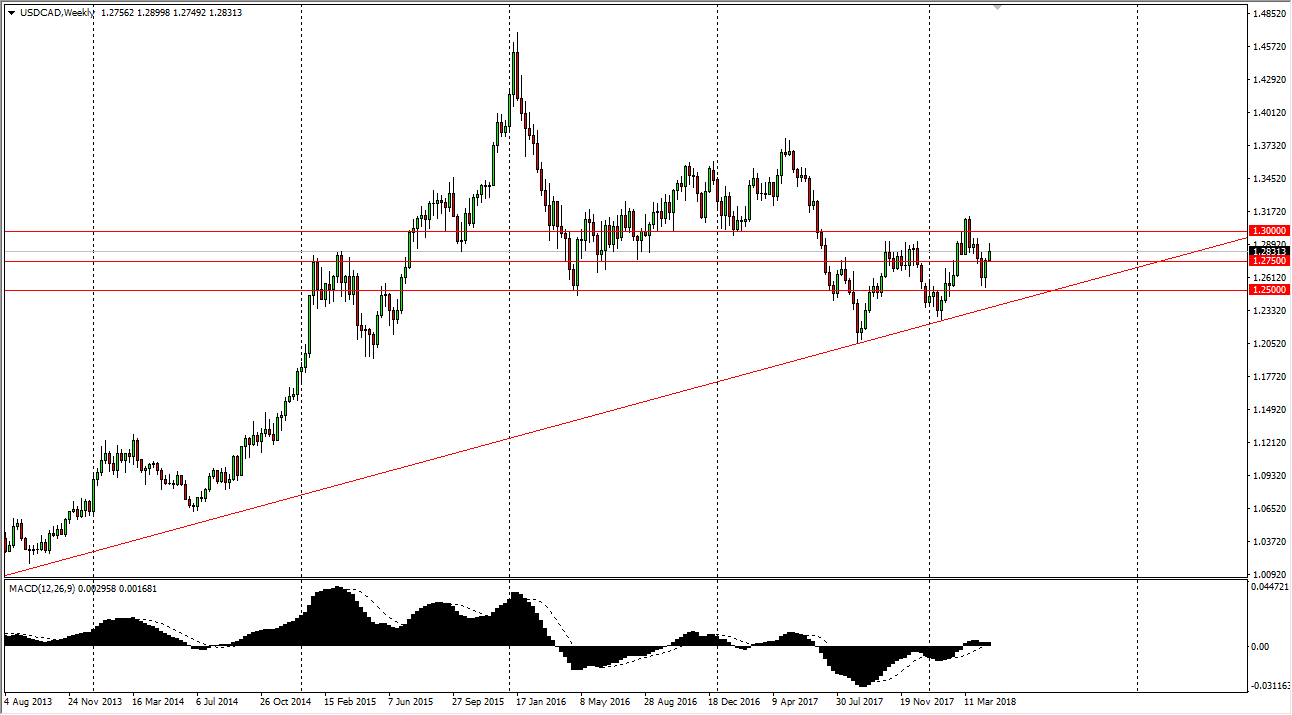

USD/CAD

The US dollar rallied against the Canadian dollar during most of the week but found the 1.29 level to be a bit too much. We pulled back a little bit, and I think we might see a little bit more of that at the beginning of the week before buyers come back in at either the 1.2750 level, or perhaps wait another week. The longer-term uptrend line has held, and we are starting to pick up a little bit of momentum on the MACD indicator, both of which are positive signs.

