Gold ended the week down $9.89 at $1335.68 an ounce, weighed down by a strong dollar. The dollar rose to its highest level since January after a series of economic data out of the world’s largest economy came out better than expected. Global stock markets were mostly firmer last week. U.S. stocks tumbled on Friday, wiping out the gains they had accumulated during the week. U.S. economic data due for release this week includes existing home sales, consumer confidence, and durable goods orders. Market participants will also pay close attention to the statements following monetary policy meetings from the European Central Bank and the Bank of Japan.

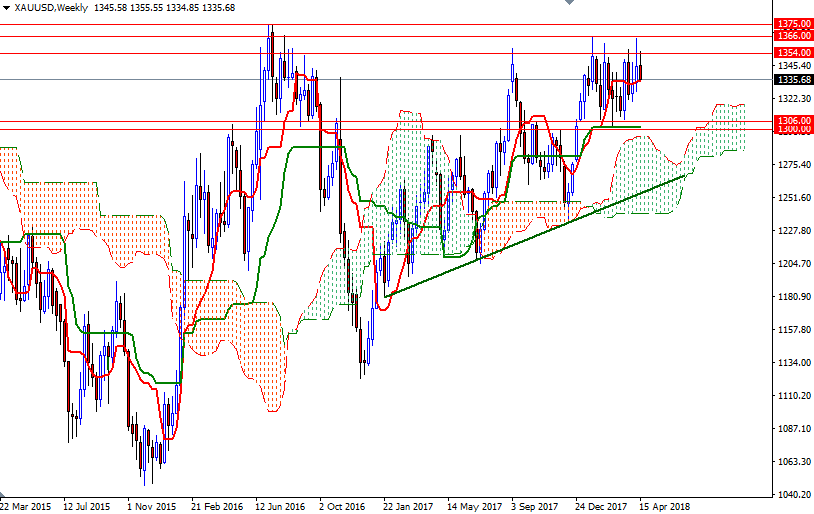

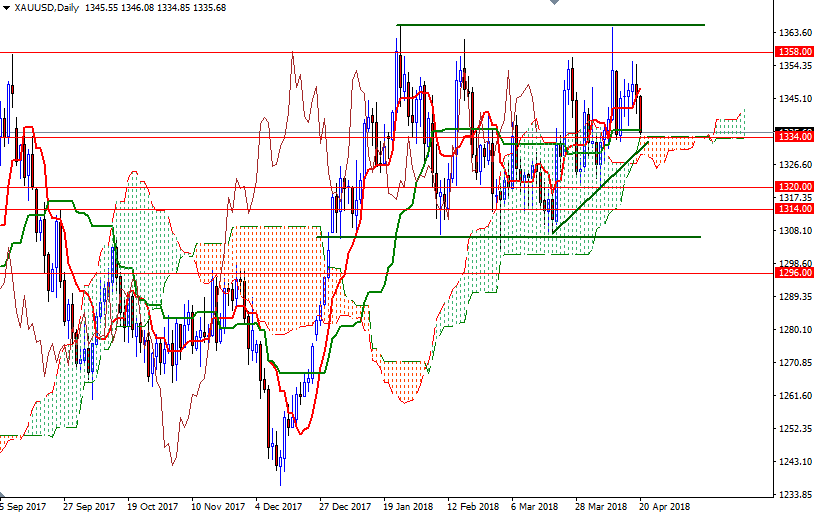

XAU/USD initially drifted higher but the market was unable to sustain a break above the 1354 level. Prices headed back to the strategic 1334/1 area after the support in 1348/7 was breached. The long-term chars indicate that the bulls have the overall technical advantage. The market is trading above the Ichimoku clouds on both the weekly and the daily charts. The Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) lines are positively aligned. However, as I emphasized in my monthly analysis, keep in mind that prices still in the 1366-1300 range and the market continues to suffer from the absence of strong momentum. The deteriorating near-term technical posture suggests a sideways-to-lower price action this week.

Down below, we have the daily Ichimoku cloud that could provide some support (for a rebound to the 4-hourly cloud). A sustained break above 1324 be needed to give the gold bulls short-term confidence. In that case, the 1321/0 area will be the next stop. If XAU/USD successfully pierces below 1320, look for further downside with 1314 and 1308/6 as targets. Once below 1306, the bears will be aiming for 1300-1296. To the upside, the initial resistance sits in 1343/2, followed by 1348/6. The bulls will have to push through 1348/6 in order to take the reins and march towards 1351. Beyond there, the bears will be waiting in the 1357/4 zone. A daily close above 1357 implies that 1362 and 1366 will be the next targets.