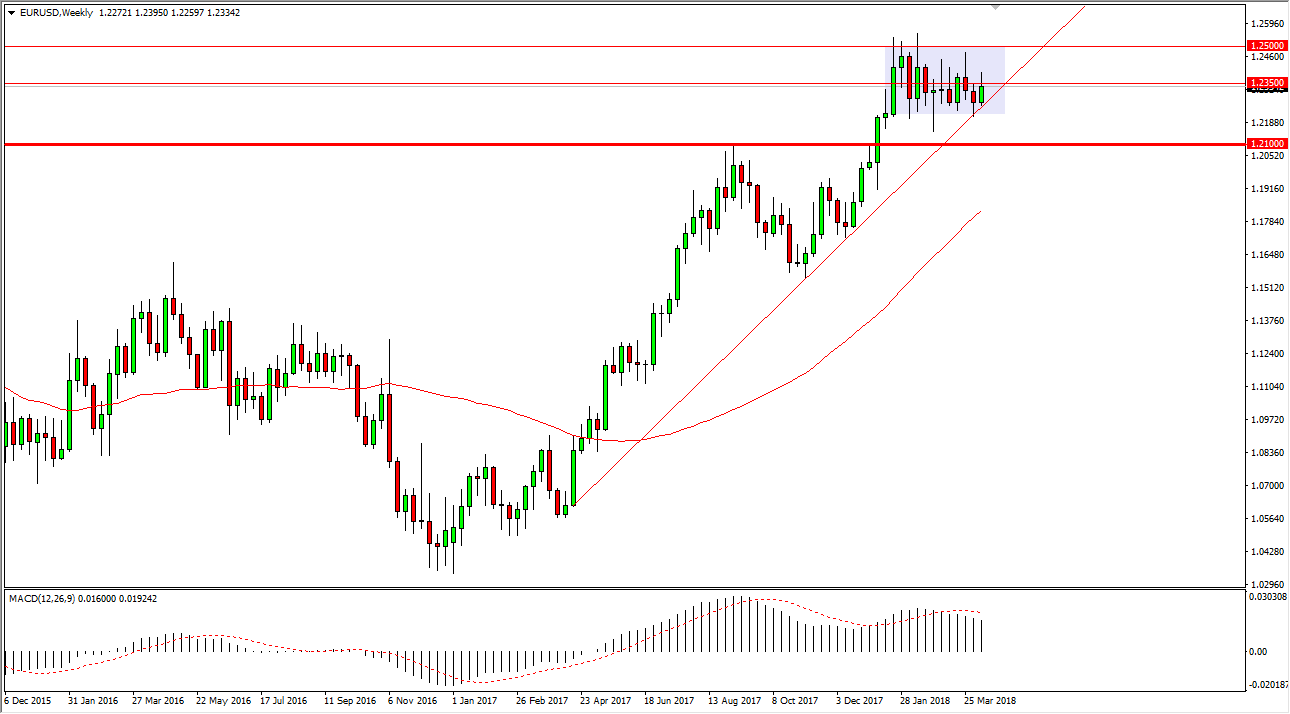

EUR/USD

The EUR/USD pair rallied significantly during the week, breaking above the 1.2350 level before turning around to form some type of shooting star like candle. However, we have a hammer just before, and then also have an uptrend line that could support this market. If we do break through the uptrend line, we probably drift a little bit lower, perhaps reaching towards the 1.21 level where I would expect to see even more support.