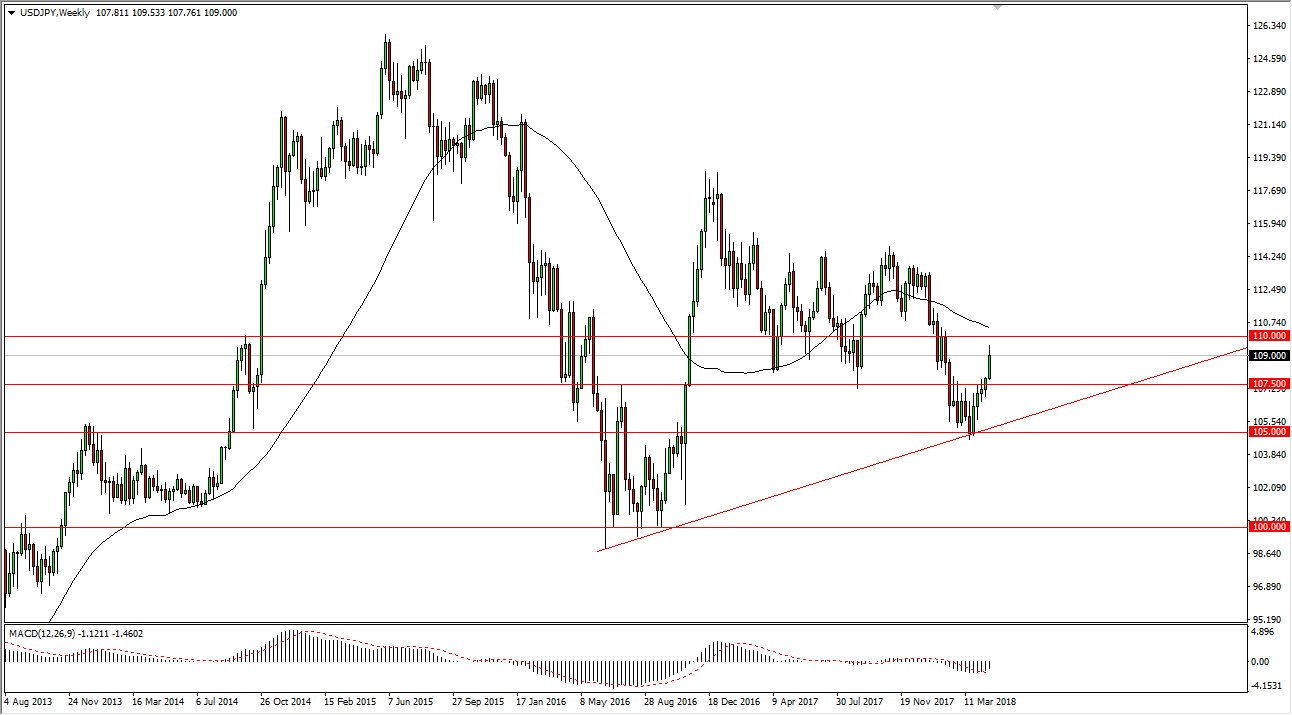

USD/JPY

The United States dollar rallied against the Japanese yen during the week reaching as high as 109 or so. We did pull back after that area was broken, which makes a lot of sense as it is the beginning of a lot of noise. I think that we will get short-term pullbacks that offer value in buying opportunities underneath, especially near the 107.50 level. If you are patient enough, you should be able to take advantage of dips.

