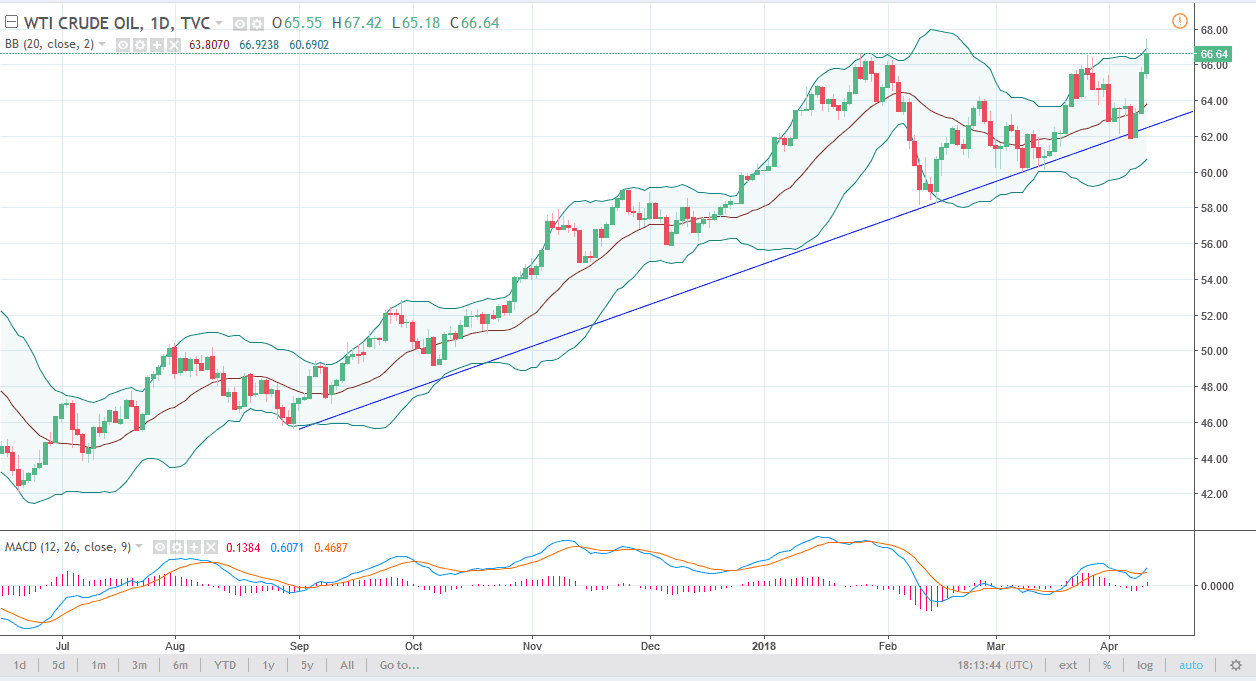

WTI Crude Oil

The WTI Crude Oil market rallied significantly during the trading session on Wednesday, reaching towards the $67 level. We pulled back slightly from there, and I think that it’s only a matter of time before the buyers come back at as we have seen so much in the way of noise underneath. The explosive move should have plenty of buy orders below just waiting to push higher, and therefore I think it will offer value if we do get that pullback. The uptrend line underneath should continue to support the market as well, and if the trade tensions between the United States and China can continue to pull back, I think that we will find that oil goes higher based upon perceived demand, and of course risk appetite. If we did breakdown below the uptrend line, this market could unwind to the $60 level rather quickly.

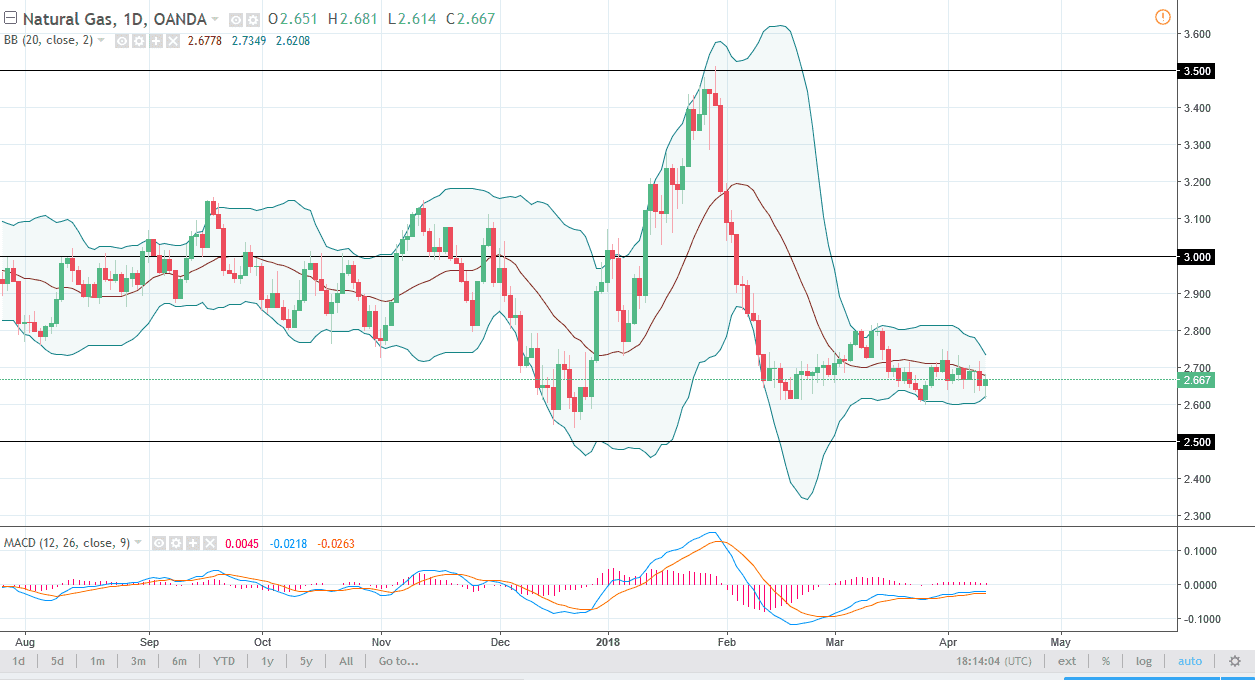

Natural Gas

Natural gas markets initially fell during the trading session on Wednesday but found enough support underneath to turn around and form a hammer. I believe that the market has plenty of resistance above, so I think that if we rally from here we could find sellers near the $2.75 level. Ultimately, I think that we will continue to see a lot of choppiness, and therefore I think that this market shows itself as offering a lot of opportunity to short-term traders, especially on rallies that show signs of exhaustion on one-hour charts. Alternately, if we can break down below the $2.60 level, I think that the market could drift down to the $2.50 level. A breakdown below that level would be catastrophic, but I don’t think that happens anytime soon. I believe that this continues to be a “sell the rallies” situation.