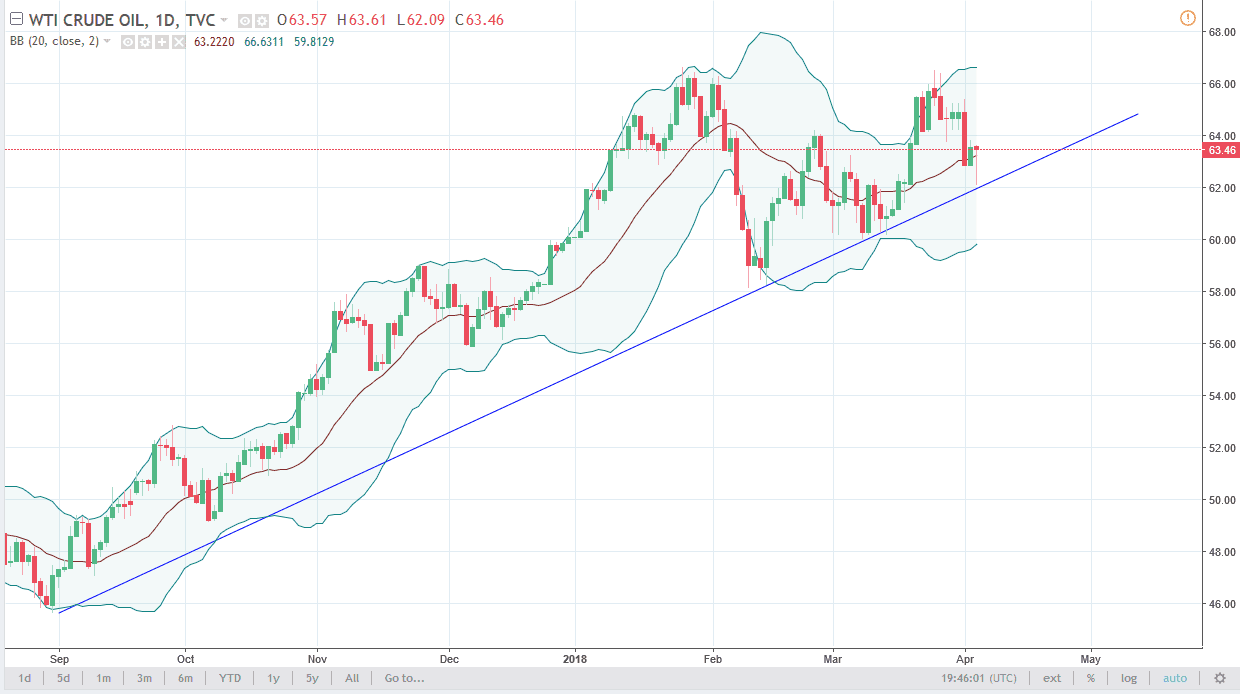

WTI Crude Oil

The WTI Crude Oil market fell significantly during the trading session on Wednesday, reaching down to the previous uptrend line that has been keeping this market afloat. I think that the market will continue to be very noisy in general, and especially with the jobs number coming out on Friday. I think that the market continues to find buyers, and that we will eventually reach towards the $66 level above. If we break down below the bottom of the uptrend line, the market probably drops down to the $60 level after that. Ultimately, this is a market that that will remain noisy, but we are in an uptrend, at least so far. I believe that the market will continue to offer opportunities underneath, at least until we get some type of negativity coming out from the headlines. The inventory number this week was rather bullish, so I think this move makes sense.

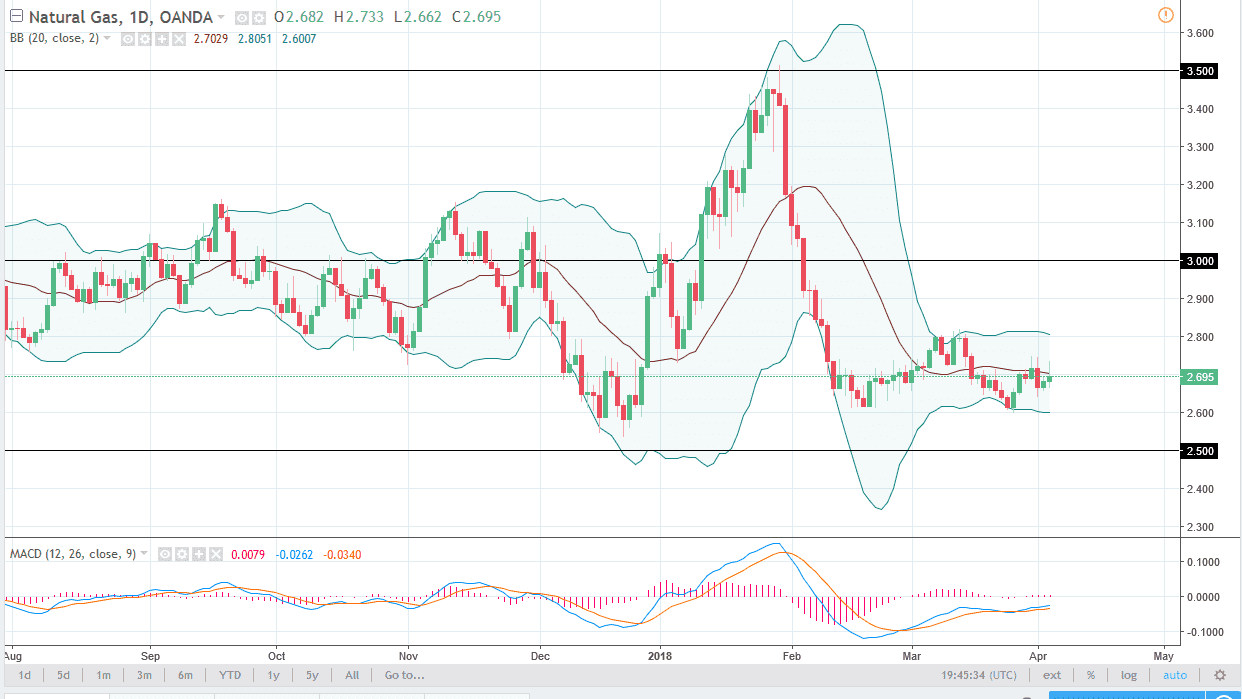

Natural Gas

The natural gas markets rallied a bit during the trading session on Wednesday, reaching towards the $2.75 level before rolling over. We ended up forming a bit of a shooting star, and it looks likely that we could drop towards the $2.60 level underneath. There is support extending down to the $2.50 level, and I think it’s going to be difficult to break through there. I think that short-term rallies continue to be selling opportunities, especially on signs of exhaustion. The $2.80 level above is resistance, and I think that if we can sell off in that area, it would be a sign to get short again. If we break above the $2.80 level, I believe that the $3.00 level above would be the next area where we could see a lot of selling pressure. I have no interest in buying this market, natural gas is far too bearish.