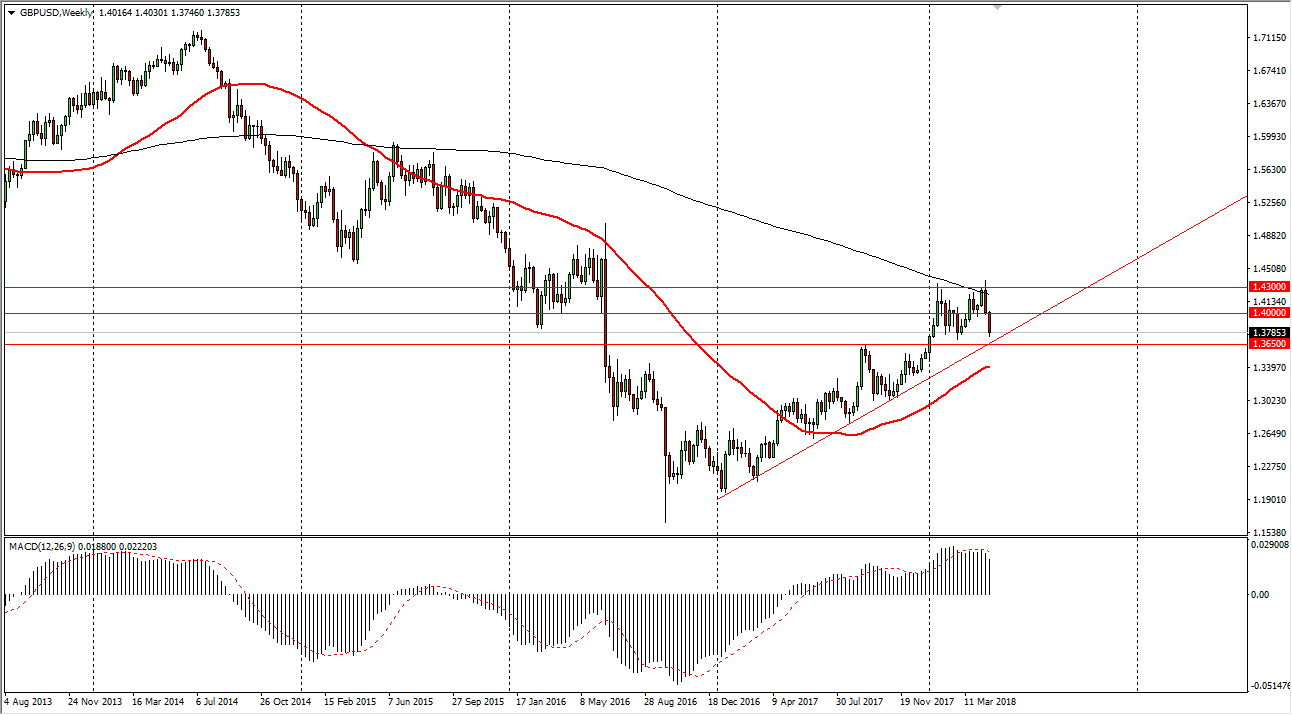

GBP/USD

The British pound fell significantly during the week, breaking down below the 1.40 level. We reached towards the uptrend line on the weekly timeframe, which of course is a positive sign as we have stayed above it. However, I think that the market will more than likely show plenty of support underneath as we should find plenty of buyers in the region of the uptrend line and the 1.3650 level.

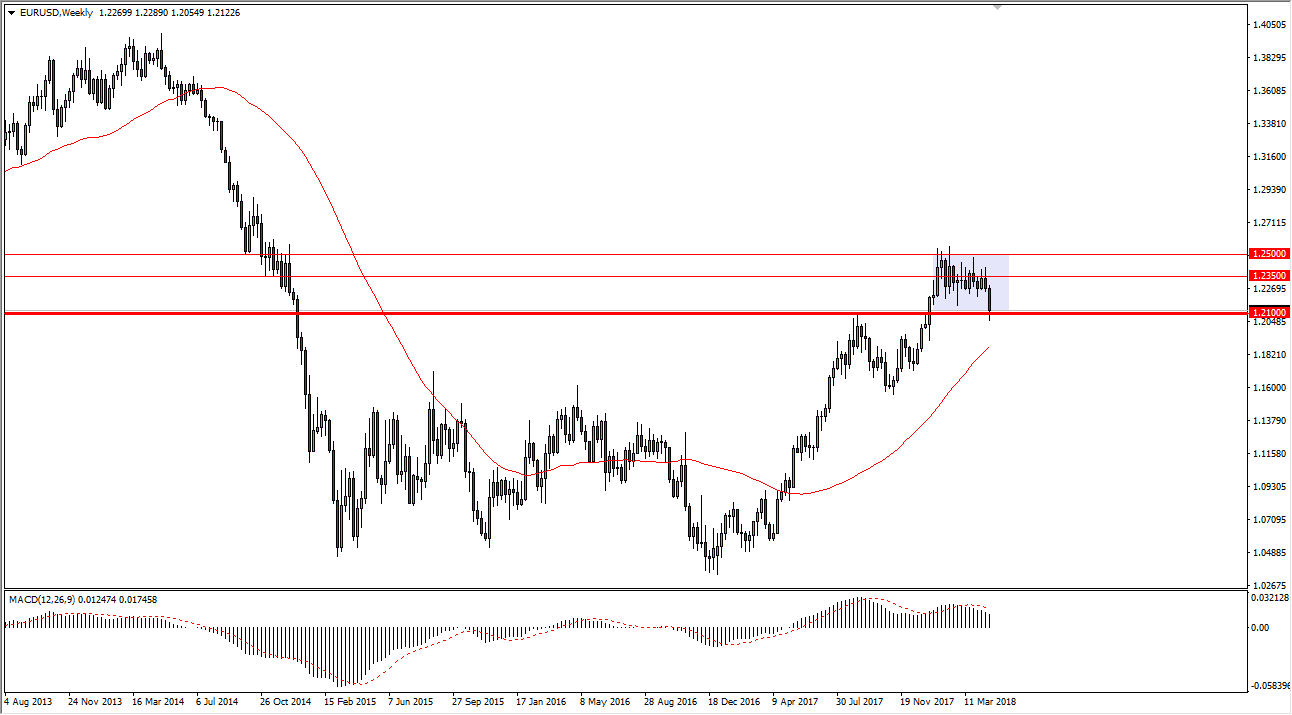

EUR/USD

The EUR/USD pair broke down significantly during the week, reaching down to the 1.21 handle. That’s an area that was previous resistance, and it should now be massive support. By bouncing back above there on Friday, it’s a good sign that we could go higher, perhaps reaching towards the 1.23 level. Beyond that, we could go as high as 1.25 while still in consolidation. The alternate scenario is that we break down below the 1.20 level, which would be very negative.