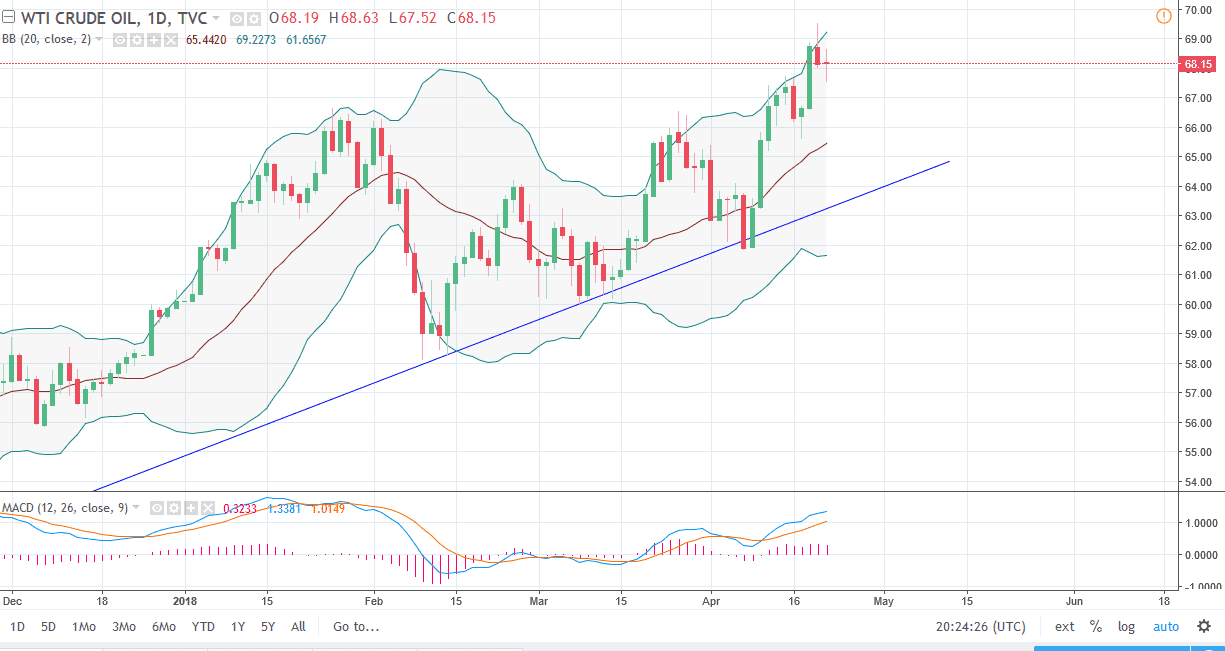

WTI Crude Oil

The WTI Crude Oil market has gone back and forth during the session on Friday, settling on a neutral candle. The market looks likely to continue to go back and forth, although I think that the overall attitude of the market is still bullish. I think that there is a lot of support underneath, starting at the $66 level, and then possibly even lower than that at the uptrend line. I think that the $70 level will be a target, but it’s going to take a lot of work to get up there. I think that short-term pullback should continue to offer value the people are willing to take advantage of, especially considering that there is a lot of tension in the Middle East right now. I think that we will continue to see buyers jump in every time we drift lower.

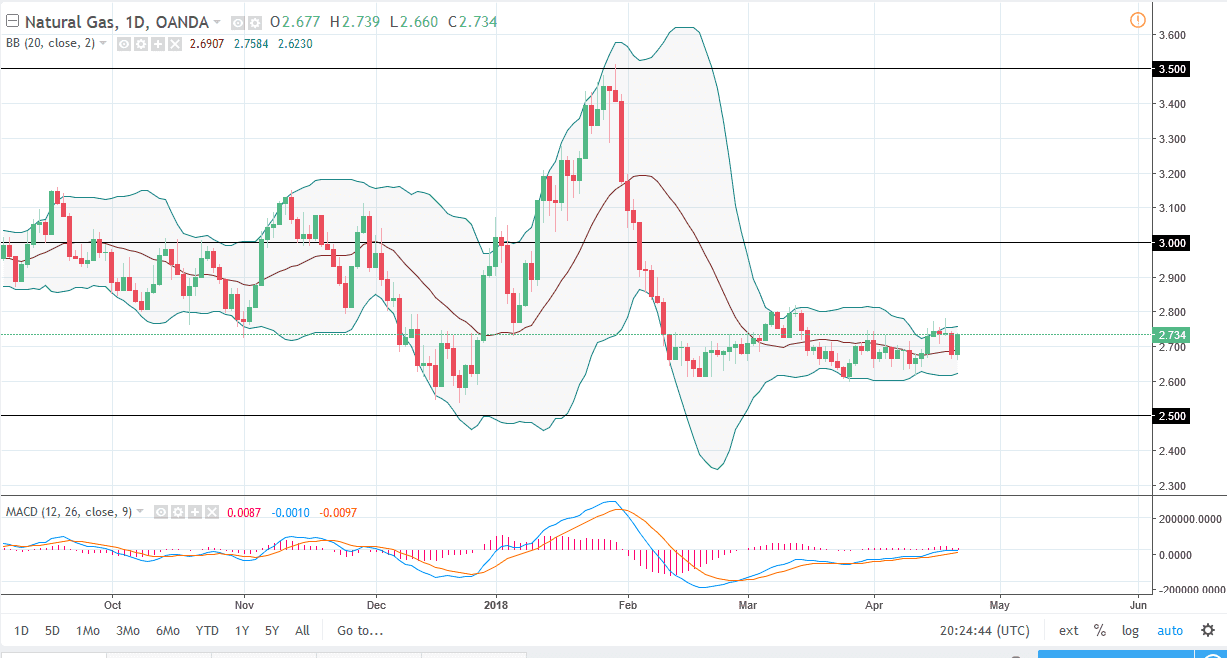

Natural Gas

Natural gas markets had a strong session on Friday but remains locked within a tight consolidation range. The $2.60 level at the bottom is support, while the $2.80 level at the top continues to be resistance. I think that the market is probably easier to trade from a short-term chart perspective, and I believe that every time we rally it’s a nice opportunity to start selling as there is no sign of bullish pressure coming into the market as we are oversupplied in natural gas to say the least. I think that we will eventually see sellers come into the market every time it rallies so I plan on taking advantage of that. I believe that the market should continue to be noisy, but I think short-term traders will take advantage of this volatility.